What is eCommerce Taxation and why is it important for your business to understand the concept?

It’s true that having an online store instead of a physical storefront can save you a lot of additional expenses such as utilities and rent, however, there are still some certain types of eCommerce taxation that online businesses cannot escape.

Being the owner of an eCommerce store, you have to understand your tax liabilities to properly operate your store. Otherwise, you will end up with penalties, fees, or even be forced to shut down your business.

Therefore, it's advisable for any business to follow Internet business tax laws to comply with government agencies like their state and the IRS.

Besides, understanding your tax responsibilities allows you to focus on all the other areas of running your business while avoiding unnecessary headaches about taxes.

Types of eCommerce Taxation for businesses to know

When starting a business on the eCommerce market you must follow the same rules as any new business owner out there. To make sure you fully understand your tax obligations, it’s helpful to have a conversation with an accounting consultant or a tax professional but here will be the different taxes that an eCommerce business should know about:

- Sales taxes

- Estimated taxes

- Employment taxes

For estimated taxes and employment taxes, you will pay them in the same way as a business does with a physical storefront.

Estimated taxes

Estimated taxes cover income tax and self-employment tax. Business owners will probably be required to pay estimated taxes but this won’t happen if you get a salary and have taxes withheld on your behalf. You could consider using the estimated fax worksheet from the Form 1040-ES instructions to identify your tax responsibilities and see if there is any estimated payment required. This type of eCommerce taxation is separate from employment taxes and sales taxes. Estimated taxes will be paid from your income.

Employment taxes

This kind of tax includes state and local tax (if applicable), federal income tax, and FICA (Social Security and Medicare) tax. These taxes are the amount of money you withhold from your employees’ gross wages. FICA contributions are made based on the employee wages. Paying federal and state unemployment taxes is also your responsibility if you have employees.

Sales tax

In this post, we will explain and focus mainly on sales tax for eCommerce businesses but first, let’s get the basics of what sales tax is.

Sales tax is a percentage of a sale added to the total bill of the customer. The customer will pay the sales tax but you are the one who collects, deposits and reports it.

To put it simply, your business will be the middleman between the government and consumers. You make consumers pay tax at the POS (Point-of-sale) machine and the end-user (the customer who buys the good or service and is not involved in other processes of selling and buying) will be responsible for paying the tax.

Usually, retailers would buy things in large quantities and sell the goods. After the wholesalers supply retailers with wholesale products, retail businesses will sell them at a higher price than they actually paid. The retailers don’t have to pay sales tax when buying products from the wholesales because they already registered for resale certificates. This way prevents the product from being taxed twice. In fact, it is only taxed once when it reaches its end consumer, here it would be the customer of the retailer.

For instance, Laura’s Little Table Shop purchases wood wholesale to produce furniture but since they have a resale certificate, they don’t need to pay sales tax on the raw wood they bought. The sales tax would be charged to their customers who buy a finished table.

Which items are taxable can be different according to states. For example, food and beverages in Pennsylvania are taxed at establishments, such as restaurants but not at grocery stores.

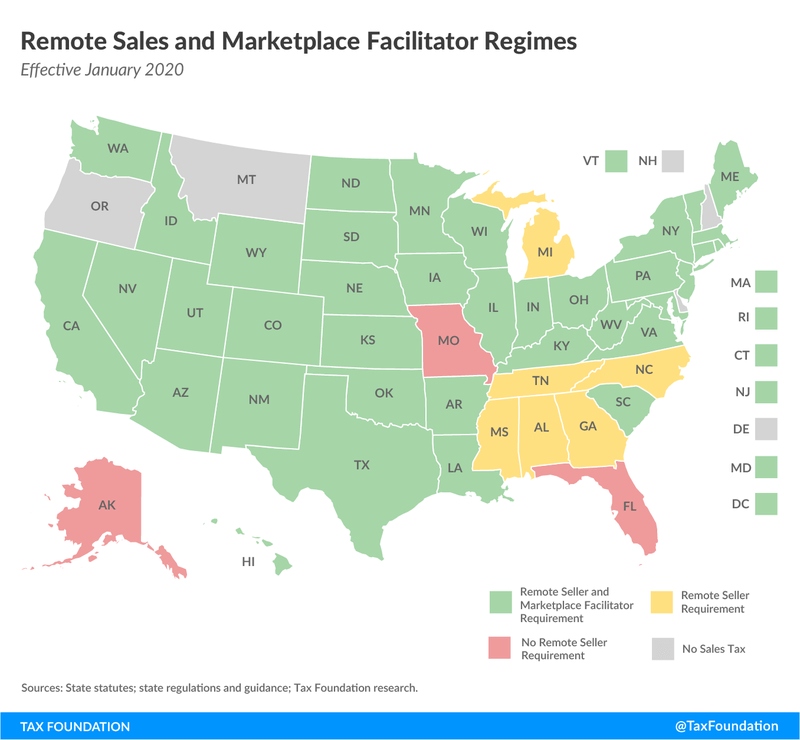

States can decide whether there is a sales tax or not and what the rate is. For example, there are 5 states in America that don’t require sales tax: Montana, Alaska, Delaware, New Hampshire, and Oregon. Although Hawaii also doesn't charge sales tax, they have a tax called GET (General Excise Tax) that is applied to all sales activities.

Both online and bricks and mortar businesses can have sales tax liabilities, but tax laws can be a bit more complicated.

Do eCommerce businesses need to charge sales tax?

Business owners have to charge sales taxes in states in which they are selling their products and services. Tax nexus refers to the connection between a business and a state that introduces tax obligations.

Before, retailers with a physical store in a state such as warehouses or offices had sales tax nexus. So, online businesses just have to simply follow that definition and also collect sales taxes in the states where they place their facilities.

The 2018 Supreme Court decision in South Dakota v. Wayfair allowed states to determine sales tax nexus more broadly and eCommerce businesses are included to collect sales tax.

How to comply with laws about sales eCommerce taxation

Since you can get freedom by operating an online store, it’s possible for you to sell your products to anyone across the nation. However, sometimes that freedom comes with confusion about sales tax and many online retailers are not sure about when to collect sales tax from consumers as they conduct their business in multiple states.

Below are some steps to help you stay up to date with the developing requirements and manage sales taxes for your eCommerce store accurately.

Step 1: Find out where you have sales tax nexus

In the US, the first thing online retailers do is to understand US sales tax laws and how to apply them to their business.

As you might know, there are 45 states that impose sales taxes and 5 states that don’t. Among states with sales tax, Florida and Missouri now require remote sellers to collect sales tax.

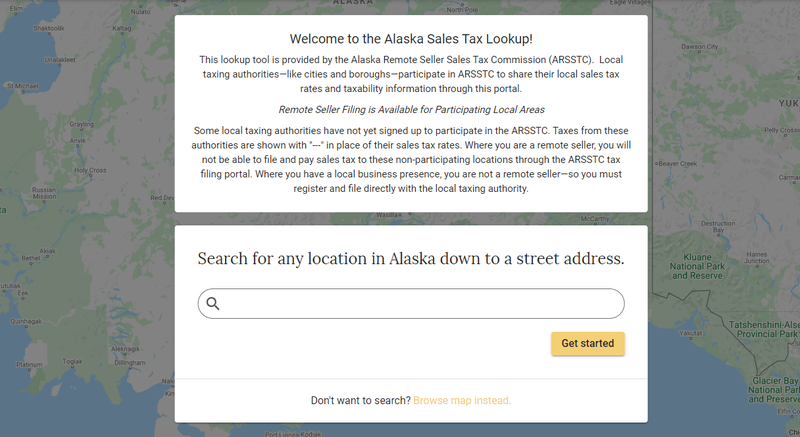

For Alaska, this state has no sales tax but many local areas in Alaska impose sales taxes. Alaska authorities passed a uniform code that requires remote sellers to start collecting in 2020.

States are still adapting to changes and you will have to determine current requirements for remote sellers where you make sales to follow the regulations of eCommerce taxation.

To understand your sales tax nexus in your country, you can consider the following key points:

- Check thresholds: For sales tax nexus, the majority of states have substantial sales thresholds and the most common is 200 transactions for 100,000 dollars in sales. You may find that numbers apply to your state’s requirements. Other exceptions are Oklahoma with a threshold of 10,000 dollars and Kansas that collects sales tax from the first sale.

- Track your sales: Look at your sales footprint carefully to get a bigger and clearer picture of what your volume is and where you are selling state by state.

- Do research on state requirements: Research what the state laws on sales tax nexus are and how they are collected by remote sellers. Consult helpful charts and maps from the National Conference of State Legislatures, the Tax Foundation, The Streamlined Sales Tax Governing Board (SSTGB) to help sort through the requirements.

- Include local sales taxes: If you have sales tax nexus, you will be responsible for collecting local and state sales taxes.

Step 2: Check the affiliate policies

If you sell your products via a market facilitator such as Etsy or Amazon, then they may help you handle the bulk of sales tax collection and remittance. If you have to work with any third party, thinking of using these tips below:

- Know the law: Gain knowledge of the state laws where you sell carefully even if you are working with an established third party.

- Ask questions: Never assume that the facilitator will handle everything for you, ask them to clarify the policies for you whenever you can.

- Verify accuracy: Don’t forget to audit your transactions regularly to make sure that your sales are taxed accurately.

Step 3: Obtain seller’s permits

When you can determine where to collect sales taxes, you have to register with the revenue department so that your business can begin collecting taxes. You will need a sales tax permit or a seller’s permit in some states.

Normally, registration is handled by the department of revenue but it can also be completed online

- Check websites of the state: Even when you are exempt from collecting taxes, you might still have to register or complete some other paperwork online. That’s why it’s wise to check the website of the department of revenue in each state to ensure compliance.

- Use state tools: Many states provide software to help you determine state and local sales taxes more easily. Take Alaska for example, the state has developed an online sales tax lookup tool so that remote sellers can facilitate their compliance.

- Check out streamlined registration: SSTGB offers a streamlined application that covers more than states to help you collect taxes in multiple states.

Step 4: Collect and remit sales taxes

Although each state has its own process for remitting sales taxes, it’s common that taxes are submitted monthly (some states may accept filing quarterly). In states where you collect sales tax, you can:

- Use software: You can look for an eCommerce CMS and tax software that is built to simplify the process of tax collection, reporting, and remittance. Some highlight features like looking up applicable rates and calculating sales tax are also important. Fortunately, now there is an excellent tool that can help those types of financial management process become much easier for eCommerce businesses. Magento 2 Xero Integration from Magenest promised to bring store owners seamless experiences when it comes to taxing and accounting management.

- Train employees: Ensure your staff knows how to handle sales tax for remote sales. Many states have resources to support, including videos and webinars, you just have to find them.

Step 5: Monitor compliance

The laws for remote sellers are still on their way to develop so it’s vital to conduct audits periodically to ensure compliance. There are tips you can use to stay on top of the changing requirements:

- Connect with states: Most of the revenue departments in the country have email newsletters to keep you posted on the law changes, you just need to sign up for their lists. Besides, you can also stay on top of the news simply by contacting the state authorities in the media.

- Monitor sales: Be sure to monitor your sales or set up notifications that are automatically sent to you when your sales are about to exceed the sales tax threshold of the state.

- Consult with advisors: Consulting with a business tax advisor and having some discussions is never a bad idea.

What are the consequences of not paying sales tax?

As an online business owner, you need to have sufficient insights into sales tax. Any failure to collect or remit sales tax to the government agency can lead to audits, fees, penalties, or even criminal charges and we know you never want any of those to happen to your company.

If you don’t collect sales tax from your customers, then you will be the one who is responsible for paying that amount instead of them. Let’s say if you are supposed to collect a total amount of 10,000 dollars in sales tax from all of your clients. It’s impossible to go back and charge each of them their sales tax portion. This means the sales tax amount would fall on you.

Conclusion

The eCommerce market is growing fast and to survive in the competition you need to have enough understanding of the eCommerce taxation in an area where you are selling. As a business owner, it’s essential to stay up to date and keep good track of your sales tax deadlines with some tools such as a calendar and reminder notifications. We hope this article is useful to you and helps you learn more about eCommerce taxation, leave us any questions if you have any. Our store blog has tons of posts like this to help you grow your eCommerce business successfully, visit us here