Like in any other industry, in eCommerce it’s impossible to have your financial records if you can’t keep those records in order. This is when eCommerce accounting shows its important role. Keeping your receivables and payables under control, along with other payments is the first thing you have to do for steady and well-planned growth in your business.

In this article, we are going to walk you through everything you need to know about eCommerce accounting in America and how it can benefit your online business.

What Exactly is eCommerce Accounting?

Basically, the definition of eCommerce Accounting refers to the process of collecting, organizing, analyzing, and reporting financial data of an eCommerce business.

All of this information is a valuable foundation for eCommerce entrepreneurs to make wise future business decisions.

There are three primary categories that accounting consists of:

- Bookkeeping

- Reporting

- Submitting tax returns

What Things Do You Need to Start eCommerce Accounting?

Some prerequisites below are essential for an eCommerce business to conduct their eCommerce accounting effectively:

- eCommerce bank account

- Business tax ID number

- Solutions to accounting

eCommerce bank account

The first thing you need for your accurate and systematic eCommerce accounting is a business bank account. Because different banks offer different benefits for business owners, the offers and maintenance fees also differ from one bank to another. Therefore, you better shop around several banks before choosing the right bank and making any commitment for your eCommerce effort.

Besides, it’s vital to find a reliable and efficient payment processor to help you collect online payments. And a separate eCommerce account can help you do that by keeping your personal and business assets separate from each other.

Business Tax ID Number

eCommerce business owners over the US will need to contact the IRS to get an EIN (Employer Identification) number - a 9-digit number that is used on all your business taxation documents. You may not go to the IRS in person, just request the EIN number online through an electronic form and get it delivered by email.

It’s necessary to know that corporations and partnerships need to own an EIN number.

Social Security Number (SSN) is the number used by sole proprietors on their tax papers and other business documents.

Accounting Solutions

No business nowadays can deal with eCommerce Accounting without having a proper accounting solution as this is a fast, convenient and accurate tool to manage your finances.

Check out the highlight benefits of the top 5 accounting software options that your online business needs:

- Xero Integration: This is an easily accessible, user-friendly, cloud-based tool that can be integrated with other tools to automate bank processes and convert currency.

- QuickBooks Online Integration: This extension is well-known for simple invoicing, straightforward reporting, tracking bills and costs, easy tax reporting, payroll, and time tracking.

- ZipBooks: Highlight features of ZipBooks are smooth credit card processing, effective cost management, accrual and cash reports, no limit on the number of customers and vendors.

- Opayo ( formally known as Sage): Many businesses choose Opayo (Sage) because of its user-friendly features, cash flow management, customer support, inventory and job management, and scalability.

- FreshBooks: Its highlight features are simple project tracking, integrated payment options, affordability, and enhanced invoicing.

What are Business Account Types to Understand?

Depending on the features and usage purpose, there are many different types of bank account for business to choose from and below are considered the four most suitable types of business accounts for eCommerce business owners.

Checking Account

You can count on the following benefits of a checking account is your choice:

- Interest rates are often low

- No requirement for a minimum amount of account balances as long as you have enough money on the checking account to cover your purchases.

- Get seamless access to your deposited money.

However, the main drawback of this account type is there is a potential limit on the number of cash deposits a month.

Saving Account

eCommerce entrepreneurs who are far-sighted and responsible will want to look for ways to put some money aside for savings. And for that purpose, a savings account is a good option for you to go for due to the following things:

- There are interest rates on the deposited money, which you can earn.

- Interest rates are subject to taxes because they are considered as income.

- There are some restrictions if you want to withdraw money from your savings account.

- There is a requirement for a minimum daily balance to keep your account alive.

Certificate of Deposits

A certificate of deposits is actually a savings account where you deposit your money for a fixed amount of time, and it can be a month for several years.

The key benefit of certificate deposits is that the interest rates are often higher than that of other business accounts.

However, its drawback is that the money you put in needs to be held on the account until the specific date if you don’t want to pay any penalties.

Money-making Account

Money-making account is an account that combines the features of checking accounts and savings accounts.

Benefits of the money-making account:

- Interest rates of money-making account are higher than that of checking and savings accounts.

- It’s a suitable option for eCommerce entrepreneurs with large amounts on their accounts to score higher interest rates.

The main disadvantage of the money-making account:

- Maximum six withdrawal activities are allowed.

Types of Financial Statements

Certainly eCommerce store owners always have to keep an eye on their transactions and financial statements so that they have a clear view of their business costs to make more reasonable financial decisions.

Generally, eCommerce business owners have to pay attention to the three financial statements such as:

- Income statements

- Balance sheets

- Cash flow statements

Income Statements

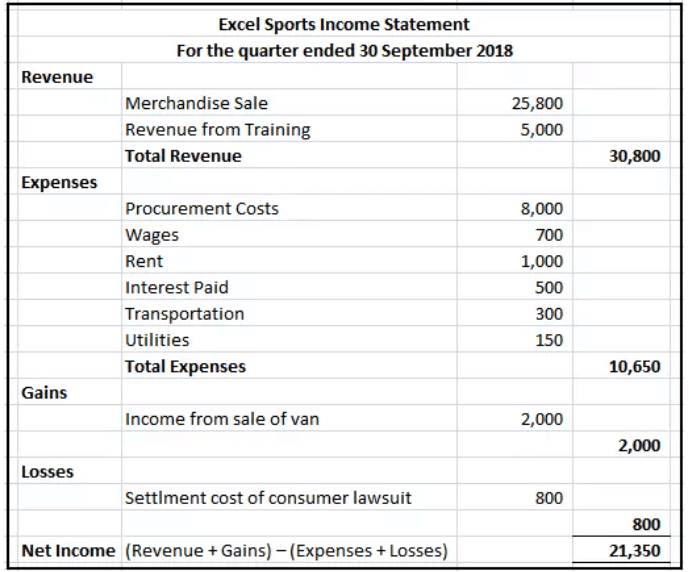

The role of this type of statement is to report your business income over a certain amount of time. Another way to call it is a profit and loss statement or the statement of revenue and expense since it covers the company’s revenue, gains, losses, and costs.

Net Income = (Total Revenue + Gains) - (Total Expenses + Losses)

Balance Sheets

A balance sheet would be a comprehensive report about the liabilities, assets, and shareholder’s equities of the company at a particular time. This statement contains data about the possessions and debts of their company. Through the balance sheet, you also can see the investments made by shareholders and investors.

Typically there are 2 columns, with the liabilities of the shareholder’s equity on the right, and the assets on the other side, a balance sheet is based on the equation:

Assets = Liabilities + Shareholders equity

Cash Flow Statements

A cash flow statement provides you with a view of the cash and its equivalents being paid by and to your company. The statement also measures the amount of cash that a company can create to cover its debts and run its operational costs.

The key benefits of cash flow statements are:

- Inform the company owner of how the financial activities are managed in the company.

- Help you understand who you collect the money from.

- Learn how the money is allocated in the company.

eCommerce Accounting Tasks

Every online store owner has to handle various eCommerce accounting tasks on a regular basis with operations like:

- Categorize transactions and expenses

- Track expenses

- Track the inventory and cash flow

- Track customer returns and chargebacks

- Calculate break-even sales

- Stay on top of taxes

Now we will take a closer look at some of the tasks of eCommerce accounting above:

Categorize Transactions and Expenses

By operating the transaction and expense activities, you will know how much you can earn from selling products and how much money is spent on business activities.

The two key elements of transactions are expenses and incomes.

Although modern solutions to eCommerce accounting can help businesses automatically sort out the transactions, you still should double-check every transaction by yourself or add more categories such as salaries and marketing expenditure if necessary.

This data is helpful when you want to calculate monthly revenues, single or regular costs.

Track Expenses

A more in-depth eCommerce accounting task is to track the following business expenses:

- Receipts

- Proof of payments

- Bills

- Financial statements from the bookkeeper

- Invoices

- Previous tax returns

- Canceled checks

- W2 and 1099 forms

- Different documents that support income, deductions, or additional credit reported on your tax returns.

Track Inventory Cash Flow

eCommerce business owners need to supervise and control their inventory cash flows to gain a good understanding of how much the business inventory costs, the expenses of manufacturing products that they sell.

eCommerce business owners that produce all the items they sell should include the following categories in the cash flow:

- Maintenance

- Raw materials

- Acquisition of equipment

To get the full picture of the inventory cash flow and precisely calculate your net profit, you must track the inventory losses such as:

- Spoilage

- Damage during production

- Theft

Track Inventory

Apart from inventory cash flow, eCommerce store owners should know the exact number of inventory items they have in real-time. There are two ways of tracking inventory in eCommerce accounting:

- Periodic tracking: This method includes counting each single inventory item in stock and noting down the cost and sale value for each of them. Any update made in the number of inventory items can reflect the amount of money you spent and gained in your business for a particular time period. It’s advisable for new store owners to perform this task at least once a month. But if your eCommerce business develops, periodic tracking can be conducted quarterly or annually.

- Perpetual tracking: In this method, you will use automated accounting software tools to constantly keep track of your inventory. For example, if a new item is scanned or added to your inventory storage, you will see the automatic update of it into the inventory count and the total cash figures as well.

Track Customer Returns and Chargebacks

eCommerce entrepreneurs should keep customers returns and chargebacks apart and also there are two different categories for them:

- Customer returns: When there is a product delivered back to your business, the return transaction of that customer should be listed on the Returns and Allowances section before being deducted from your revenue.

- Chargebacks: When a customer files a dispute in their bank in case of either non-delivery of paid goods and services or fraud, a chargeback will occur. All chargebacks ought to be filed under Returns and Allowances. Note that any additional fees due to chargeback should be marked as business expenses.

Calculate Break-Even Sales

eCommerce businesses have to pay attention to the main types of taxes that are sales taxes and business income taxes.

In the US, e-store owner has 2 different levels of taxes to keep in mind:

- State sales taxes

- Local sales taxes

It depends on the state where an e-store is registered, the sales will vary, therefore, the owners may need to contact the local tax administration to determine their tax liabilities.

Important Terminology in eCommerce Accounting

There are eCommerce accounting terms that businesses should get themselves familiar with:

- eCommerce sales tax: Retailers pay the state government for the sales tax on the sold goods and services. This kind of money is collected at the POS and then forwarded to the government.

- Sales order: This is an official internal document that is put together by the selling party and submitted to the customer for confirmation and verification purposes towards their goods and service purchases. The sales order includes sales details, price of goods and services, the quantity of the item, payment method, delivery address, and date.

- Purchase order: Another official confirmation from a seller contains the desired quantities and prices. Sellers make sales orders according to the purchase orders.

- Invoice: A document eCommerce accounting that the seller sends to the buyer contains the pricing and some other buying details. While the invoice is sent to the buyer, a sales order remains with them.

- Receipts: This document is officially written by the seller to confirm that the buyer has paid the seller for the purchase made. Receipts are used as proof of payment.

Conclusion

eCommerce accounting is not a simple concept to learn overnight but consists of multiple categories and subcategories that online business owners need to learn step-by-step and implement into their eCommerce business. Hopefully, with the definition, tips, and instructions we have brought up today in this guide, store owners may find everything they need to quickly and efficiently handle their eCommerce accounting obligations. For further reading, visit our store to gain insights, and find the best extension you may need!