Magento 2 QuickBooks Online Integration

Magento 2 QuickBooks Online Integration

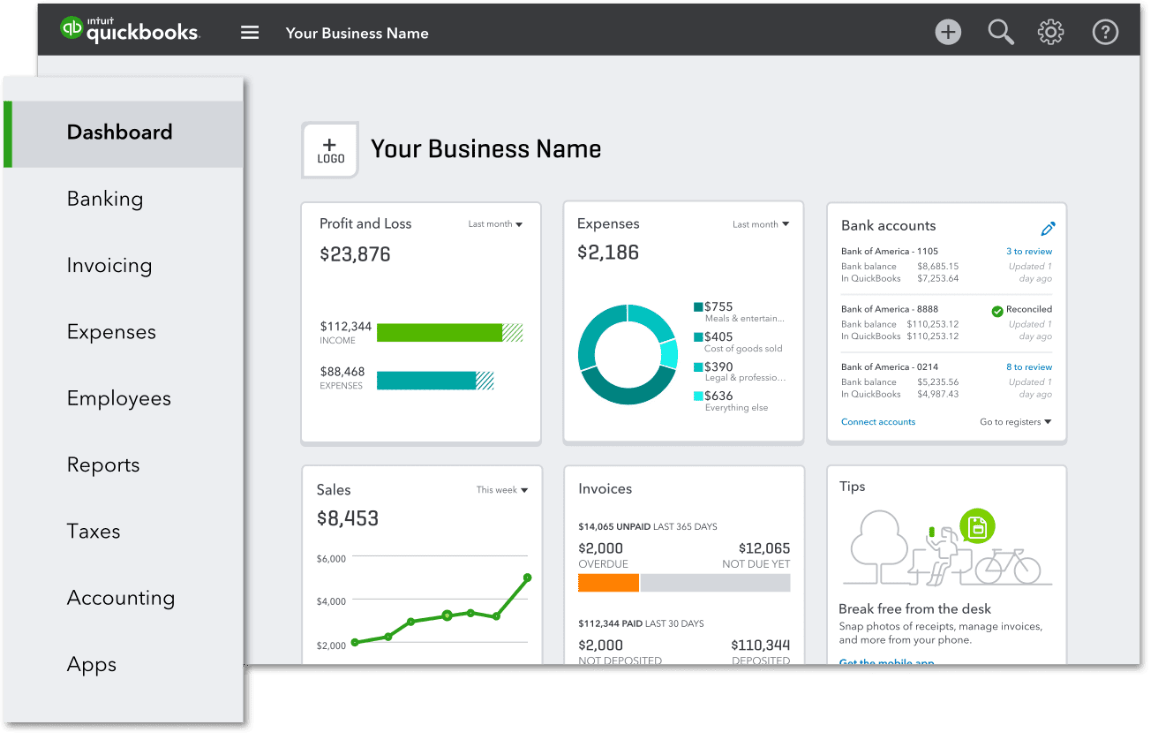

This powerful extension helps vendors getting better financial management by automatically update all data from Magento to Quickbooks in realtime. The amount of time you spend tracking down transaction data, fixing errors, and manually entering data now is resolved by Quickbooks Online Integration.

- Data changes from Magento 2 are automatically updated to QuickBooks Online

- Sync products data from Magento 2 to QuickBooks Online (Stock sync only Available on QBO Plus)

- Sync customer data from Magento 2 to QuickBooks Online

- Sync sales orders, invoices, and credit memos from Magento 2 to QuickBooks

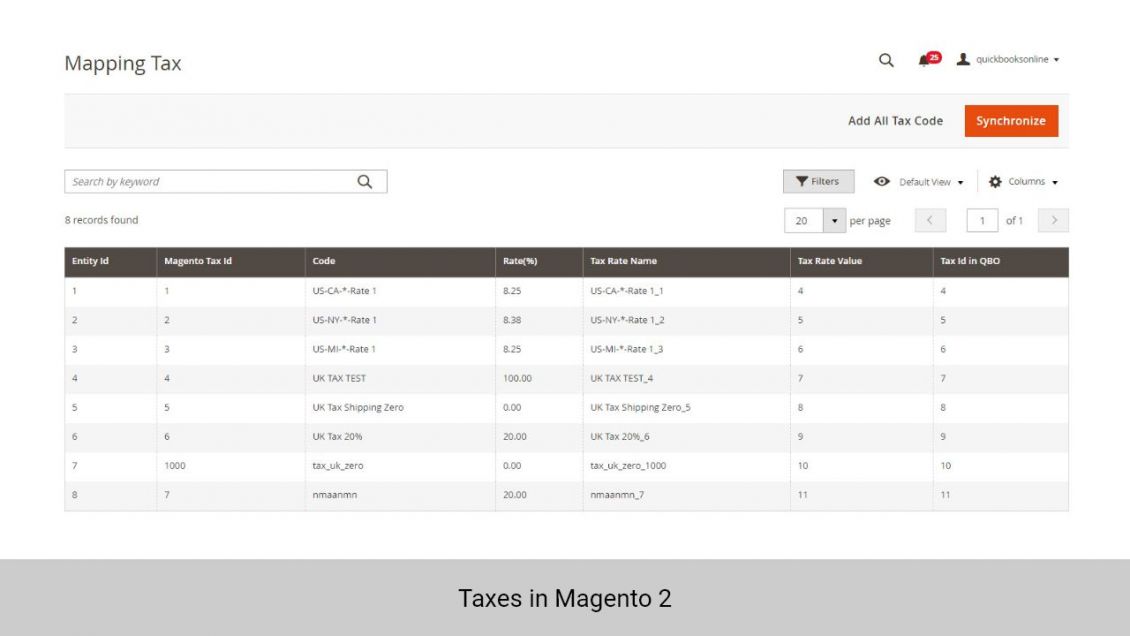

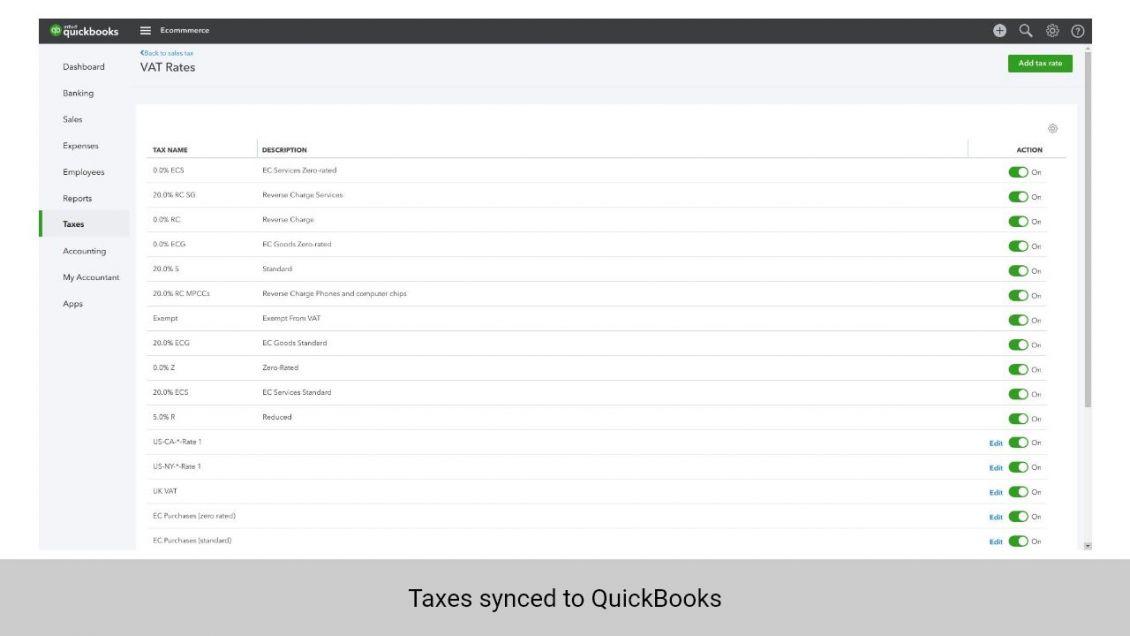

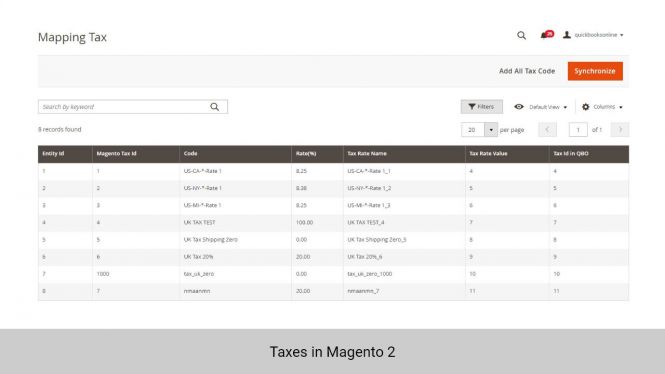

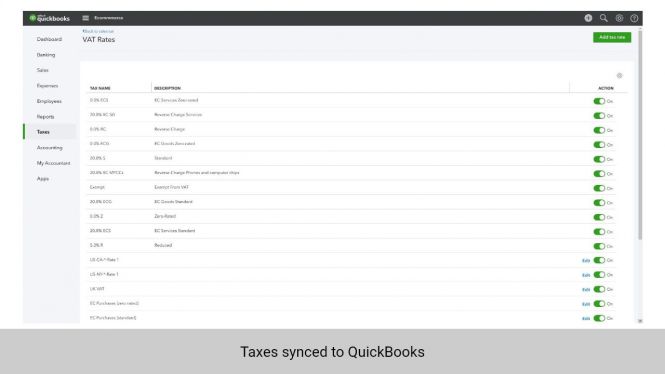

- Sync tax rate from Magento to QuickBooks

- NEW Map payment methods to deposit accounts

- Connect multiple sales channels to a single account

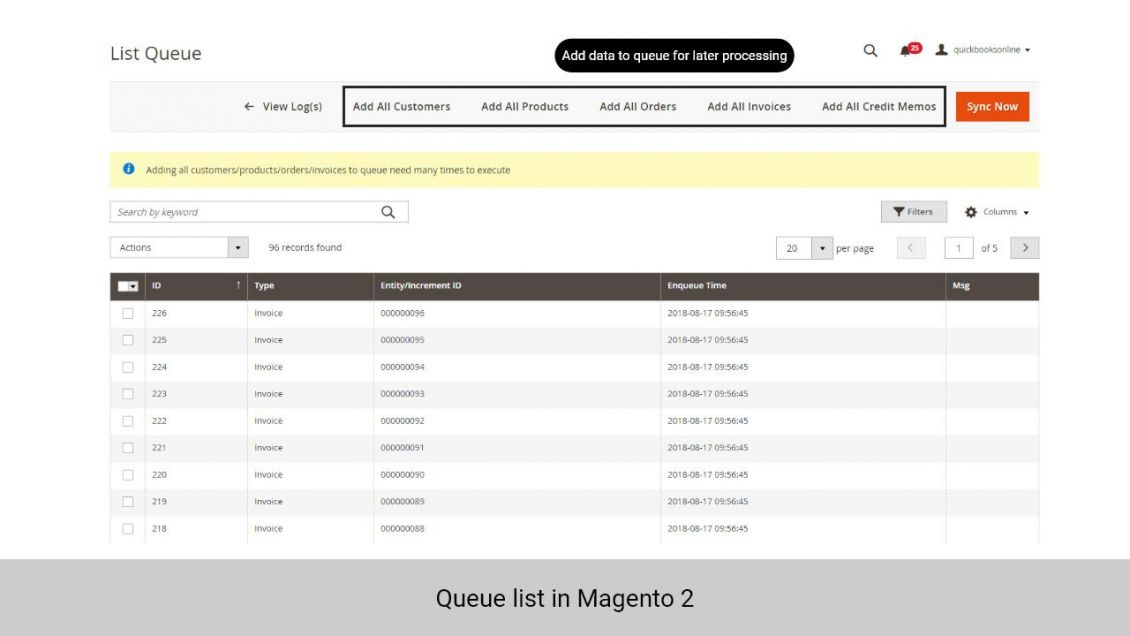

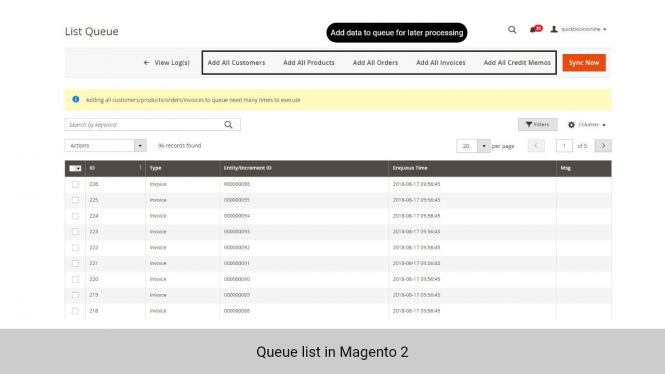

- Option to sync data by hand

- One time setup and installation

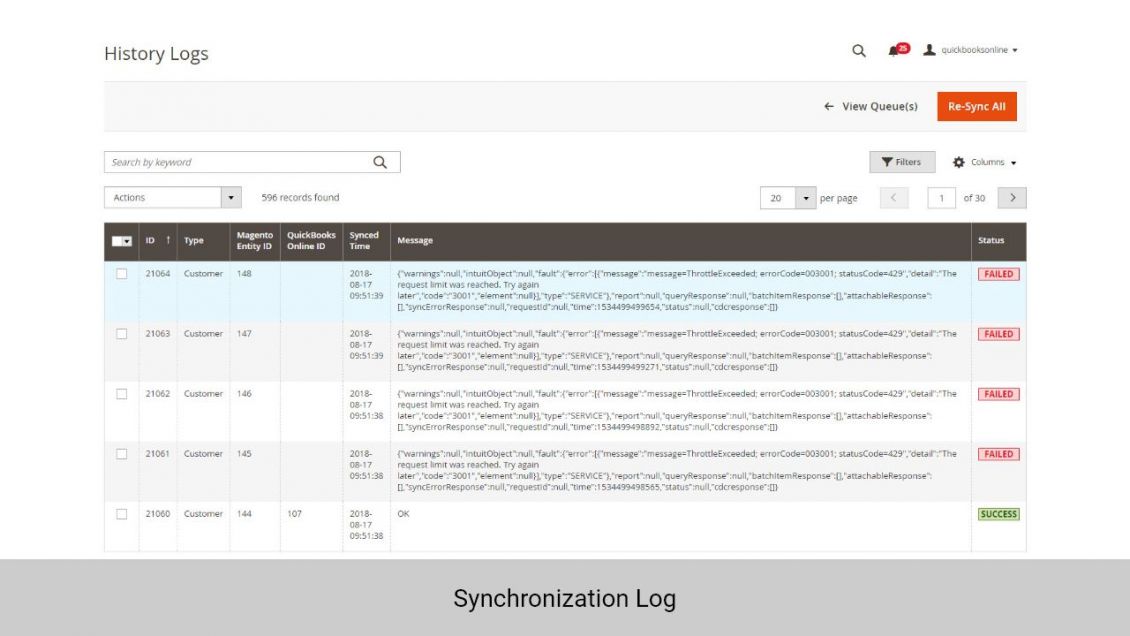

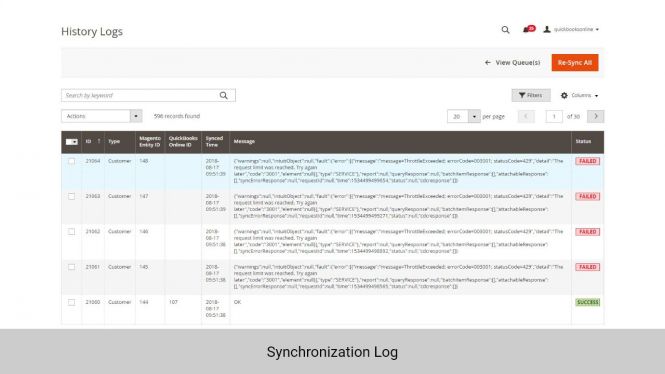

- Debug mode to track all sensitive data

- Set automatic synchronize mode immediately or cron job

NOTE:

- Your current data in QuickBooks Online might need to be remapped before syncing with our integration to avoid conflicts. Please contact us if you want to map existing data in Magento 2 and QuickBooks.

- Our demo is for feature testing only, the Magento Demo edition is not relevant to the Magento Extension edition. Please check on the product pages or with our support team for the correct Magento edition of our extensions.

Details

Synchronize and keep track of your revenue accross your Magento 2 store and QuickBooks

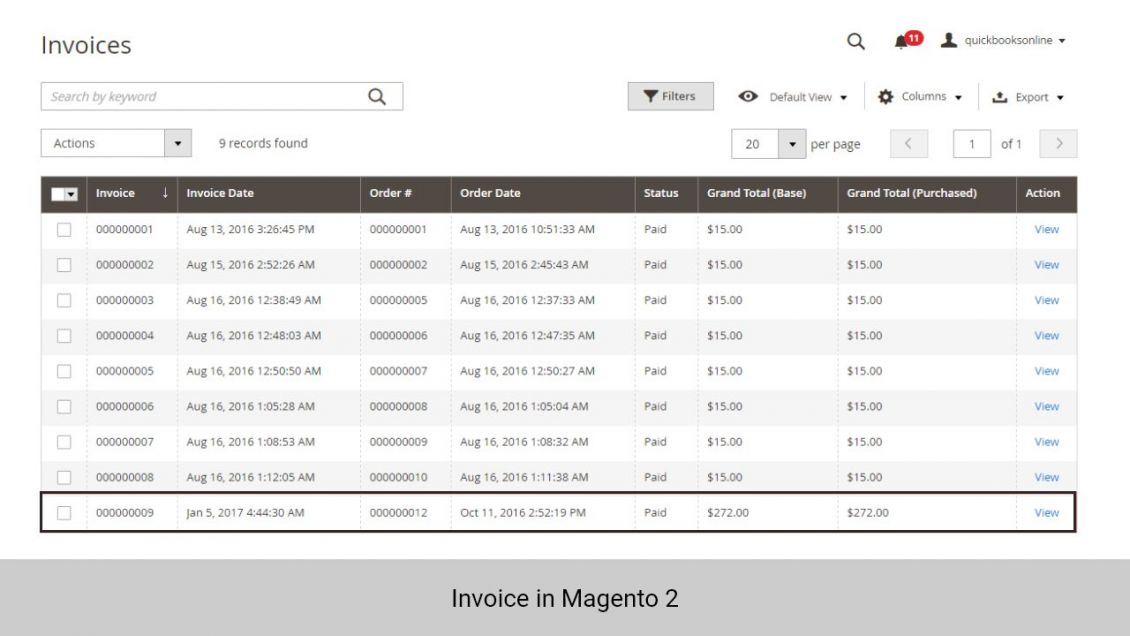

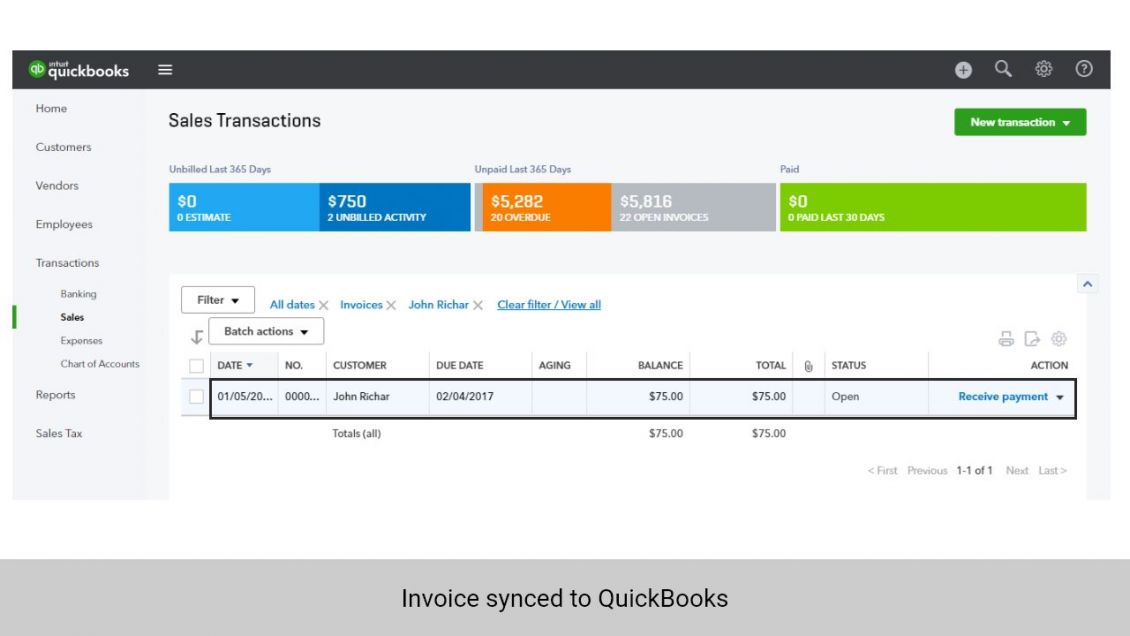

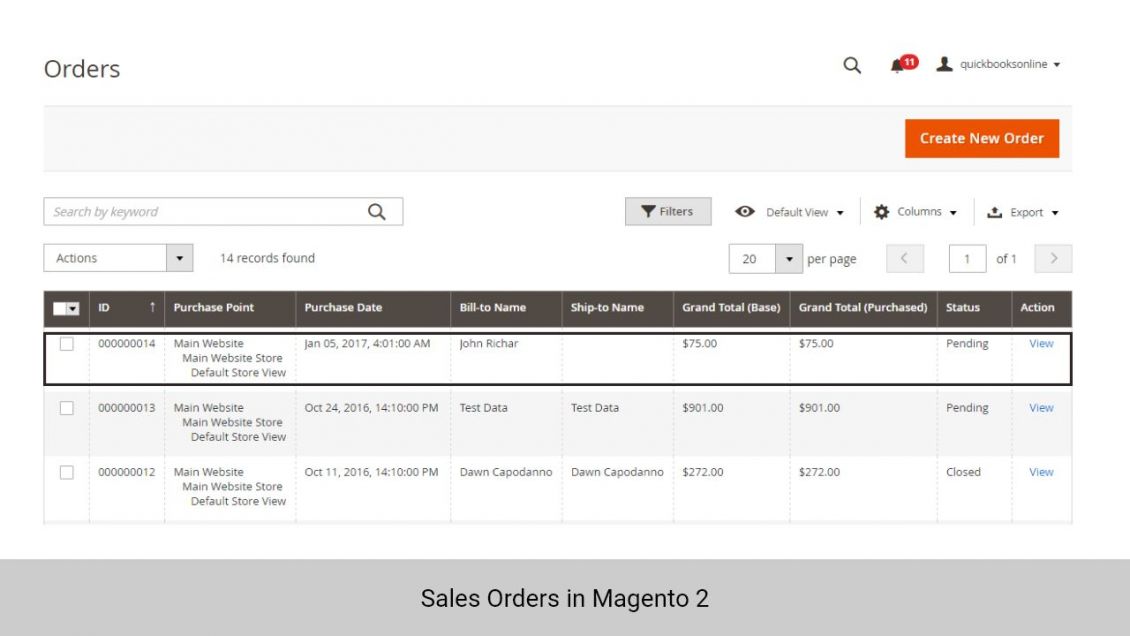

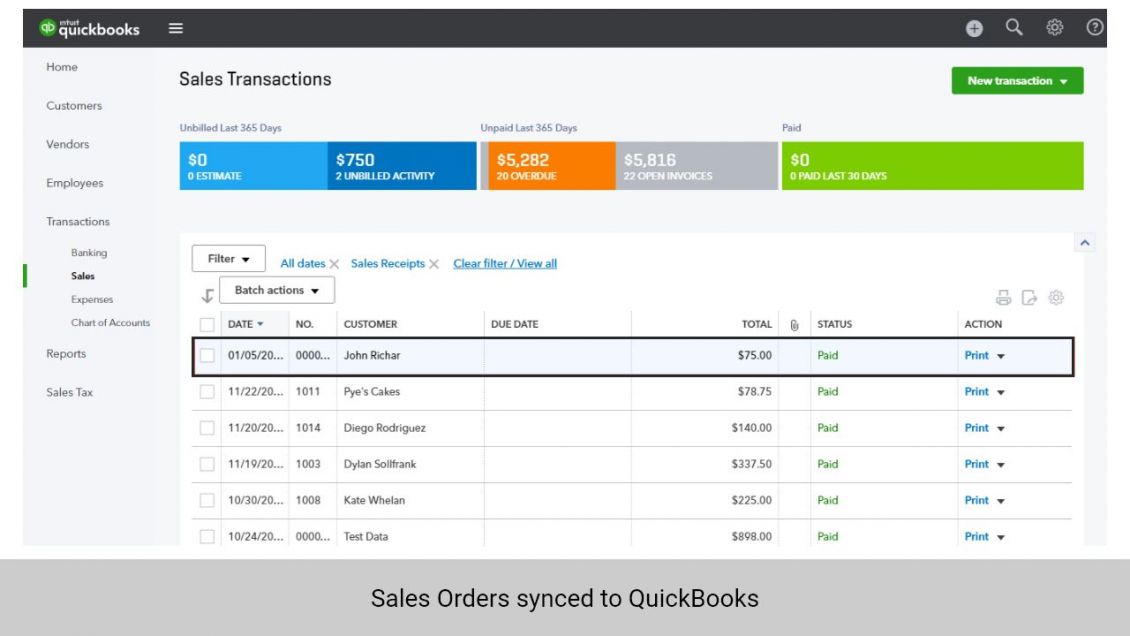

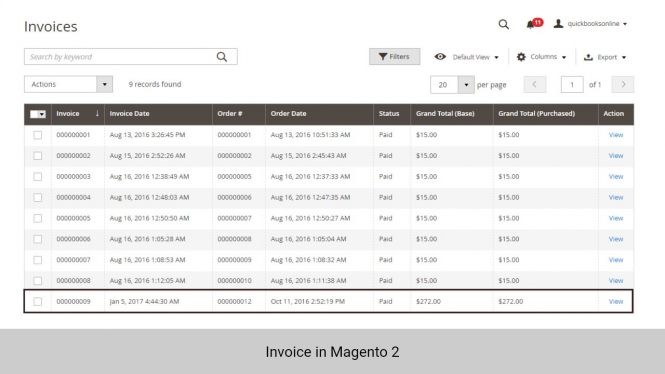

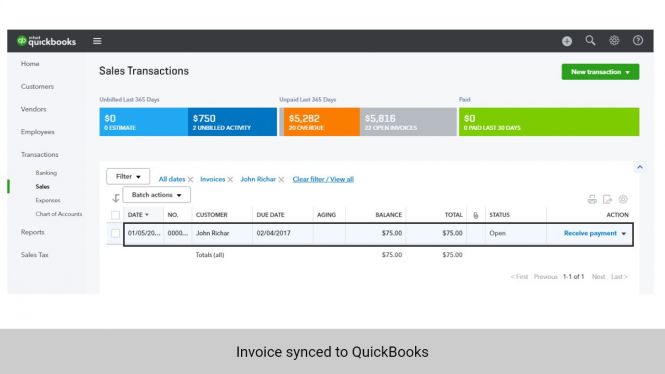

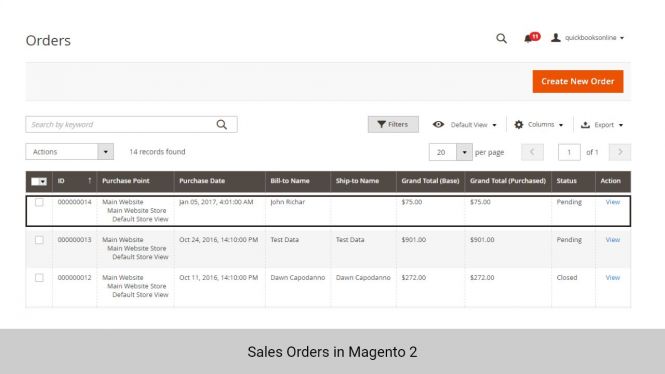

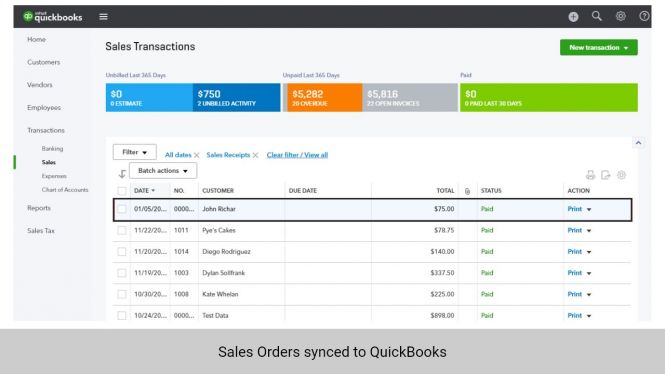

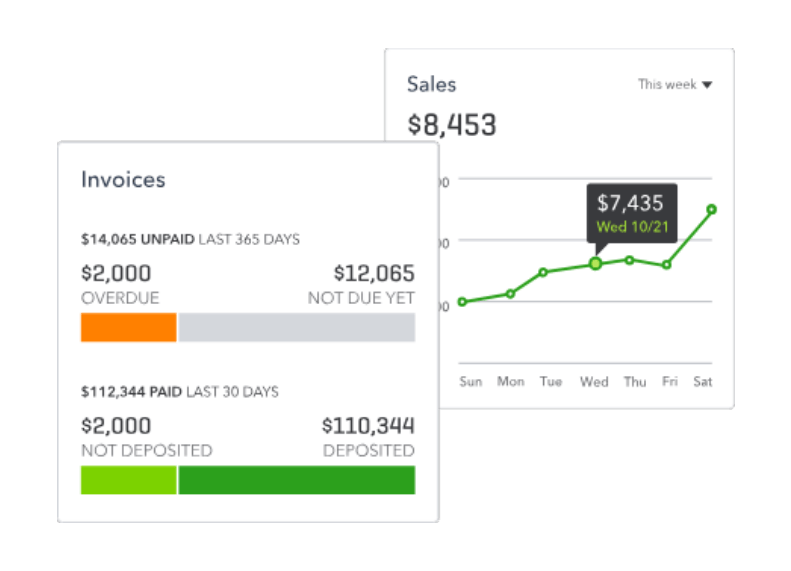

Automatically synchronize sales orders and invoices in Magento 2 to QuickBooks

- New orders generated by customers in Magento 2 will be synced automatically

- Orders imported from your store are automatically filled with corresponding data pulled from Magento 2

With Magenest extension, you can sync sales orders and invoices from your store to QuickBooks using the previously imported customer data, product data, payment method, shipping method, etc.

Synchronize sales invoice with ease

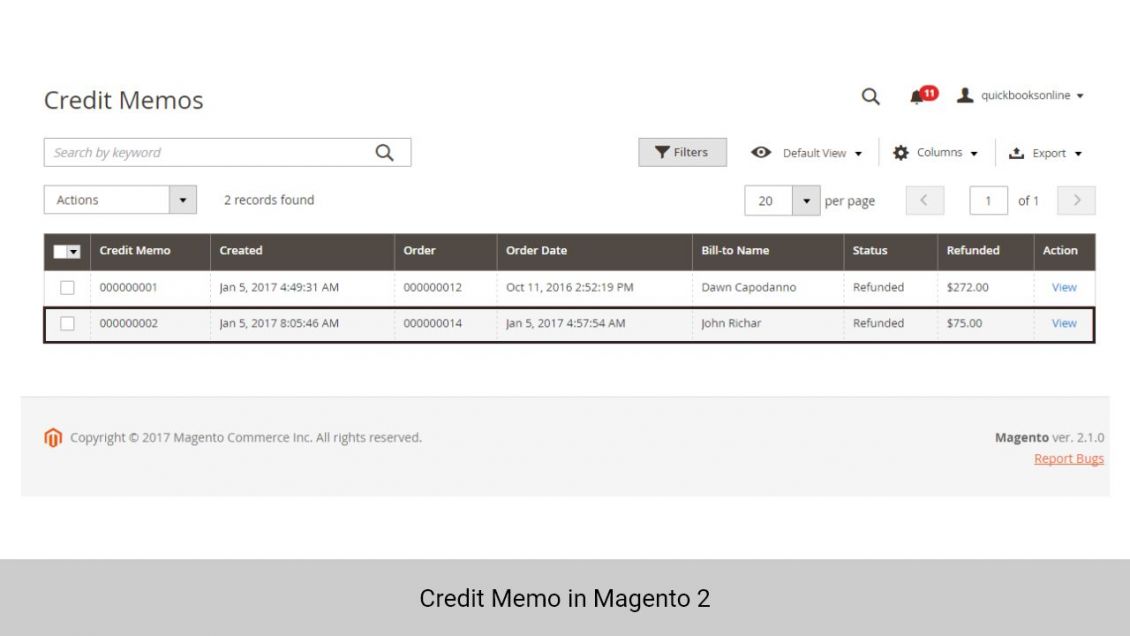

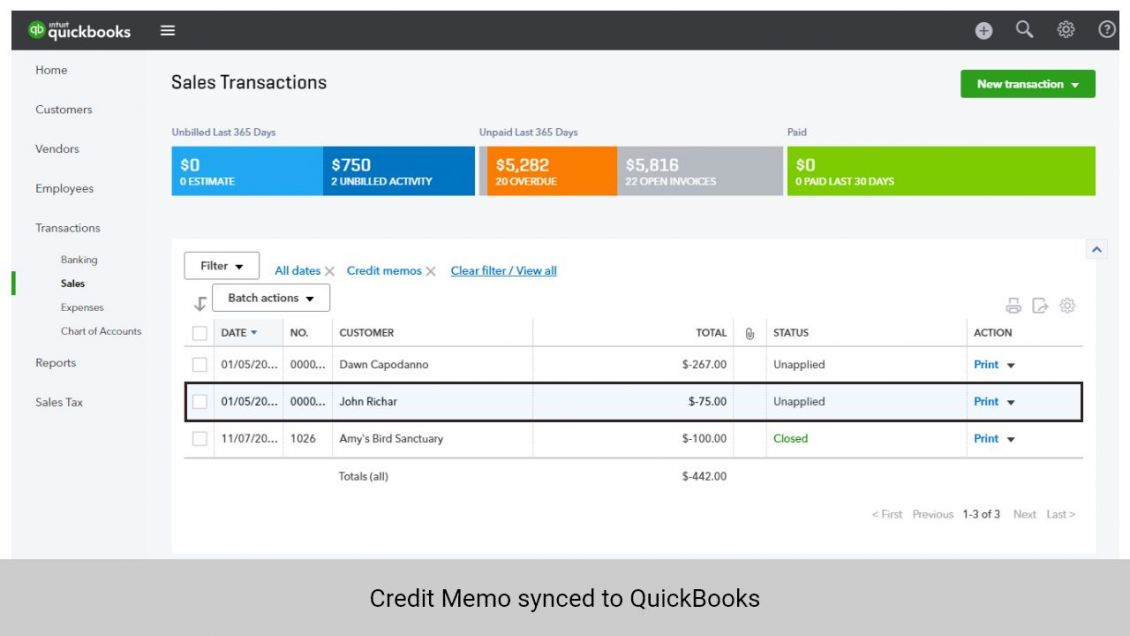

- New invoices generated by the merchants will be dynamically synced to accounting system

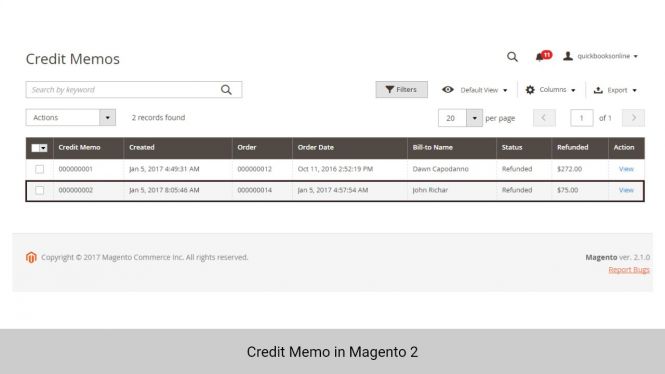

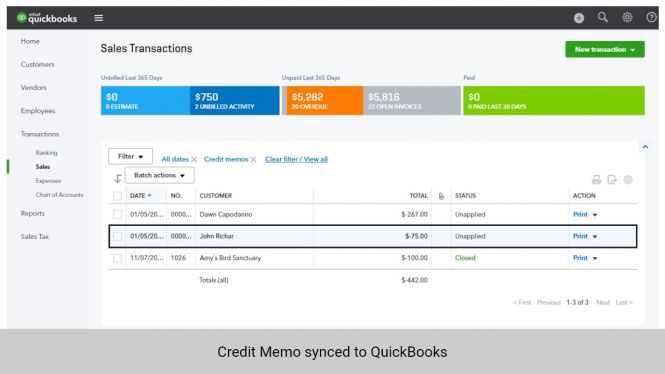

- Old credit memos can be manually added to the sync queue to QuickBooks Desktop

You can easily export credit memos from your store manually and automatically after setting up QuickBooks Desktop Integration

Tax synchronization

Different taxation policies affect your revenues and profit in different ways. So keeping track of your taxes and calculating tax accurately is important to manage your income. By syncing tax codes between Magento 2 and QuickBooks, you can ensure tax calculation accuracy.

Shipping Information synchronization

Synchronize shipping address correspondingly for each customer helps you to complete one of the required fields to sync sales orders and invoices from Magento 2 to QuickBooks Desktop.

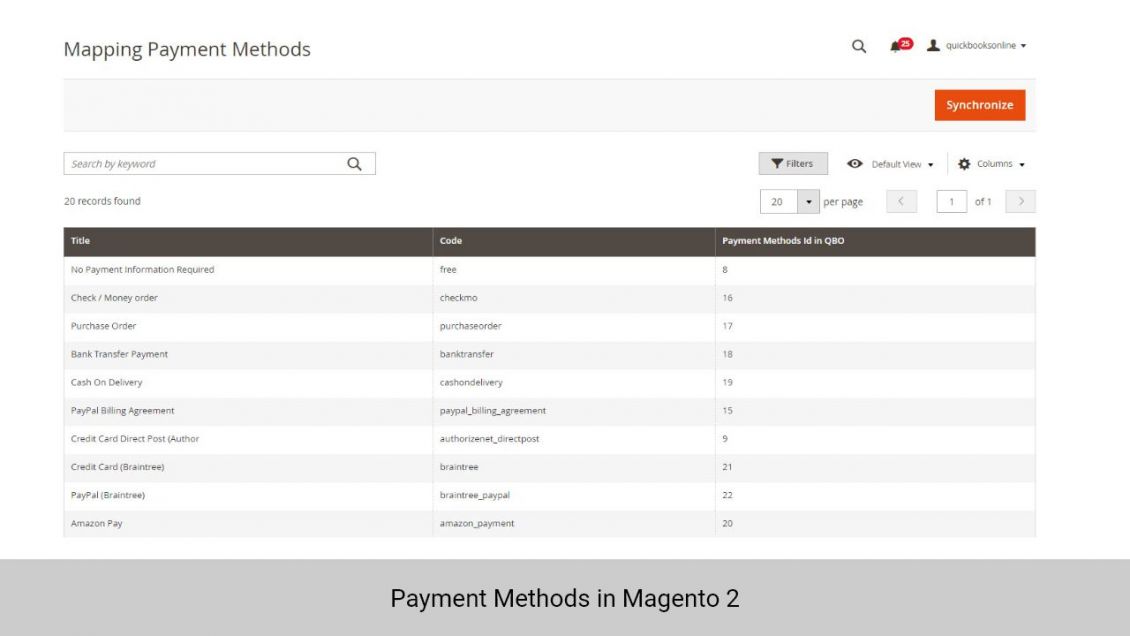

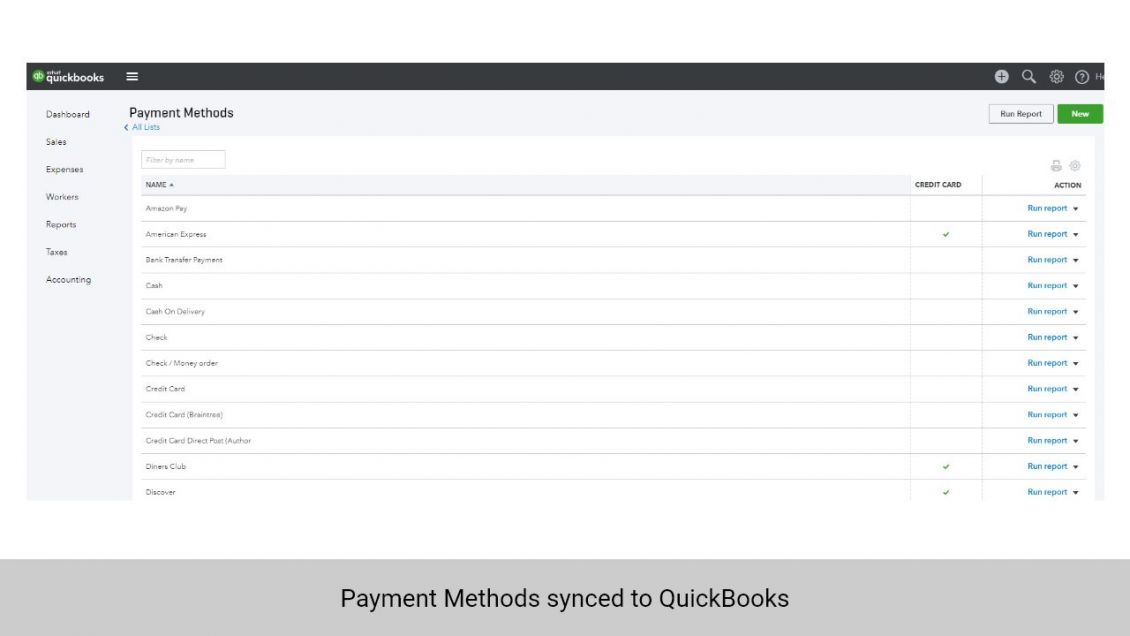

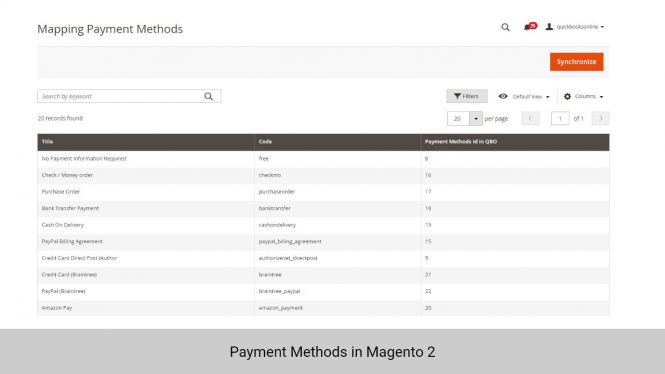

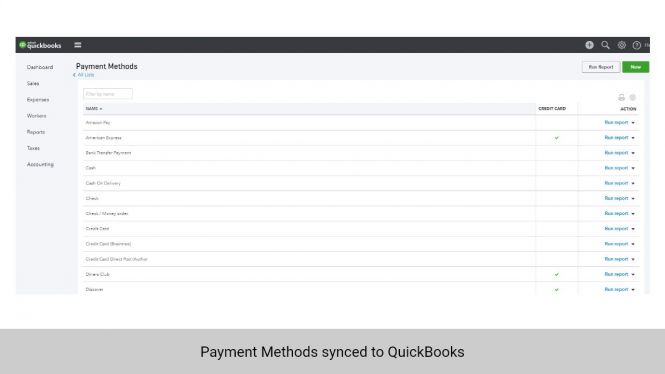

Easily synchronize payment methods

- Paypal, Braintree, Authorize.net, etc.

- Bank transfer

- No payment method

With Magento 2 QuickBooks Online Integration Plugin, you can easily specify the payment methods with each invoice from Magento 2. Our extension supports 20+ payment methods, including ACH/Direct Debit, credit card to payment gateways.

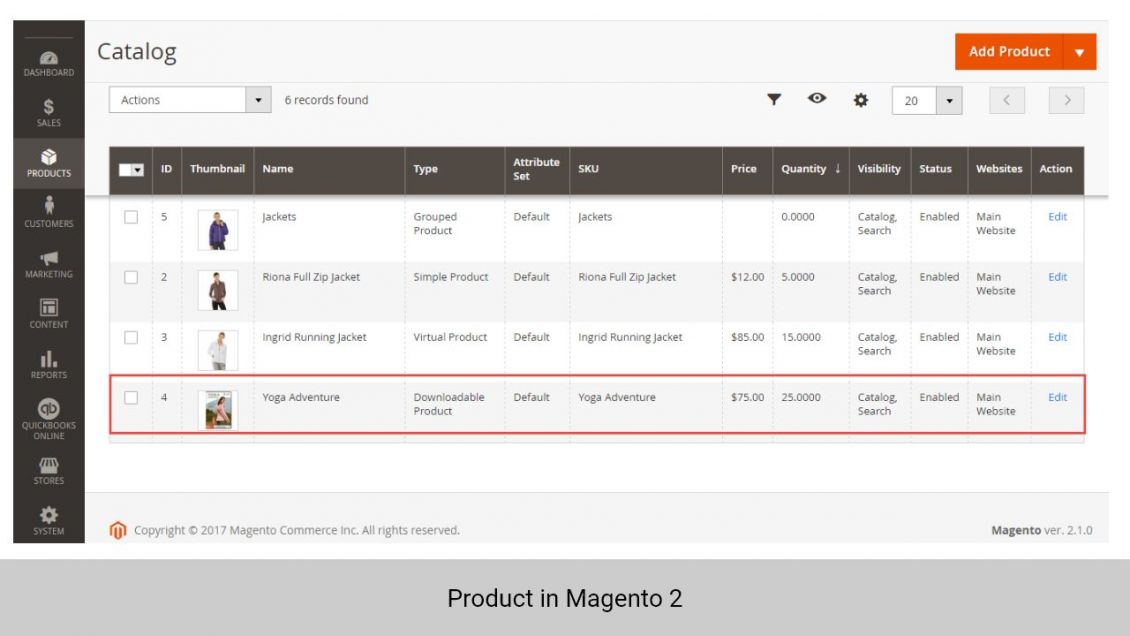

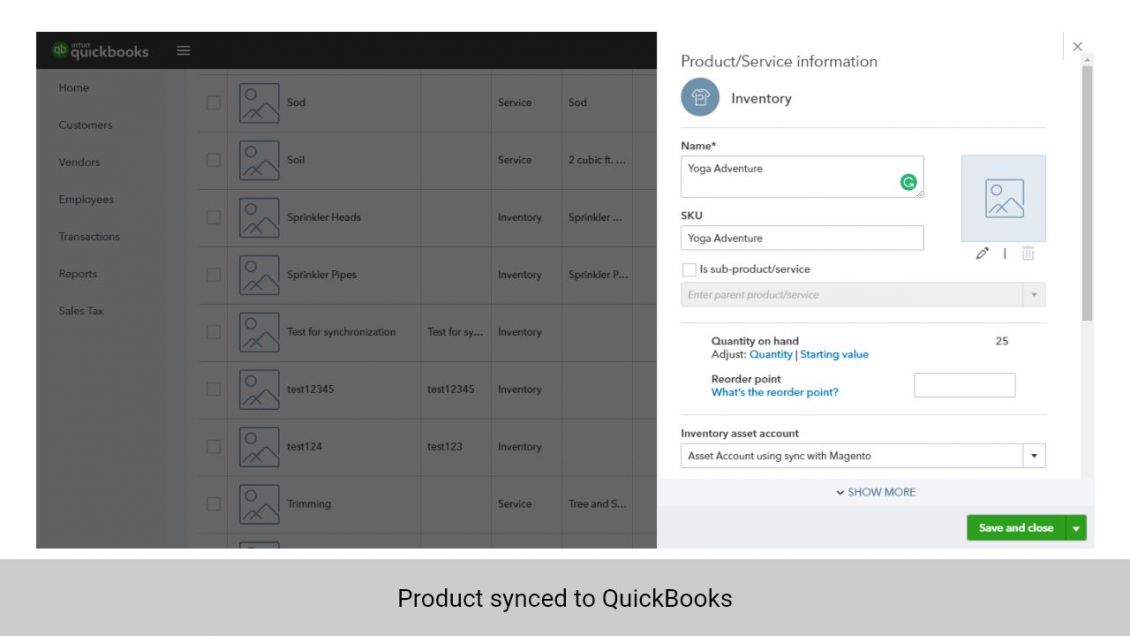

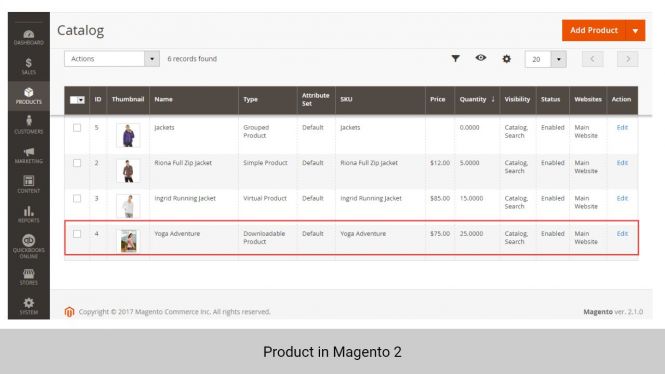

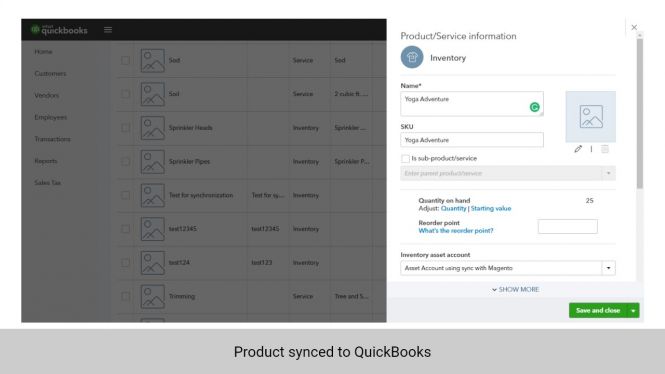

Automatically synchronize product data

QuickBooks Online will be automatically updated when merchants create a new product in Magento 2, while existing products can be manually added to the sync queue to QuickBooks. Product Stock (Quantity) synchronization is available for QBO Plus Version.

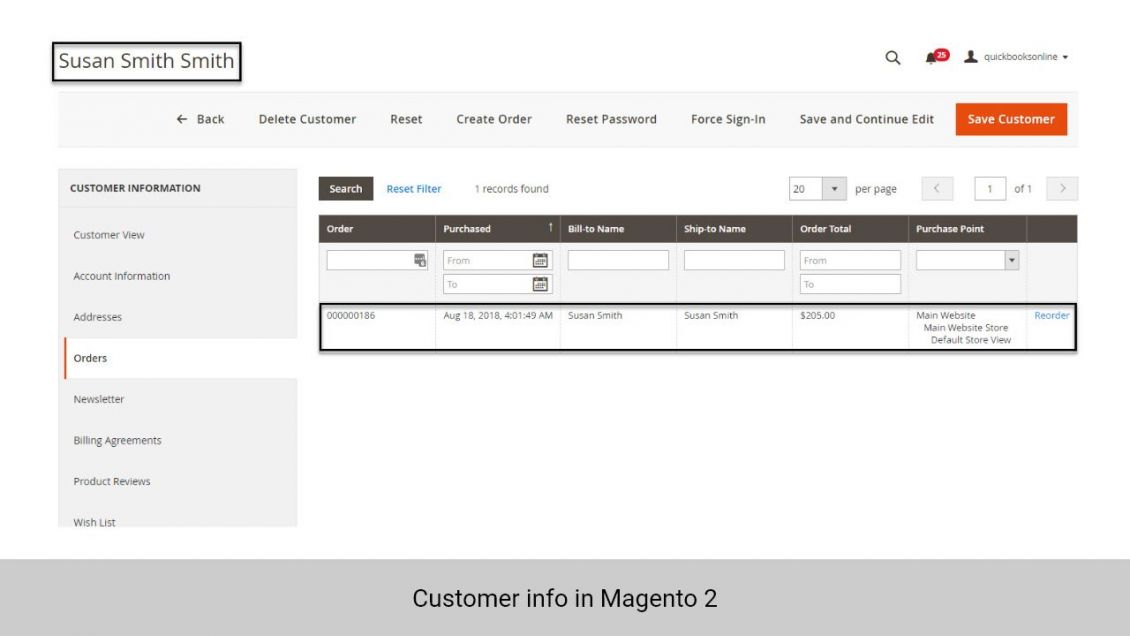

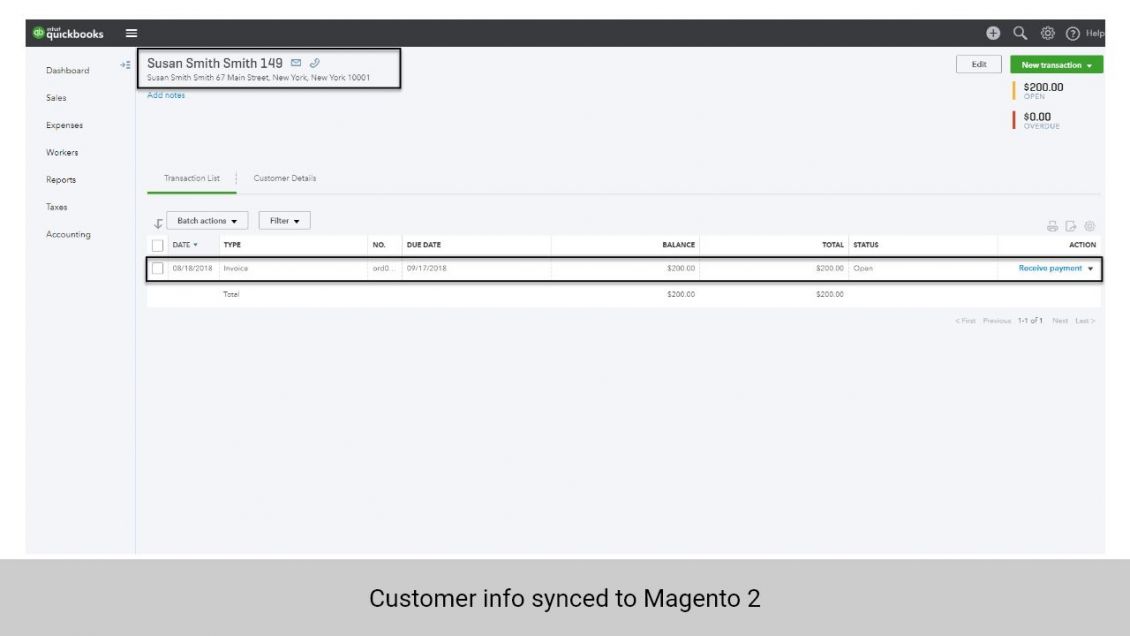

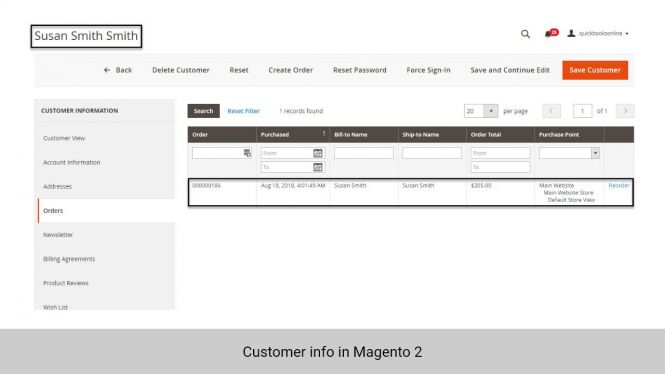

Customer data synchronization

When customers create a new account in Magento 2, the database in QuickBooks Online will be updated accordingly. Merchants can also manually sync old customer data.

One-time set up and payment

- Manual queue syncing or Automated cron job syncing

- Manual synchronization requests are added into queue so you won't have to do any coding

You only need to spend time setting up the first time you connect QuickBooks Online to Magento 2, future synchronization can be automated. Plus, you only have to pay once to fullly use this extension.

Free lifetime

software updates

Verified by

Magento Marketplace

One-time payment

without hidden cost