To help businesses expand to the international market easily, Magento 2 allows you to create and set different tax rates for each region and product.

We hope this article will help you understand better about Taxes in Magento 2.

Create a Tax Rates

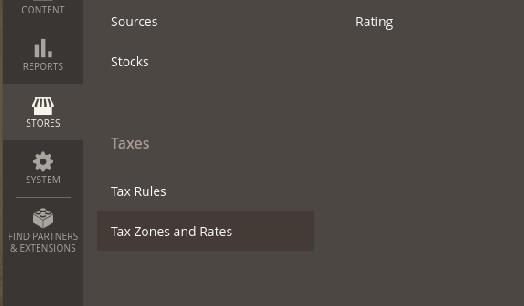

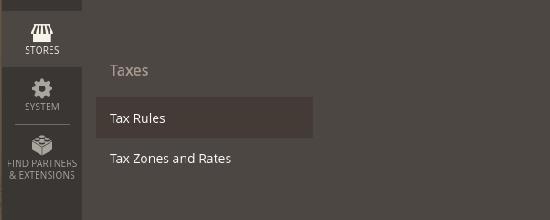

Login to your admin page, click to Store->Tax Zones and Rates

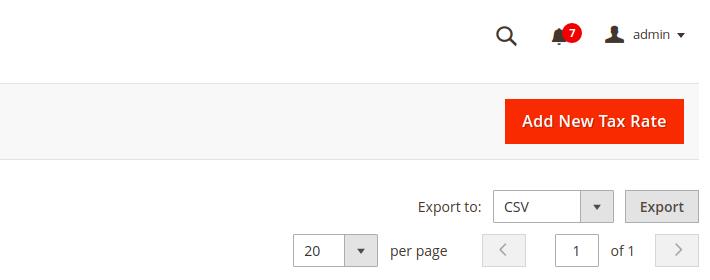

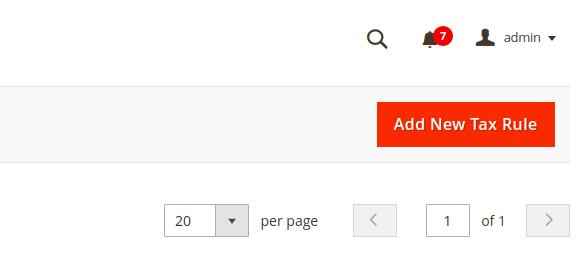

Click on Add New Tax Rate

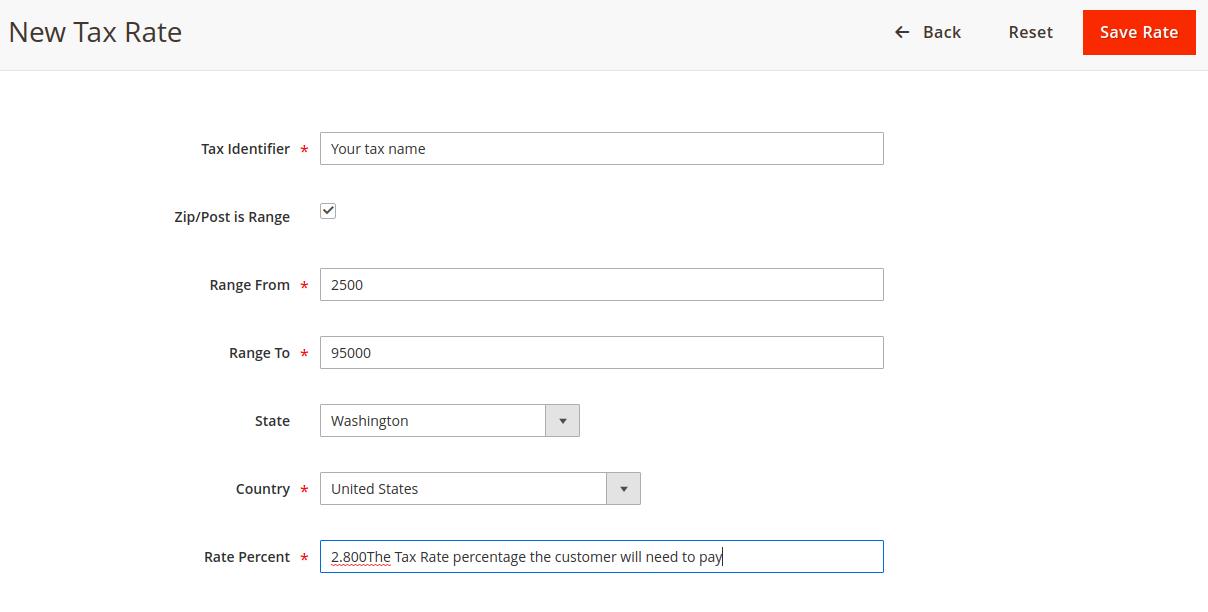

Now, you can configure tax rates

- Tax Identifier - The name of the tax used for internal identification

- Zip/Post is Range - If selected you will be able to set up a Range of Postcodes in the two fields below this one

- State - The State on which you wish to impose the Tax Rate (If your country does not have States, this option will be grayed out)

- Country - The Country on which you wish to impose the Tax Rate

- Rate Percent - The Tax Rate percentage the customer will need to pay

Click on the Save Rate button to save the Tax Rate.

Create a Tax Rule

Click on Tax Rules

Click on Add New Tax Rules

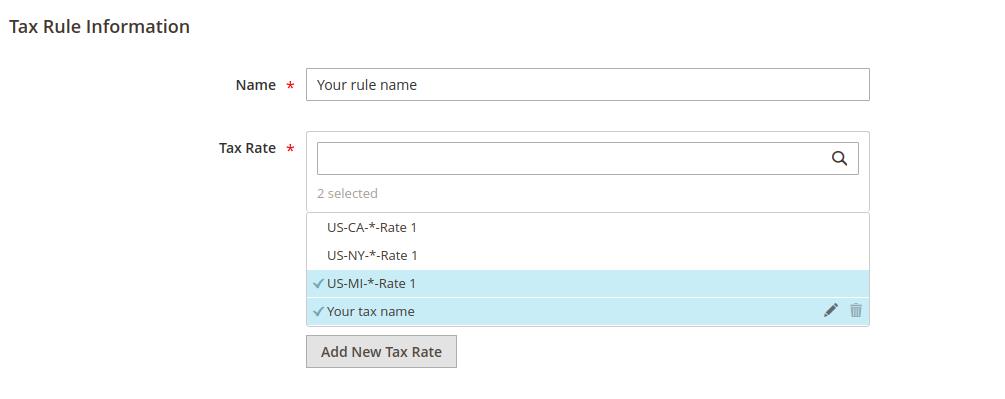

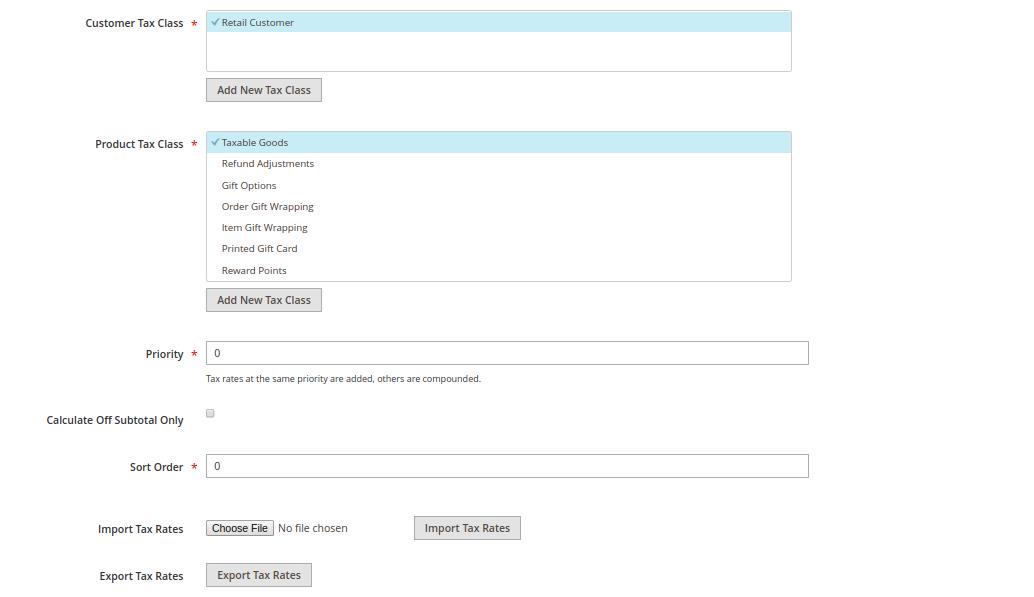

Tax Rules Information

- Name - Your tax rule name

- Tax Rate - Select the tax rate you want

- Add New Tax Rate - Create a new tax rate

Additional Settings

- Customer Tax Class – you can select from the existing ones, edit them or press Add New Class Tax to create a new customer tax class.

- Product Tax Class – select from the list of the existing ones, edit them or create a brand new product tax class by pressing the button below.

- Priority – indicate the rule priority in case more than one tax will apply. Taxes with the same priority will add up together, the taxes with different priorities will be compounded.

- Calculate Off Subtotal Only – mark the checkbox to base taxes on the order subtotal.

- Sort Order – the order of the tax rule in the list among the others.

You can Import Tax Rates and Export Tax Rates

Click on the Save Rule button to save the Tax Rule.

Thank you for reading the article. If any problem occurs, let us know in the comments.

Lucy Pham

Marketing Manager