More entrepreneurs are turning to venture debt to raise additional capital and today we are going to help you know the answer to the question “What is venture debt?” How to compare it to venture capital? Why should a private company consider it? And also the future of the venture debt industry.

It’s true that venture debt can be an attractive option as it provides companies, especially start-ups a way to access capital without having to give up too much of their ownership. This is a relatively fast way to raise new funds and help young companies extend their runway between equity rounds but still hit some milestones in the company’s performance.

Among all the economic uncertainty due to the Covid-19 pandemic, an increasing number of businesses have turned to venture debt so that they could quickly adapt to the new economic conditions or just a way to avoid raising from venture capitalists in a down round.

What is Venture Debt?

Venture debt or venture lending is a type of debt a company owes when it gets funded from specialized banks or non-bank lenders.

Basically, venture debt offers an alternative way for Venture Capital-backed startups to access funding by borrowing money. Venture debt could complement venture capital and provide higher value to the growth of a company as a whole. Unlike traditional lending by banks, venture debt is available for all startups or companies that don’t have a positive cash flow.

Banks use deposits to fund their lending but they are heavily regulated about the types of lending and the amount of risk they face.

Venture debt is different from most other forms of credit because it depends less on factors such as inventory held, cash levels, and account receivable. Instead of that, the venture debt focuses more on the relationships of business owners and VC backers of the company.

For instance, a typical amount of venture debt that a company can raise is set between 20-35% of the latest equity round.

What is Venture Debt used for?

Typically, venture debt is used for growth capital or equipment financing. For growth capital, venture debt can be used for any purpose and will be secured by the assets of the company. For equipment financing, the money borrowed may be used to buy new buying machines for a factory.

But basically, venture debt is intended for fast-growing and VC-backed startups are usually negotiated near the time when a start-up has an equity round. Like how startups would use VC financing, they normally make use of venture debt for the growth purposes of the company, including marketing, investment in R&D, building out sales teams, and much more.

In America, most of the venture debt financing comes from entrepreneurial-focused banks such as Silicon Valley Bank or specialized funds for venture debt like WTI (Western Technology Investment), Trinity Capital, and TriplePoint Capital. Commercial banks may not offer venture debt but businesses can get it from other sources like private equity firms, hedge funds, and business development companies (BDCs).

How Can Venture Debt Lenders Earn Money?

Venture debt lenders will earn their profit mainly through interest payments, warrants, and fees. Warrants are later converted into shares during an exit - like acquisition or an IPO.

How Can Venture Debt Lenders Evaluate The Potential of Startups?

Venture debt lenders will choose candidates for their investments after an intense underwriting process and many different factors to be considered such as the product; market traction, management team, investors, and other value drivers. Because the ultimate repayment source for venture debt depends on the future equity rounds, the lenders must evaluate carefully to see whether a company has enough conditions that allow them to raise future rounds.

Other criteria for the underwriting process are the capital strategy and the company’s life stage.

For example, companies that are early in their stages with limited operating history can be judged based on investor quality, projected cash burn rate, and recent equity rounds while companies with high burn rates are considered to have more risks as they rely more on external capital.

4 Benefits of Venture Debt?

1. Less Equity Dilution

Since venture debt doesn’t require the business owner to give away much equity, founders can raise capital while still retaining much of their company.

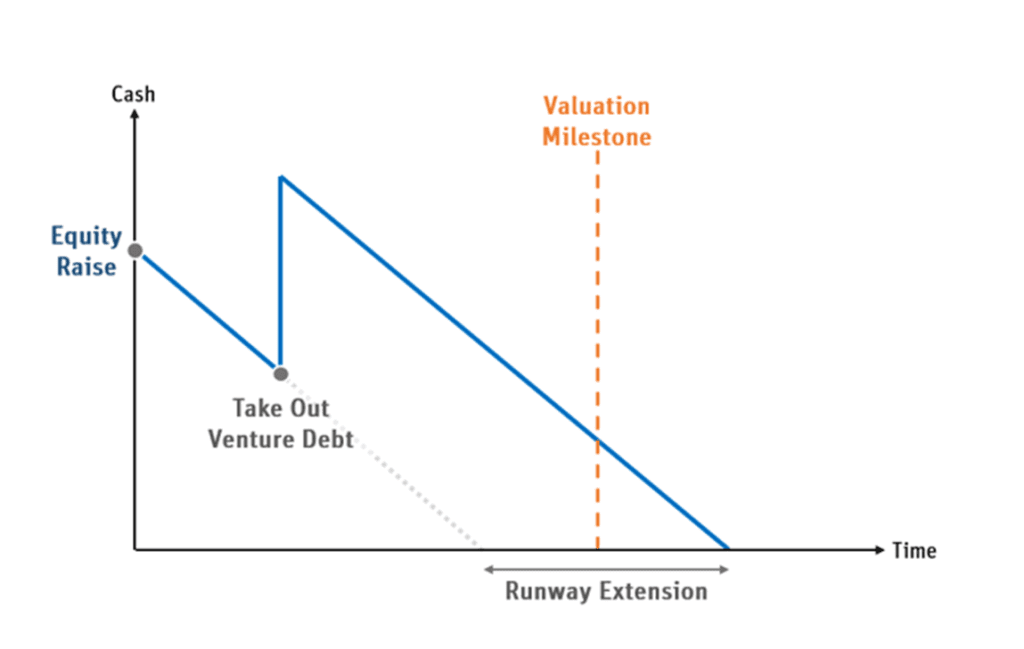

2. Extends Cach Runaway

Start-up companies tend to use venture debt to raise cash quickly so that they can hit milestones between raising equity rounds.

3. More Adaptability

Venture debt can support young companies in terms of unexpected market conditions and short-term challenges.

4. Helps Avoid Down Rounds

Many companies also use venture debt to postpone raising additional equity rounds until they could gain a bigger valuation.

However, despite all the potential benefits of venture debt above, it’s not a direct substitute for a VC-backed equity round because of some drawbacks it may have. For example, one downside of venture debt is that it needs to be repaid. And things can get very tricky if your projections fall short of your expectations and you have to pay off the loans at the same time.

The Difference between Venture Debt vs. Venture Capital

Venture debt cannot be a direct alternative to venture capital. The purpose of venture debt is to complement equity funding from VC firms, but not to fully fund an early-stage company as it will grow and turn into an exit. Normally, startups cannot even gain their venture debt without getting venture capital first.

Nevertheless, venture debt is different from equity financing in multiple aspects. To delay or avoid raising another VC round, some companies will choose venture debt.

How Is Venture Debt Different from Venture Capital?

Although both venture debt and venture capital funding can be used for any general business purpose, they are still different in many ways.

- Venture debt issuers tend not to take much equity in a company while VCs often take a considerable amount of equity stake in a company in exchange for capital.

- The cost of venture debt is limited to pre-agreed interest rates but equity in the venture capital model could fluctuate in value over time and sometimes vary dramatically.

- With venture debt, over time debt will be paid back with interest while VCs earn money from selling equity.

- There are not typically board seat requirements in venture debt but in venture capital, investors receive a board seat.

- Compared to venture capital, the diligence process of venture debt is likely to be less comprehensive and strict.

What is the Difference between Venture Debt and Venture Capital Business Model?

The main differences between the venture debt and venture capital model are:

- The failure rate of venture debt is much lower: According to Kruze Consulting, from 1 to 8% of the invested capital is canceled and this is likely due to the borrowers having already raised VC funding and an exhaustive due diligence process.

- The internal rate of return (IRR) is driven by fees, interest rates, warrants, and repayment schedules. The capital lent to young startups is estimated to be returned back to a venture-debt fund within the first 15-18 months of a 3-year loan. Meanwhile, venture capital funds usually have holding periods of 5 to 8 years before there is any return on the investment by selling equity.

- Venture debt lenders often support a startup based on the near-term viability rather than growth potential. In other words, venture debt lenders pay attention to the ability to pay back a loan of a company within a few years.

Why Should a Start-up Consider Venture Debt Solution?

As we mentioned above, one of the advantages of venture debt is that it could provide access to additional capital without having to give way too much equity. Start-ups may want to get venture debt as a way to get an influx of cash in order to deal with unanticipated events, short-term market downturns, and challenges. Below are some questions to answer so that you get a better understanding of the venture debt solution.

The Best Time to Raise Venture Debt?

It’s normal for companies to raise venture debt around or soon after a round of equity.

What Do Startups Need Venture Debt for?

There would be a variety of reasons for young companies to use venture debt, but usually, it’s intended for a combination of earning large capital expenditures, extending cash runaway, or preparing themselves for unexpected challenges.

A startup that wants to extend its cash runaway with venture debt often hopes to restrict its equity dilution at its next VC raise and reach some milestones linked to higher valuation by an influx of cash.

(Source: The Startup)

Besides, a startup company may want to use venture debt to fund large capital expenses so that it can avoid completely depleting its cash balance. Take Facebook as an example, it raised debt from venture debt fund WTI to buy some of its very first servers.

When a startup faces a market challenge, it may need venture debt to avoid the situation of raising VC funding from a weakened negotiation position, which may lead to giving away a large equity stake at a reduced valuation.

For instance, a digital lending startup based in India - Lendingkart raised venture debt of 11.5 million dollars from Alteria Capital in June 2019. That’s the time when VCs reportedly took a cautious approach towards financing lending startups due to a liquidity crunch made by the nonbank lender giant IL&FS in India.

How Do VCs View Venture Debt?

VCs do not see venture debt as a bad sign for a start-up, in fact, most VCs work closely with venture debt funds.

It depends on different situations, VCs may have an unfavorable view of some debts. For example, inventors may want to hold back if a startup wants to use equity funding to repay the previous debt.

Moreover, venture debt appears to not be well-suited for those who face big business challenges like being unable to raise additional equity, highly unstable revenue streams, or elevated cash burn rates, and so on.

The Future of Venture Debt

After the financial crisis in 2008, the modern venture debt market emerged as an influx of new market participants fostered competition, which made not only the number of venture debt lenders increase but also interest rates, loan structures, and terms become more favorable.

More and more businesses have raised capital in the form of venture debt from a wide range of investors over the last decades.

Although venture debt is not going to replace venture capital, it seems the pandemic has added to this situation and the trend will continue.

The Covid-19 has forced startups to explore more cost-effective measures and find ways to increase their cash runaway. Some founders make it clear that they plan to skip venture capital funding to avoid down rounds that would take away or dilute their ownership. What adds more to the situation is the current period of low-interest rates that stems from the economic uncertainty due to the coronavirus which makes it more appealing for startups to look for a more favorable business environment.

Even when venture debt becomes an attractive option, businesses should stay cautious before choosing that approach. Adding debt to a balance sheet clearly is not a big problem when capital is free-flowing, however, debt could turn into a burden on your business growth if a company’s performance lags behind or there is an unexpected return from the market.

Conclusion

Clearly, there’s undeniable that venture debt has a critical role to play in helping business owners and founders to meet their business goals but this is not the only source of capital for fast-growing businesses to consider. After understanding "what is venture debt", using venture debt can be a smart move in many business situations thanks to all of the advantages it could bring. For more insightful posts like this, please pay a visit to our store blog and figure it out by yourself, we have tons of excellent extensions to help you grow your store.