What is ACH Payment?

Difference between ACH payments, wire transfers, and EFT payments

What are the Benefits of ACH Payment Processing?

How do ACH Payments Work?

What are Typical ACH Payment Processing Times?

How much does ACH Payment Cost to Process?

Why are some ACH payments rejected?

Other Frequently Asked Questions about ACH payments

One of the most common ways to pay or receive money online is through an ACH or automated clearing house transfer. ACH transfers include online bill payments and direct deposits, as well as other types of transfers.

ACH payments are a great choice for paper checks and credit card payments for businesses. They are faster and more secure than checks since they are electronic, which helps to automate and streamline accounting. In general, an ACH transfer is less expensive to process than a credit card payment or wire transfer. If you run a business that accepts recurring payments, the savings would be significant.

Here’s a guide to what is an ACH payment and how it works.

What is ACH Payment?

ACH is an abbreviation for Automated Clearing House, a financial network in the United States that is used for electronic payments and money transfers. ACH payments, generally known as “direct payments,” are a method of transferring money from one bank account to another without the need for paper checks, credit card networks, wire transfers, or cash.

The volume of ACH payments is continuously increasing. As a consumer, you're probably already familiar with ACH payment meaning, even if you're not aware of the jargon. The ACH network is most likely in use if you pay your bills online (rather than writing a check or inputting a credit card number) or get a direct deposit from your employer.

Difference between ACH payments, wire transfers, and EFT payments

While ACH payments and wire transfers are both methods of moving money between accounts, they differ in a number of ways. In contrast to ACH payments, which are processed in batches three times per day, wire transfers are processed in real-time. As a result, wire transfers are ensured to arrive the same day, but ACH transfers might take several days to process.

In addition, wire transfers are more costly than ACH payments. While some banks do not charge for wire transfers, they can cost users up to $60 in other cases.

EFT (electronic funds transfer) payments and ACH payments can be used interchangeably. They both refer to the same payment system.

In short, to differentiate the 3 terms, remember that ACH Transfers (also called EFT) are often less expensive than wire transfers but they might take several days to process while Wire Transfers are pricey but quicker since they do not employ a "batch" procedure.

What are the Benefits of ACH Payment Processing?

There are several reasons why ACH payments are becoming a more appealing option for businesses.

Reduced processing costs

ACH payments have the lowest processing fees of any payment method. If you choose a flat-rate supplier, processing ACH payments will cost your company much less than processing credit cards.

Very few declines due to expiry

Checking accounts, unlike credit and debit cards, do not have items that "expire." As a result, when processing ACH payments, you will see significantly fewer declines.

More convenient for you and your customers

There will be no more paper invoices, checks, or time-consuming bank trips. Offering a variety of payment methods improves the customer experience. Customers don't have to look for their checkbook every month when they use ACH payments. By signing up for recurring billing, they can simply "set it and forget it."

Although ACH payment processing is inexpensive and convenient, it does have certain restrictions. ACH payments might take several days to process, usually three to five business days. Moreover, there may be daily and monthly limits on the amount of money you can move. The Same Day ACH per transfer limit is set at a maximum of $25,000 per transaction.

After a certain time of day, a transfer won’t be processed until the next day (or Monday, if it’s before a weekend). And it’s likely your bank doesn’t allow ACH transfers to and from international bank accounts.

Examples of ACH payments

ACH payments are classified into two types. Money is "drawn" from your account during an ACH debit transaction while ACH credit transactions allow you to "push" money to many banks (either your own or to others). Here are two examples of how they work in reality.

Direct deposit payroll

Many businesses provide direct deposit payroll. They use ACH credit transactions to transfer money into their workers' bank accounts at predetermined pay periods. (To set this up, employees must give a voided check or a checking account and routing information.)

Recurring bill payments

Consumers who pay a business (such as their insurance provider or mortgage lender) on a regular basis may opt to set up recurring payments. This enables the company to begin ACH debit transactions at the end of each billing cycle, deducting the amount owing straight from the customer's account.

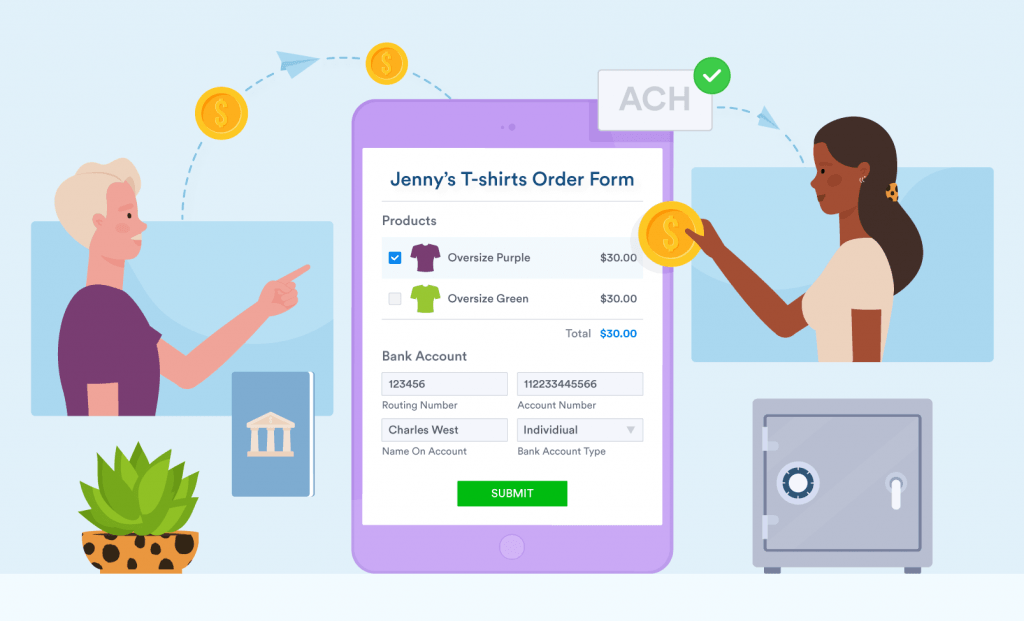

How do ACH Payments Work?

Aside from the Automated Clearing House network (which connects all US banks), three other parties are engaged in ACH payments:

- The financial institution that initiates the transaction - known as the Originating Depository Financial Institution (ODFI).

- The financial institution that receives the ACH request - known as the Receiving Depository Financial Institution (RDFI).

- The nonpartisan governmental entity is responsible for overseeing and regulating the ACH network - known as The National Automated Clearing House Association (NACHA).

So, how exactly do ACH payments work?

As an example, consider your automated monthly phone bill payments. You submit your checking account information (routing and account number) and sign a regular payment authorization when you sign up for autopay with your phone carrier.

When you reach your billing cycle, your phone company's bank (the ODFI) sends a request to your bank (the RDFI) to transfer the funds owed. The two banks then communicate to confirm that sufficient money is available in your bank account to complete the transaction. If you have enough funds, the transaction is completed and the money is sent to your phone company's bank account.

What are Typical ACH Payment Processing Times?

ACH payments generally take several business days (days when banks are open) to process. Payments are processed in batches through the ACH network (as opposed to wire transfers, which are processed in real-time).

According to NACHA guidelines, financial institutions can have ACH credits processed and sent within a working day or between one to two days. In contrast, ACH debit transactions must be completed by the next business day.

Following receipt of the transfer, the other bank may also detain the transferred funds for a period of time. Overall, ACH payments have a processing time of three to five days on average.

However, a new NACHA rule (which went into effect in September 2016) mandates the ACH to process debits three times each day rather than just once. The modifications (which are being implemented in stages) have allowed for the widespread usage of same-day ACH payments since March 2018.

How much does ACH Payment Cost to Process?

ACH payments are generally less expensive to process for businesses than credit cards. Prices are set by your merchant account provider (or whichever entity you use to handle ACH payments).

Some ACH processors impose a flat fee per transaction, which generally runs from $0.25 to $0.75. Others impose a fixed percentage fee for every transaction, ranging from 0.5 percent to one percent. Providers may also charge a monthly fee for ACH payments, which varies. Square accepts ACH payments for deposits, and there is no cost for Square retailers.

Why are some ACH payments rejected?

If an ACH payment is denied, your bank (OFDI) will provide a reject code that indicates what went wrong. These reject codes are critical for informing your consumers as to why their payment did not go through. The four most common reject codes are as follows:

R01: There are insufficient funds

This implies that the consumer did not have sufficient funds in their account to pay the amount of the debit. When you receive this code, you will most likely have to rerun the transaction when the consumer transfers more funds into their account or offers a new payment method.

R02: Bank account has been closed

This occurs when a customer closes a previously active account. They most likely failed to tell you of the change. To complete the transaction, they must give you a new bank account.

R03: There is no bank account/the account cannot be found

This code is generated when some combination of the data provided (the account number and name on the account) does not match the bank's records, or when a nonexistent account number is submitted. The customers must double-check and re-enter their banking information.

R29: Reject

If a bank refuses to allow a business to withdraw funds from a certain bank account, you will receive this rejection code. In this situation, the client must provide their bank with your ACH Originator ID in order for your company to be permitted to create ACH withdrawals. The transaction must then be re-run.

Other Frequently Asked Questions about ACH payments

Are there any Penalty Fees with ACH payment?

Sadly, rejected ACH payments may result in a penalty fee for your company. If you receive a reject code, it is critical that you address the problem as soon as possible to prevent paying additional fees on each recurring payment cycle. It may be worth just accepting ACH payments from reliable clients to avoid the bother of untangling ACH rejections.

Is ACH high security?

Despite the fact that the ACH network is managed by the federal government and NACHA, ACH payments are not subject to the same PCI-compliance requirements as credit card processing.

However, NACHA mandates that all parties engaged in ACH transactions (including companies initiating payments and third-party processors) establish sensitive data protection processes, procedures, and controls. Their rules also require that any financial information (such as a customer's account and routing number) be encrypted using "commercially acceptable" technology.

This implies that you cannot send or receive bank information via unencrypted email or unsecured web forms. If you utilize a third party for ACH payment processing, ensure that the company has installed systems with cutting-edge encryption.

According to NACHA standards, ACH payment originators must also take “commercially reasonable” efforts to guarantee the validity of customer identity and routing numbers, as well as to detect possible fraudulent behavior. Most third-party ACH processors should offer these features but double-check before signing up with anyone. It's also a good idea to consult with an IT or security professional to verify your business is processing ACH payments securely.

How to Accept ACH Payments at a Small Business

NACHA does not let small companies operate as the ODFI or RDFI in an ACH transaction. You can, however, utilize a bank or payment processor that is set up to accept ACH payments.

Square uses ACH to deposit funds processed via Square as fast as possible into your connected bank account. ACH transactions are batch-processed and deposited on a regular basis. (We also use ACH payment processing to pay workers through Square Payroll and to deposit cash into sellers' Square Capital accounts.)

Square ACH deposits can be made as soon as the next business day. If you set your close of day to 5 p.m. PT (the default) or earlier, your cash will be available in your bank account the following business day. If you set your close of the day after 5 p.m. PT, your money will be sent into your bank account within two business days.

Conclusion

ACH payments are safe and easy to use. Customers are familiarized with them. They use them on a daily basis to pay utility bills and accept direct transfers from employers. By offering your AR with the ability to process ACH payments, you are providing your consumers with a payment method that they may choose over others. After all, you want to make it as simple as possible for customers to pay your company.

Understanding what is ACH payment helps you economically receiving money, but if you're the one sending money, make sure you understand your bank's policies beforehand. This will help you avoid costs, unexpected processing delays, and potential limitations, enabling you to get the most out of this service.