Customer churn is one of the most powerful metrics for an increasingly developing business to take into consideration. Even if it's not the most contented measure, it's a number that can provide your company the hard underlying truth about its customer retention.

It's difficult to measure success if you don't measure the unavoidable failures, too. While you aim for 100% of customers to stay with your company, that's completely impossible. That's where customer churn is put into play.

In this article, we’ll first find out the customer churn meaning and look at the many determinants causing this churn. We will also provide you with ways to calculate customer churn rate then bring out an example to clarify everything.

Are you ready?

What is Customer Churn?

Simply put, customer churn takes place when subscribers stop carrying on business with a company or service.

Customer churn definition is also perceived as the term “Customer Attrition”, customer churn is a crucial metric unit since it is much cheaper to retain existing customers than it is to win new ones – which means working with potential leads all the way through the entire process of sales funnel. The term “Customer Retention”, on the contrary, is regularly more cost-effective as you’ve gained the loyalty and trust of existing customers already.

Customer churn prevents growth, so businesses should have a determined method for calculating customer churn in a specified period of time. By being conscious of and monitoring churn rate, you will be well-equipped to manage their customer retention success rates and pinpoint strategies for advancement.

What Causes Customer Churn?

There is a multitude of causes that can lead customers to drop a business, but there are a few that are believed to be the main causes of customer churn.

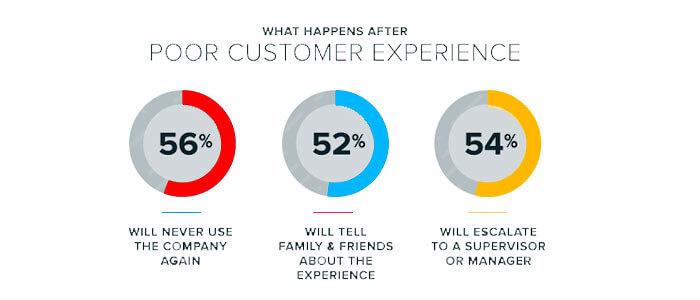

The first and foremost is the substandard customer service. One study found that nearly nine out of ten customers have left a business owing to a poor experience. We are living and working in the age of the customer, and customers are increasingly demanding excellent customer service and experiences.

If you couldn’t provide them with it, they will flock to your competitors and even share their harmful experiences on social media posts. Consequently, poor customer service results in several customers churning than just the one customer who receives a bad service experience.

Other reasons for customer churn are: a lack of value, a lack of brand loyalty, a lack of open-ended customer success, a lengthy and complicated onboarding process, natural causes that happen for all businesses from time to time, or low-quality communications.

What are the Benefits of Customer Churn Prevention?

#1 Get Information for Improvement

Disappointed customers are the origin of valuable feedback for an organization’s improvement. A company will obtain information about aspects that need to be improved while executing strategies to prevent customer churn.

#2 Reduce the Risk of Business

Customer churn points out a direct loss to the company. Marketing a new product/service to an existing customer will be far easier than doing it to a brand new customer. Therefore, churn can be detrimental to the growth of the business.

#3 Understand the Target Market

Working consistently towards the decline of churn will reveal layers of the market which were otherwise utterly unknown. Surveys focus groups and other relevant activities can be conducted to understand the target market in a better manner and help with customer churn reduction.

#4 Build a Competitive Advantage in the Market

In a society where there is a never-ending competition to gain new customers and retain existing ones, holding an edge over rival(s) is so great.

During the process of diminishing the churn, not only do customers know hidden aspects of a business but also build a competitive advantage over the others in the market.

Why We Need to Predict Customer Churn?

Customer churn prediction means the capability of seeing that a certain customer is likely to churn in advance, yet, there is still enough time to do something meaningful about it. This serves as a great potential revenue source for any company.

For any business or organization, acquiring new customers is a costly business but losing the existing customers will cost even more because existing customers are normally returning customers who if satisfied will repeatedly purchase from your brand. And since the competition is on a rise in any market, companies are focusing more not only on new business but also on retaining existing clients.

READ MORE Customer Acquisition and Retention: Which One Is Better?

Remember that not just a few incidents but a whole customer journey results in churn. Hence, the most important step of predicting client churn is to begin awarding existing but soon-to-churn customers for continuous support and incentives on purchases.

As previously stated, a customer’s intent to quit using a product/service may always be a decision made over time. There are multiple factors that lead to this decision and it’s necessary for you to understand each and every one of them so that customers can be persuaded to stay and make purchases. This can be done by consistently carrying out customer satisfaction surveys and spending time looking into the received feedback.

How to Calculate Customer Churn Rate?

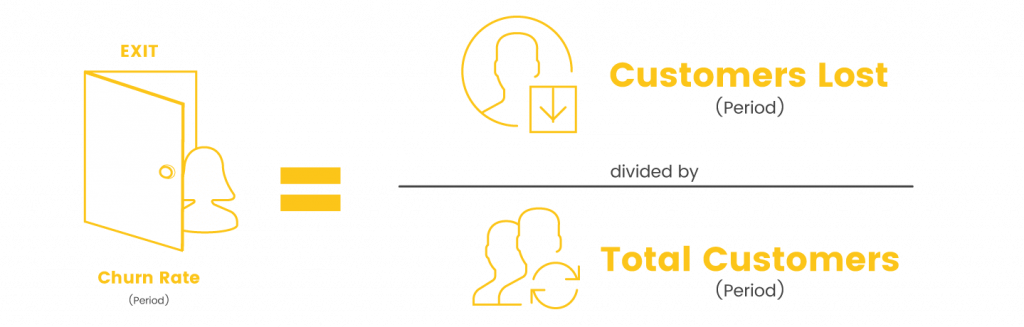

Customer churn rate is calculated by various companies in a variety of ways, as it may illustrate the sum total number of customers lost, the value of recurring business lost, the portion of customers lost in comparison to the company’s total customer, or the percent of recurring value lost. Others calculate churn rate for a specified period of time, such as fiscal years or quarterly periods.

One of the most frequently used methods for calculating churn rate is to divide the number of customers lost throughout a defined time period by the total number of customers at the beginning of the same period. To have an estimate, you can segment your customers based on the frequency of their purchase.

Customer Churn Calculation = Number of Customers lost / Total number of customers (Period) x 100

For instance, the number of customers lost in the first year is 10 and the total number of customers is 200 then your churn rate for the first year is 10/200*100= 5%.

Applying this customer churn rate formula for one iteration is pretty easy, however, it is much more complicated if you have to calculate client churn over numerous time periods. And keep in mind that revenue loss is incremental by its nature even with a consistent customer churn rate.

An Example of Customer Churn Calculation

This is a case in point calculation of the customer churn rate formula:

First, assume every year you acquire just 10 customers who purchase $200 worth of goods and services. Over a 3-year time at 0% churn rate, you will be gaining ($200 X 10) + (200 X 20) + ($200 X 30) = $12.000.

However, things get more complex when the churn rate comes into force. Now let’s assume an average business churn rate of 30% and all of the sudden, you just have ($200 X 10) + ($200 X 17) + ($200 X 21.1) = $9620.

The above customer churn example is to say, the churn cost the business $2380, which over a 3-year period costs the company over 20% of overall revenue. This lost revenue as a consequence of client churn is called revenue churn.

Most businesses spend a considerable amount of money on acquiring new customers but are very less concerned with making sure that how many customers continue to make repeat purchases. Some professionals even recommend for any business that wants to make incremental profits that more focus needs to go into higher customer retention and customer attrition as a business grows

3 Techniques to Reduce Customer Churn

#1 Focus your Attention on your Most Loyal Customers

Instead of just only focusing on offering incentives to customers who are about to be churning, it could be furthermore beneficial to pool your resources into your loyal, paying customers.

#2 Analyze Churn whenever it Occurs

Utilized your churned customers as a resource for understanding why clients are leaving. Analyze when and how churn takes place in a customer's lifetime with your company, and apply such customer churn data to put some preemptive measures into place.

#3 Show your Customers that you Care

Rather than sitting then waiting to connect with your customers until they reach out to you, make some efforts, maybe a more proactive approach than that.

Communicate with them all the advantages you offer and convince them that you truly care about their experience, and they'll be really convinced to stick around.

Final thoughts

Customer churn is now the biggest nightmare that most online businesses face. But don’t worry, the customer churn metrics are a good way of estimating how many customers are abandoning your business and how much lost revenue you are suffering as an effect. As a result, you can better retain them and thrive your business.

Above is the summary you need before getting down to the nitty-gritty. Next, let's start to calculate your churn rate and to prevent it before it's too late.