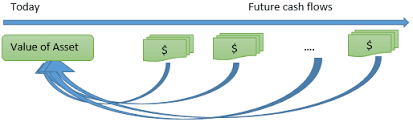

Discounted cash flow is a method used to evaluate the value of a business by using data of its future cash flow projections. DCF analysis could be applied to value a stock, a project, a company, and many other activities or assets. This model is popular and has been used widely in not only corporate finance management but also the investment industry.

In this concept, the money in the future will not be worth as much as the same money worth today (the time value of money).

In order to calculate how much a certain amount of money is worth in the future, we must discount it and be prepared that we may lose the chance to invest and earn revenues from it. This is basically what the Discounted Cash Flow approach is about.

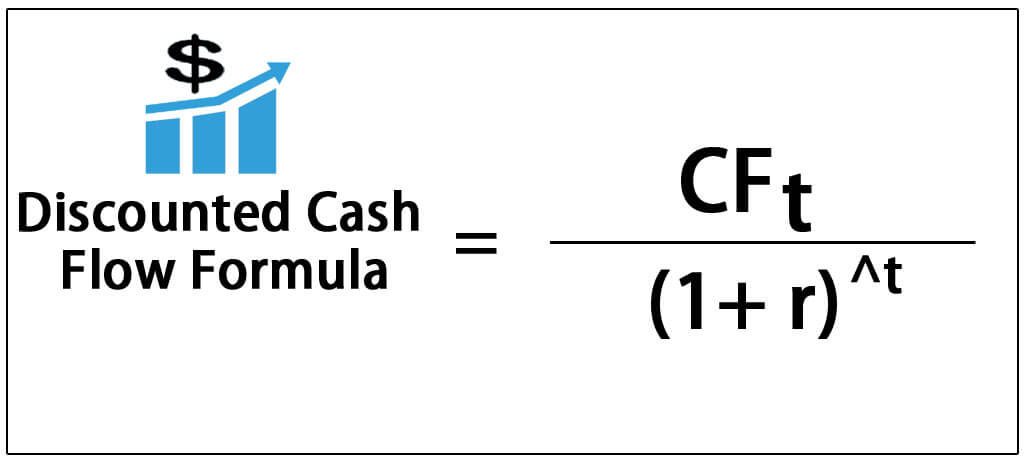

How to calculate DCF?

To help our readers more easily understand the definition of DCF, let’s say a business can make $20,000 today and this amount of money will be worth more than $20,000 after a few years from now because you invest the $10,000 today and earn its interest. With an interest rate of 5 percent, after a year you will grow your money up to $21,000.

Clearly, $21000 sounds much better than $20000 but we still need to take a closer look at its true value by doing some calculations.

There is an equation to calculate what is $20000 after a year worth today.

Discounted Cash Flow = Cash Flow / (1 + Current Interest Rate) years in the future

In this example, our DCF will be: $20,000 / (1+0.5)1 = 19,048

$19,048 is the value of the future $20,000 worth today.

It means that the value of $20,000 after a year from now on with an interest rate of 5% is $19,048. By doing this calculation, we can also see that the future value of $20,000 after 2 years is even less than $19,047, and the further you go, the less its value it will be.

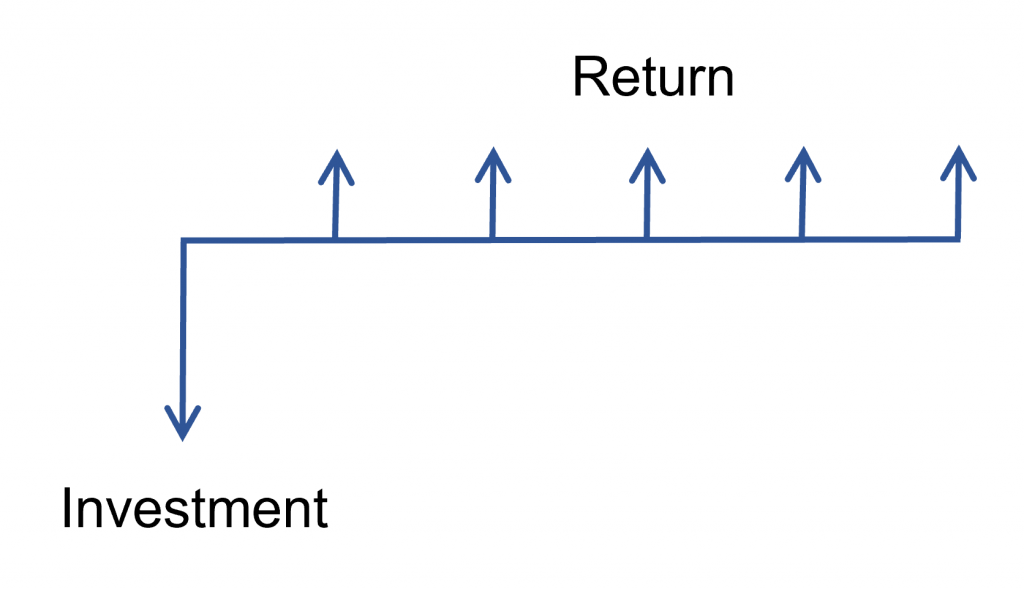

Investors can determine the cash flow of a property by calculating the elements below:

- Initial investment: the cost of buying the property at the beginning

- Income: payments from rentals, rental income

- Expenses: utilities, mortgage payments, cost of debt, upkeep.

- Estimated sales

To determine the discount rate, business owners can use a basic formula like this:

DCF = CF1 / (1 + r) 1 + CF2 / (1 + r) 2 + … + CFN / (1 + r)N

DCF = Discounted Cash Flow

CF = Cash Flow

r = discounted rate

For new investors, it can still be like a foreign language, just don’t forget that you can use Excel to find the DCF for your business (Excel classifies it as = NPV).

How to understand the DCF analysis?

Before getting started with your DCF analysis, you should remember the initial cost of the property, yearly expenses and profits, interest rates, and any holding periods laid out. (The holding period is the time for which you invest your money, usually about 5 to 15 years.)

Since DCF analysis will estimate the value of the money a business earns from their investment after adjusting for the time value of money, it can be used in any investments for projects that are predicted to create future cash flows.

Usually, people use the DCF to compare with the initial investment to see whether their plan is on the right track or come up with solutions to avoid as much loss as possible. The DCF can tell them that their investment is profitable or risky. It’s a good sign if the DCF is greater than the current cost and if the opposite happens, it means businesses will lose their money. And of course, the higher the DCF is, the more return the investment can generate and bring profits to the business. Investors tend to hold the cash and may stop their investment if the DCF is lower than the present cost.

The first step of the DCF analyzing process is estimating the future cash flows for a specific amount of time and the terminal value of the investment. If additional investment is needed to continue your plan, then that future cash flow model will be considered negative.

It’s necessary to determine an appropriate rate of discount in the cash flows beforehand because the cost of the capital which is used as the discount rate can vary for different projects and investments.

When should you use Discounted Cash Flow?

Discounted Cash Flow (DCF) is used to estimate how attractive an investment opportunity is as well as to evaluate the potential for that investment. If the value result of DCF analysis is higher than the present cost of the investment then it seems to be a good opportunity to keep.

Business owners should use discounted cash flow when they want to make sure their investment's value in the future would have low risks if they cash out. In the investing industry, companies also can use the DCF formula to see if their business value is a good investment in the long term.

However, everyone should know that not all Discounted Cash Flow analysis is accurate. Instead, it’s vital to note that when investors use DCF valuation, they are just trying to predict the business situation in the future and reduce the risks of their investment as much as they can. After all, the result of DCF valuation is only an estimate. Nevertheless, we still want to have good estimates and this method is one of the best tools for business investors to identify the total value of the investment.

Discounted Cash Flow is different from the other valuation methods but it allows investors to see the value of their future cash flow in today’s time while other metrics such as Net Present Value enables users to evaluate the return on the total investment. In addition, the IRR formula often uses the DCF to determine the pros and cons of a real estate investment.

DCF analysis works best when it’s used with other valuation tools (such as Comparable company analysis, Precedent transactions) to create a balance mechanism and validate the results.

Although DCF is not a perfect model, it’s useful in terms of evaluating the expected cash flows at a risk-free rate over a certain period of time. And this kind of information is truly crucial to help investors make wiser investment decisions.

Using the DCF analysis can be both advantageous and disadvantageous because how precise and helpful the result is will depend on the situation it is used for. Below we will discuss the main pros and cons of the DCF analysis model.

Advantages of the Discounted Cash Flow model

- One of the main advantages of the DCF method is that it can be applied to a wide range of companies and projects and investments of all fields, provided that their future cash flows could be evaluated.

- Discounted Cash Flow can help merchants calculate the intrinsic value of an asset or business because it truly captures the underlying fundamental drivers of a company, including the cost of equity, growth rate, the weighted average cost of capital, reinvestment rate, and so on,.. in order to reflect the crucial assumptions and characteristics of the investment.

- With Discounted Cash Flow data, investors can also try to create different scenarios and adjust the estimated cash flow for each situation, which allows them to analyze how their returns will be like under each condition.

- What’s different about DCF is that it relies on Free Cash Flows (FCF), which is a reliable measure of the money left over for investors.

- DCF allows investors to incorporate major changes of their business strategy in the model to evaluate, whereas these elements are often unreflected in other models (such as Relative, APV,..)

- Although other methods such as relative valuation are quite easier to do a calculation, they may face the dilemma of the entire sector or market being overvalued or undervalued. This makes DCF become the best method to predict possible intrinsic value because it cuts across this dilemma.

- Another great thing about DCF is that it can be used as a sanity check and allow the current share price of the company to be included in the model. This way the DCF model can tell business owners how the stock of the company is overvalued or under-valued and whether the price of the current stock is being justified or not.

Disadvantages of the Discounted Cash Flow model

It’s true that the Discounted Cash Flow can be a very helpful tool for businesses to use in the financial industry and even small business owners. However, the DCF model also comes with a few drawbacks.

- Since it’s considered extremely sensitive to the assumptions related to the perpetual growth rate of the cash flows, discount rate, and terminal value. Any minor can make the DCF Valuation fluctuate wildly so there will be a need for a large number of inputs to ensure the result of the forecast performance is more accurate.

- Because the DCF analysis of a business is usually based on the three-statement model, its result is less reliable if the future cash flows of a project couldn’t be properly estimated.

- The DCF analysis works best when the degree of confidence about the future cash flows is high. However, if the company lacks visibility and good operations, it will be difficult to predict sales, capital investment, and operating expenses with certainty.

- Forecasting cash flows for the next few years is not an easy task, in fact, it’s always difficult to make accurate assumptions and the DCF method is also susceptible to error.

- One limitation of the DCF method is that the terminal value accounts for a very large number of the total value (65-75%). This means even a small variation in the assumptions of the terminal year could create a big effect on the result of the final valuation.

- The DCF model needs constant observation and modification. Any change in the company’s expectations can lead to a change in the fair value.

- The DCF model is more suitable for long-term investing activities rather than short-term ones as it focuses on long-term value creation.

Examples of Businesses Using DCF model

Although the DCF analysis hasn’t been used too often in the last decade due to the low inflation rates over the US, this model has become more popular to help improve the situation. Mostly, it’s used to estimate the value of a business, and large companies also greatly need this analysis because the method uses projections and predictions which are very significant for their developments.

It makes the most sense for big businesses as larger companies would have more data to work with, while a smaller company or business just starts joining the market and may not have enough history financial records to be able to make a prediction or projection for the future cash flow.

Businesses of all fields can use the DCF analysis to see how far they would go. Merger and acquisition firms often make good use of the DCF model to help them determine the value of the other company.

For example, in the construction field, a large construction company buying a large piece of equipment can make a DCF analysis to find the future value of the equipment and determine if the investment is a wise decision.

Even a restaurant can also use the DCF analysis for their business. Like the example of the construction company, a restaurant owner uses the analysis to assess the long-term value of the property they are going to buy.

The same goes for other small businesses and if they are in a position to buy another company, then the Discounted Cash Flow analysis is very necessary to help them determine the value of their long-term investment.

Conclusion

The DCE model is very helpful to the business strategy and brings successful analysis results only if an appropriate amount of time is spent to ensure that the predicted values are comprehensive and accurate. Failure to spend sufficient attention to the analysis will result in inadequate valuation, therefore it’s advisable to devote considerable time to working on the models such as organizing the projects, doing sensitivity analysis, making it more dynamic, etc. We hope this article is useful for you to understand more about the Discounted Cash Flow model. If you have any questions related to DCF as well as the eCommerce industry, please contact us, we are always happy to provide support to our readers.