Some new business owners may be excellent at controlling and directing talented individuals or marketing their services to expand a customer base. But without the commitment to successfully running the fundamental operations of every organization, those talents won’t have a chance to shine. Payroll is one of these operations.

It's critical to understand how to calculate payroll. It guarantees that your company complies with local employment and taxation policies, as well as instilling trust in your employees that their efforts will be fairly compensated. Unfortunately, payroll is one aspect of business in which entrepreneurs may not place a high priority or be well-versed.

But it doesn't have to be a bit of a nuisance. Here's a summary of the payroll process and why understanding the ins and outs may help your company thrive.

Initial Considerations for Payroll Calculations

#1 Pay periods

Pay periods, which might last a month, a fortnight, or a week, are the days during which payroll calculations are finalized. The most usual payment schedule is monthly.

At the end of each pay period, a payroll is calculated. When setting pay periods, there are a few things to keep in mind.

- All payroll-related government reporting is organized by financial year and is broken down into monthly, quarterly, half-yearly, and annual returns of various types.

- Pay periods should ideally correspond to the financial year to simplify and streamline processes. (In the case of Indian payroll, financial years run from April 1 to March 31 of the following year.).

- The gap between the end of the pay month and the distribution date should be 3–5 days. This relieves the payroll processing department of some of its workload. If you want to pay the salary on the first of every month, the previous pay period must conclude on the 25th of the previous month.

#2 Salary structure

Different types of employees may exist in your company, thus it's a good idea to begin one or more salary structures for each.

The salary structure is made up of several salary heads, including:

- Wages (Basic salary)

- Allowances (House Rent Allowance, Dearness Allowance, Transportation Allowance, etc.)

- Benefits (Retirement benefits: Health Insurance: ESI, Medical Insurance, Provident Fund & Gratuity)

- Accruals (Annual Bonus and Performance Linked Bonus)

- Claims (Tax-free allowances to employees against bills. Driver allowance, Petrol allowance, Include Book allowance, Telephone allowance)

- Perquisites (Employees are not paid for these, but they are included in their salary structures and are taxed)

Miscellaneous heads, such as Rewards, Referral bonuses, Joining bonuses, Sales Commissions, and expense reimbursements, are not included in salary structures.

A wage structure streamlines the payroll process by making it easier to identify CTC (Cost to Company), run reports, create offer letters, and manage increments.

Remember that a salary structure is nothing more than a template with numerous heads. Each employee's salary head values will be different.

#3 Employee types

Different types of employees have different salary components and taxation requirements. You must identify which employee kinds are suitable for your organization.

The various types of employees covered include Hourly Consultants, Salaried, Piece rate, and Commission agents.

#4 Statutory requirements and PAN No

There are a number of statutory obligations that apply to both salaried and hourly employees.

- Minimum wage (based on the location of work of the employee)

- Provident Fund (mostly universal and depends on the size of your company)

- Health Insurance (ESI) (depending on the number of ESI clinics/hospitals available and the size of your organization)

- Taxes on Professionals (based on the state where the employee works)

- Gratuity (mostly universal and depends on your company's size)

- Statutory Bonus (depending on the state where the employee works)

The Indian government has mandated that enterprises keep track of each employee's PAN number while calculating payroll, especially when taxes are deducted. This PAN number is necessary for a variety of reports that must be filed as part of the statutory filing process. Additional identifiers, such as PF No and ESI No, are used to transfer benefit deductions to the relevant employee record.

#5 Salary calculation modes

Employers are responsible for accurate deductions (taxes and benefits), thus it's critical to specify the basis of salary calculation, document it, and communicate it with all employees. This is something you should put in your company's policy document.

To calculate the eligible salary, most employers use Leave Without Pay (absence without leave) or Days Worked.

Pieces created (piece rate employee), sales achieved, and other compensation systems may be available in addition to a base salary (commission-based employee).

#6 Employee bank information

Cash payment of salary presents logistical obstacles, and the government discourages it. Check payments are inconvenient since they take longer to send to an employee's bank account.

For salary payments, automatic bank transfers have become the norm. Bank transfers are easier, faster, and less expensive once they are set up.

Because employees may have a bank account that is separate from the company's bank account, it is critical to keep track of each employee's bank transfer details.

How to Calculate Payroll?

Much of the payroll process starts with computing gross wages — whether hourly or salaried — and then deducting deductions and taxes and getting to the final payment that employees receive in their paycheck.

Those gross wage calculations and the following deductions are based on a variety of criteria in each case, but here are some basic guidelines and examples to consider.

Calculate Hourly Gross Wages

Many companies pay their employees on an hourly basis. This entails keeping accurate records of hours worked. The ability to keep track of time is crucial to the process. It determines not just how many hours must be compensated, but also whether there are any salary changes, such as overtime or hazard pay.

For example, if a $20-per-hour employee works 48 hours per week, with 8 of those hours count as overtime, the equation is as follows:

- 40 hours worked at a regular rate of $20 per hour: 40 x 20 = $800

- 8 hours worked at an overtime rate of $24 per hour: 8 x 24 = $192

- Total Gross Pay for the week: $800 + $192 = $992

Calculate Salary Gross Wages

Salaried wages are an easier task since they are based on a predefined amount of hours — usually, a 40-hour workweek — and they are decided by the pay period schedule you choose. Some employers choose semimonthly pay, which is paid twice a month and equals 24 pay periods, while others choose biweekly pay, which equals 26 pay periods.

For this example, assuming a general predetermined 40-hour workweek and an annual salary of $67,000, the gross pay calculation would be as follows. Divide a $67,000 annual salary by 24 pay periods to get the following:

$67,000 / 24 = $2,791.67

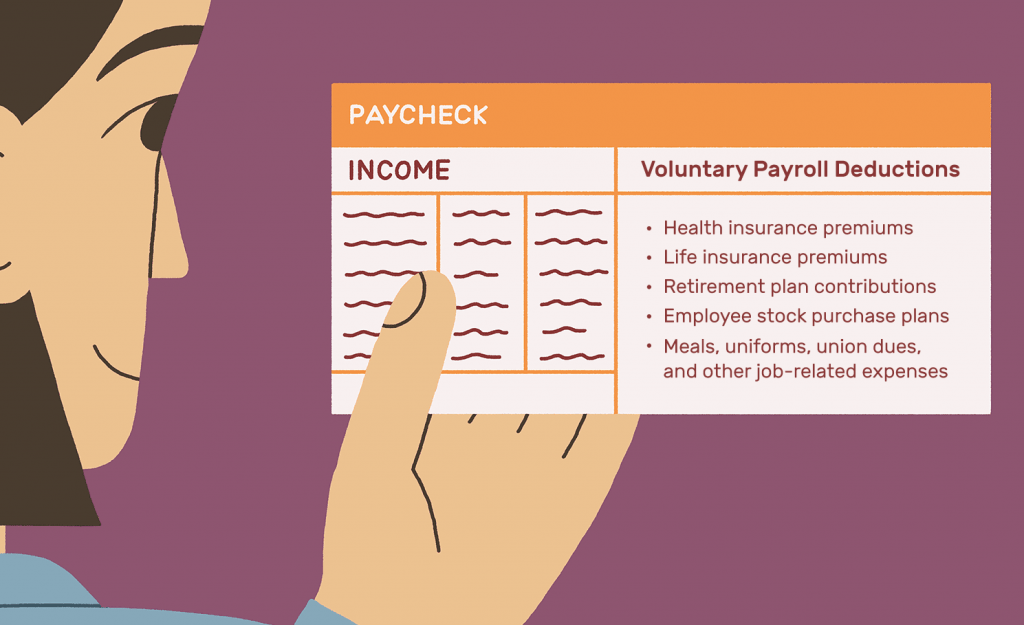

Account for Voluntary Deductions

In addition to monetary compensation, many businesses employing full-time employees provide a wealth of benefits. Many of these benefits are provided on a “pre-tax” basis, whether they are healthcare, retirement savings, or other comparable alternatives.

If an employee has chosen to deduct benefits from their paycheck, such benefits must be deducted in the legally required step of the process, whether that is “pre-tax” or after taxes have been taken out.

Subtract Necessary Taxes

The most difficult part of the process begins after any necessary benefits have been deducted from the employee's paycheck. Understanding and accurately implementing payroll taxes is a crucial step for any company.

Those in charge of payroll should be familiar with federal taxes such as FICA and unemployment taxes. They should also keep track of any state or local taxes that may apply to their business and deduct from their employees' gross pay.

Pay Your Employees

The payroll process is not complete until gross pay has been calculated, benefits have been selected, and taxes have been withheld. Employers must be able to process payroll in order for employees to get their paychecks. This entails figuring out a way to pay your employees in full and on time.

An efficient system is one that appears seamless to the employees who direct deposits to their bank accounts or receive checks in their hands at the end of each pay period.

Step-to-step Guide on How to Calculate Payroll

The determination of gross pay is followed by the subtraction of deductions and payroll taxes to get at net pay in the payroll computation. Payroll calculation is a very structured procedure. This computation should be meticulously followed to ensure that the amount of net pay distributed to employees and taxes paid to the government are correct.

The steps for payroll calculation are as follows:

Step 1: Notify the staff

Instruct staff to submit their timesheets before the end of the payment period's last business day. Otherwise, pursuing employees to finalize their timesheets will cause payroll to be delayed.

Step 2: Gather timesheets

Obtain all staffs’ timesheets. Such data may be found in a web-based timekeeping system.

To save time for other important jobs, you should consider using Odoo integration as a web-based timekeeping system. It will help you reduce a great amount of workload including monitoring your employees’ activities and performances.

Step 3: Review and verify timesheets

Check all timesheets for accuracy before sending them to the appropriate supervisors for approval. The overtime part, in particular, should be permitted because it costs 50% more than regular pay.

Step 4: Enter hours worked

If the hours worked data is manually gathered, enter this information. Otherwise, it's likely that it was already in the system.

Step 5: Enter changes in wage rates

Changes to wage rates, withholdings, and deductions must all be entered into the payroll system. Make sure that any deductions for adjustments to gross wages for tax purposes have been input, as they affect the amount of payroll taxes paid.

Step 6: Make a gross pay calculation

To calculate gross pay, multiply wage rates by the number of hours worked.

Step 6: Make a net pay calculation

To calculate net pay, subtract all authorized withholdings and pay deductions from gross pay.

- Remember to account for any overtime, bonuses, or commissions earned during the pay period.

- Weekly, biweekly, or monthly pay periods are all acceptable. If the period is biweekly, for example, a full-time employee should work around 80 hours.

- A fixed-salary employee earns the same amount regardless of how many hours they work.

Step 7: Review

To confirm that the gross pay, deductions, and net pay for each employee are correct, print a preliminary payroll register. If it's not accurate, go back and amend the previous inputs before conducting another preliminary payroll register.

It is usually a good idea to have a maker-checker process in your payroll. All of the above activities are performed by the maker, and the checker (who can be a senior employee such as the CFO, Head HR, or board member) approves the processing.

The best way to validate a payroll is to compare it to the payroll from the previous month. Investigate the reasons for any changes, and you'll be done with approvals in no time.

Step 8: Pay employees

Paychecks and remittance advice will be cut. Also, print and archive a final payroll register. Make sure the checks are signed by someone who is authorized to do so. Employees can also be paid via electronic methods.

Step 9: Remit taxes

By the due date, send any applicable payroll taxes to the government.

Step 10: Distribute pay

If checks were cut, keep them in the business safe until payday to distribute. Before issuing a check to an employee, you can add an extra layer of security by requiring confirmation of identification.

>> Read more:

Conclusion

This article covers how to calculate payroll and the steps involved in payroll calculations in order to reduce complications and create a satisfying workplace.

Payroll processing on time is a difficult and challenging process, however, if the above steps are communicated and properly followed, the work of your payroll processing staff may be greatly reduced.

Implementing a payroll process that conducts payroll calculations predictably and with zero mistakes indicates a mature and stable organization and leads to improved employee and Human Resources satisfaction.