You don't know how to create a Budget in QuickBooks? You already have a budget plan for your business but it’s been challenging to stick with it for the last several months? If you don’t have products or services that are in great demand when the COVID-19 pandemic has happened, you will somehow need to adjust your budget significantly.

To prepare for better days ahead, it’s a good time to start doing some planning for the second half of your 2022 budget. Although there is still uncertainty about what will come next, creating a budget will definitely give you a good starting point.

In this article, we are going to cover a step-by-step guide on how to create a budget in QuickBooks effectively.

But first, we will discuss what is a business budget and its benefits to see why this is an excellent first step for any new business owner.

What is a business budget?

The definition of a business budget would be an outline of all the revenues, expenses, and profit over a period of time that an organization has. It can be determined and calculated monthly, quarterly, or annually. In a good business budget, every dollar your business earns will come with a purpose. For example, some money has to go towards business investment or the company bills. Other funds might be for daily operational expenses and salary for yourself and your employees.

A solid business budget is like a road map for earning and spending. It provides a vision of the financial future that your organization will go through so that you can come up with better solutions for it. To make wiser decisions whether you can or should purchase new facilities and equipment this year, it’s advisable if you refer to your business budget.

Besides, if you are looking for ways to cut down on expenses, a business budget could give you a present view of your financial health like what sector you should spend money on and what advantages you may get from cutting back. The main aim of a business budget is to offer businesses better foresight to boost earnings as well as the overall performance.

Why should your business have a budget?

Although the benefits of having a business budget may be obvious to some people, a recent study shows not all companies are sure about whether they should get one, especially those who have just started a new business.

To be more specific about its benefits, there will be reasons why you should have a business budget.

- It gives business owners greater confidence to run their organization successfully

- Through a business budget, a business owner can identify the cash flow and possible problems in the way they spend.

- It gives business owners more control and insight when they face financial obstacles.

- Provides chances to identify problems and react quickly because they already have a backup plan.

In short, it’s not exaggerating to consider a detailed budget as one of the key factors that lead your business to success.

How to Create a Budget in QuickBooks

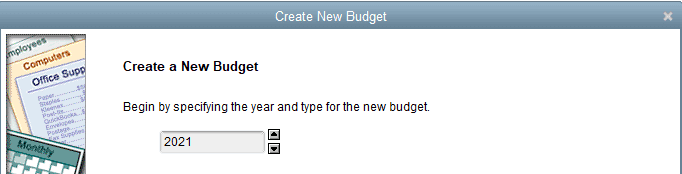

To get started with the process of how to create a budget in QuickBooks, go to “Company”, next see choose “Planning & Budgeting” go for “Set up Budgets”.

Step 1: Choose Budget Year

The first thing to do is select the year in which you want to build a budget plan.

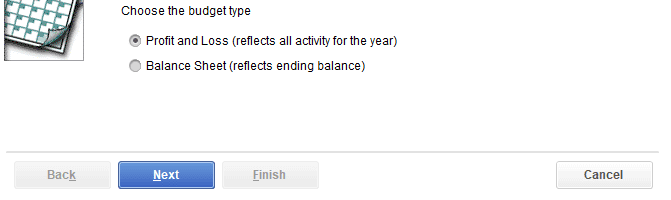

Step 2: Select Budget Type

To have a suitable budget type, either create a “Profit and Loss” budget or a “Balance Sheet” budget.

The first type - “Profit and Loss” budget will provide users a comprehensive view of yearly activities their business has, while the second option - “Balance Sheet” budget deals mostly with your ending balances.

In this sample company, we will go for the “Profit and Loss” type.

Once you have chosen “Profit and Loss”, click the “Next” button at the bottom. However, if you choose “Balance Sheet”, just click “Finish” and move on to Step 5.

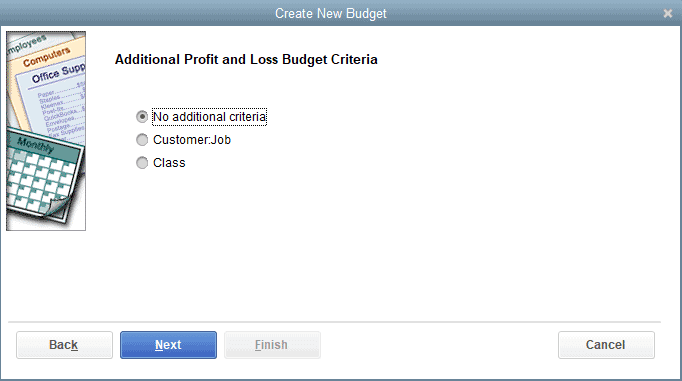

Step 3: Add Additional Criteria

This step is not compulsory and you can choose whether to skip or proceed.

This third step is for those who want to create budgets for specific clients for jobs. To do this, choose the “Customers:Job” option. If not, you could click “No additional criteria” to create a yearly budget.

To finish this step of adding additional criteria, click the “Next” button.

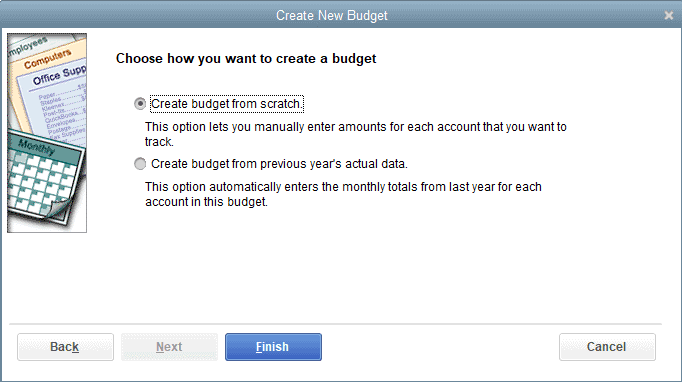

Step 4: Choose Your Preferences for Budget Creation

Basically, you will have two options to choose from: “Create budget from scratch” or “Create budget from previous year’s data”.

For the second option, the previous data can be useful and provide insight when making a new budget.

The sample company is brand new so we are going to choose “Create budget from scratch”.

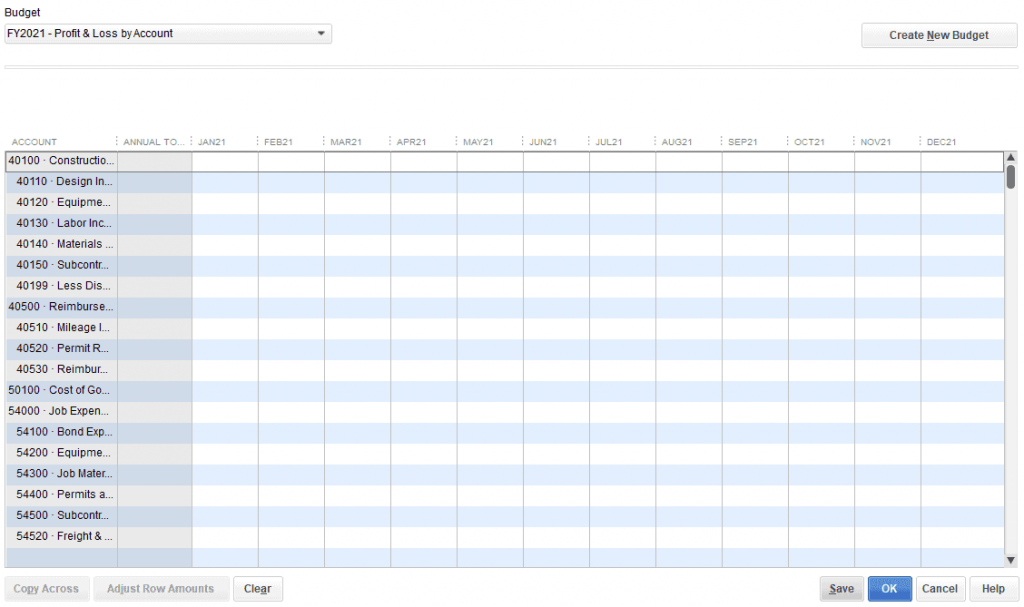

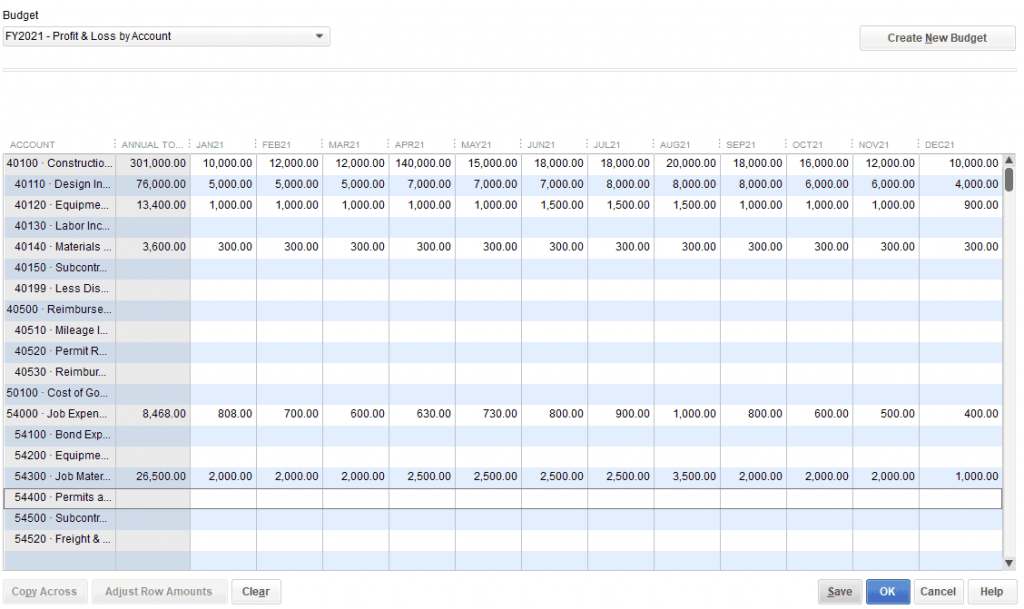

Step 5: Enter Your Budget

This part will take some time and thought because you need to enter your budget goals each month and each account as well, but no worries since QuickBooks is a great tool to help you handle it.

Remember to make your budget realistic and practical. For example, imagine you want to earn 5000 dollars in sales each month, just don’t put that number in QuickBooks before you come up with manageable steps and feasible solutions to make it come true. You must break that goal into actionable steps and think of effective marketing and advertising practices to make sure it’s possible to happen.

Step 6: Save your data

Once you can make your budget look like this, it’s about time to save your work. This can be done easily by clicking “Save”.

You can run reports to view the budget status any time you want. The reports can be Budget Overview, Profit and Loss Budget Performance, Budget vs Actual, Budget vs Actual Graph.

Conclusion

One of the best ways to stay on top and survive in the financial world is to budget, and with QuickBooks, everything should be simple and effective. QuickBooks extension can be easily integrated into your Magento 2 store, synchronize error-free data automatically in real-time so that you can transfer unlimited online transaction data at a glance.

Hopefully, this guide on how to create a budget in QuickBooks can help you set up your budget plan successfully. If you have any questions, just leave a comment below or email us, we are always happy to provide as much support as we can.