We might have all seen a paystub at least once but have you ever questioned what is a paystub? If there is anything you are not clear about its definition and usage then this post is for you.

When you pay your employee for the time they worked and give them a check or a direct deposit, all they see is their net pay, then they might wonder how you came up with that number. Questions like How much of the pay was taken out for income tax? How much are they compensated?.. may pop up in the mind and that’s how we need a paystub. Paystub gives your employees key details about their pay.

Today in this article, we are going to help you understand exactly what is a paystub, what information can it give to your employees, its benefits, and whether you should give it to your employees with each paycheck or direct deposit.

What is a Paystub?

Paystubs are pay statements that provide employees with paycheck details for each pay period. Other ways to call are paycheck stubs, wage statements, or payslips.

Paystubs allow your employees to have better insights into their compensation, along with their pay rate, gross earnings, and any deductions taken out of their pay such as employee benefits and income tax.

If your company offers physical paychecks, the paystub will be attached with the check. If you choose to pay them via direct deposit, employees may access their paystubs through a portal online.

Why are Paystubs important to your business?

Now, after answering the question "What is a paystub?", we will look at its importance in today's business.

A paystub is not just a legal obligation but also an essential document to have from the perspective of an employer and employee. This kind of record about salaries can prevent uniformity and non-discrepancy throughout the organization. Also, it plays a crucial role in establishing trust between the employer and staff.

Here we’ve listed 3 of the most frequently encountered reasons what your business needs a paystub for:

1. Proof of Income

This is one of the key reasons why paystubs exist. You can easily see a paystub out there along with a credit check. In many situations related to money, businesses need to show their paystub as proof of income so that they can buy a new house, a new car, need a loan, or even just register for a credit card.

As long as it involves a significant amount of money, you will need proof of the business you are dealing with so that they believe you can manage the money to cover your expenses.

2. Help you check inaccurate payment

There are always mistakes whether you like it to happen or not. Imagine your employees suspect that you haven’t paid them enough then you need to show them all the information to figure it out.

Your check stub shows your gross income, your net income, deducted taxes as well as insurance. All that details can be compared to identify any errors, from the amount of taxes that should be taken out to the incorrect deductions for insurance, etc.

Without any paystub to reference, proving wrong payments can become much more difficult.

3. Prepare for Tax filing

If you can keep good track of what is taken out of each pay period, you will no longer feel shocked by discovering you owe more taxes than you thought. A habit of keeping a paystub carefully can save you a potential headache about money.

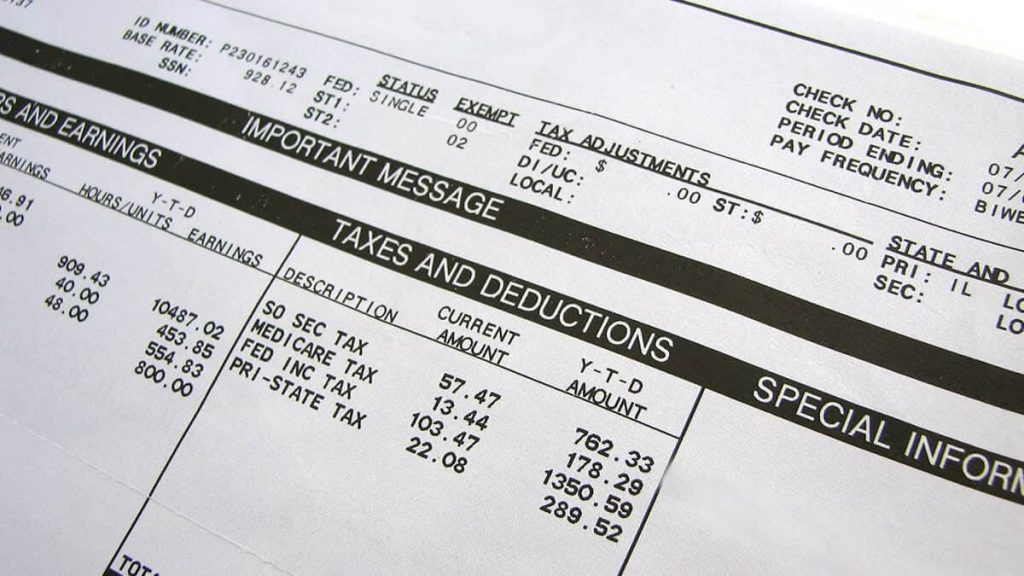

What information to include in a paystub?

To understand what is a paystub more, let’s take a closer look at each category of a typical paystub below.

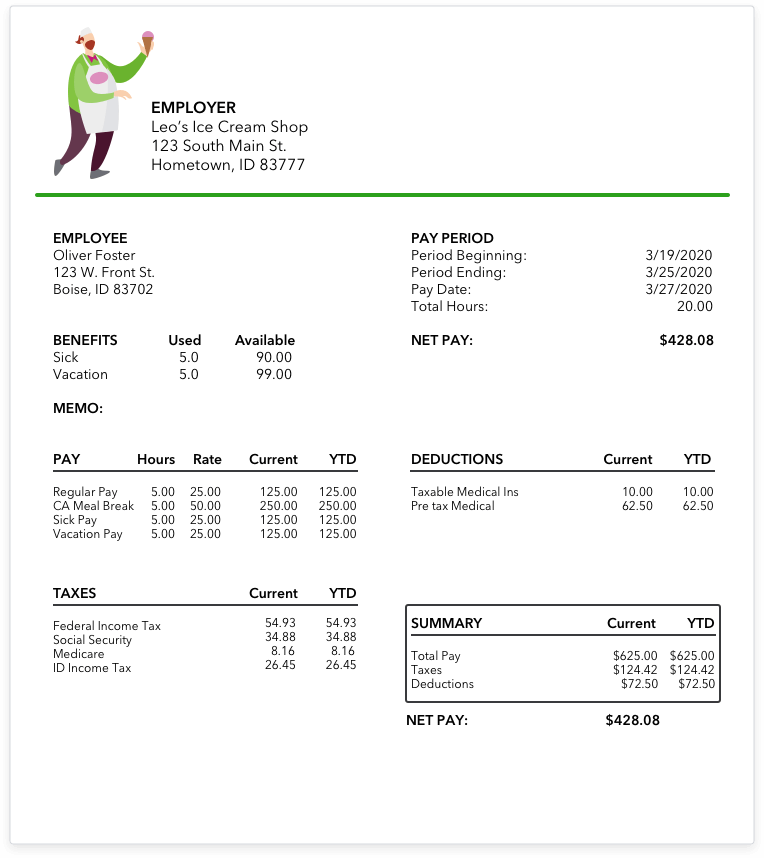

Gross wages

The starting point of your employees’ pay is gross wages, which are how much money you have to pay your employee before any taxes and deductions are taken out. If there is any nontaxable income that an employee has, it should also be included under the gross wages.

Depending on whether your employee's pay is hourly or monthly, there will be different ways to calculate the gross wages for them. For hourly employees, you need to multiply the hourly pay rate by the number of hours for each pay period. To calculate the gross pay for salaried workers, you will divide the annual salary by the number of pay periods in that year.

A typical paystub shows the information of gross pay in 2 separate fields which are current gross pay and year-to-date gross one.

The gross pay of a paystub can also have other information such as:

Total hours worked: The number of hours worked for hourly and nonexempt salary employees must be included. If nonexempt workers have different types of working hours such as overtime, double-time, or just regular, the total hours of each working type should be included too.

Pay rate: This part of a paystub is vital and it shows the amount of pay the employee would get for each pay period worked.

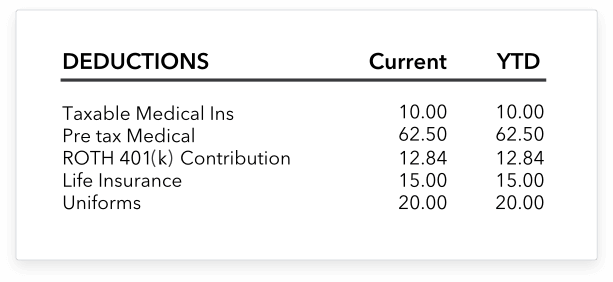

Deductions

Gross pay is how much you earned but that’s not how much you can bring home because there is still deduction. It is the amount of cash taken out of the employee’s gross wages such as taxes, contributions, and maybe allowances for meals.

Deductions of a paystub include:

- Income tax deductions: state tax, federal tax, local taxes for unemployment and disability insurance, Medicare, Social Security, and other critical services.

- Deductions for employee benefits: health insurance, life insurance, health savings accounts, and contributions to retirement savings

- Voluntary deductions: such as charitable contributions.

- Involuntary deductions (or wage garnishments): this is the money that employers withhold to pay off their employee’s debt (such as a tax bill or court-ordered child support payments).

Like gross pay on a paystub, deductions are displayed in 2 places: deductions current and deductions year-to-date. The former is the money taken out of the current pay period and the latter is the total amount for each type of deduction.

Employee Contributions

Contribution is another type of deduction. As an employer, you will need to make a certain amount of contribution on your employee’s behalf (including the employer portion of the Federal Insurance Contributions Act tax - FICA tax). Additional employer contributions can be insurance premiums, retirement, or saving plans).

These contributions are included on the employee’s pay stub although they are not deducted from your employee’s wages.

Contributions vary according to the benefit opportunities that the employer offers. For example, a worker may request to make contributions to a pension or have a small amount taken out from each paycheck as a non-profit donation.

Again, like the first two sections, employer contributions should be listed for both the current pay period and the year-to-date one.

Net Pay

All the information on a pay stub, in the end, will lead to a final result - it’s often called the net pay or take-home pay. This will be the actual amount of money your employees can bring home on payday.

The net pay of an employee can be significantly lower than their gross pay depending on the size of the deductions.

Paystubs consist of both the YTD net pay and the net pay for the given pay period.

On the paystub of an employee, net pay is recorded for the pay period and for the whole year.

Back Pay

The amount of money that employer owes their employees because of a working adjustment. For example, the employee changes from hourly type to salaried type.

Paystub examples

If your business is not big and doesn’t offer many types of benefits, the paystubs of your employees would look quite simple like this:

The more benefits your business offers and the more chances your employees have to invest the pay, the more complicated the paystub would look. Here is an example of a paystub that included additional deductions:

Best Practices for your Paystub

How are paystubs created?

When a business is still new and small or has very limited resources, it may have no choice but handle paystubs manually. Doing paystub this way is complicated and time-consuming because it involves a big number of paper documents, spreadsheets, and so on for each pay period. Payroll software can be a much better option to go for and become more essential for businesses as they grow.

How to read a Paystub?

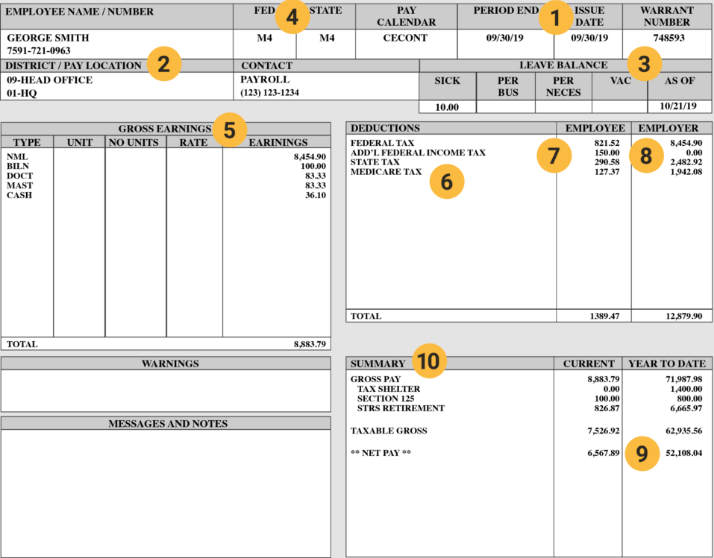

Now it’s time to learn how to read a paystub. We are going to show you a very concise and clear explanation so that you will be confident to understand any paystub next time you read them!

- This section covers the beginning date and the ending date of the payroll.

- Your home address

- This is information about leave balance

- Your Federal and State filing status

- Your current year and year-to-date hours and gross earnings

- Deductions you may have

- The amount of money before Tax Deductions

- The amount of money after Tax Deductions

- This is Employer Paid Benefits, the portion of your benefits paid by your employer.

- This is the summary field of the paystub.

How to calculate your Net Pay?

There are websites where you can calculate the deductions that are going to be withheld from your pay to estimate the amount of money you have to pay.

These paycheck calculators can help you work out how much would be taken for taxes, healthcare, FICA, retirement, and so on.

Also, using tools could be helpful for tax planning purposes because they allow you to check your holdings. This way enables you to discover whether you are deducting too much or too little from your check and make proper changes.

Do you need to give a paystub to your employees?

The answer is yes in most states (14 states to be exact), you will have to give your staff their paystubs even though there is no federal law that requires employers to provide paystubs.

The information you must include on a paystub will vary by state. Consult your state for further information about paystub requirements.

You can give your workers either an electronic paystub or a paper-form one. If you choose payroll software to pay your staff, they should be given access to their paystubs via an online portal.

How long should your business keep employees’ paystubs?

It’s advisable for employers to hold on to copies of their employee’s paystub and other payroll records for a minimum of 4 years. The IRS requires business owners to “keep records of employment taxes for at least four years after filing the [fourth] quarter for the year”. Besides, most payroll services encourage businesses to keep payroll records.

According to both the Fair Labor Standards Act (FLSA) and the Age Discrimination in Employment Act (ADEA), employers have to keep at least 2 years of records showing job evaluations, wage rates, collective bargaining agreements, seniority, and merit systems. These kinds of information are helpful on the basis of paying different wages to employees of opposite sexes in the same environment.

Finally, the Equal Employment Opportunity Commission (EEOC) requires business owners to hold all personnel and employment records for a year after an employee’s termination date if that employee was fired.

It’s necessary to have a record of each payroll period to avoid unwanted risks and errors related to finance.

Conclusion

Understanding what is a paystub and what kinds of information must be included on a paystub can help both businesses and their employees solve various issues.

For employers, a paystub is significant for tax purposes and for references to resolve any discrepancy with employee pay.

For employees, a paystub is an essential record of their wages which helps them understand their contributions, deductions, and taxes and get paid correctly.

We hope that this article is helpful to run your payroll system more effectively. Feel free to give us any questions about not only paystub but also any other concerns you may have, don’t forget to visit our insightful blog for more posts like this.