What is discounted rate? It is a frequently asked question as the discount rate is actually a financial terminology with 2 separate definitions.

In banking, it is the interest rate charged by the Federal Reserve to banks for overnight loans.

The discount rate is not reduced, despite the “discounted" in its name. In reality, it is higher than market rates because these loans are intended specifically to be backup sources of financing. However, during major financial crises, the Fed can lower the discount rate – and thereby lengthen the loan period.

In investing and accounting, the discount rate is the rate of return used to determine how much potential cash flows are currently worth. Consider consulting with a financial advisor if you need assistance interpreting this or some other financial term.

So let dive into each of the terms.

What is Discounted Rate in Corporate Finance?

A discount rate is the rate of return used in corporate finance to discount future cash flows back to the present value. This rate is generally a company's Weighted Average Cost of Capital (WACC), required rate of return, or the rate at which investors expect to receive a certain amount of money in relation to the risk of the investment.

The central bank's discount window rate and rates resulting from probability-based risk adjustments are two other types of discount rates.

The most popular method for calculating the discount rate is to use a weighted average cost of the capital model, which calculates a weighted average of the after-tax cost of debt and the cost of equity, with the weighting determined by a company's target debt-equity ratio, as determined at the market.

When determining business value, a capitalization rate and a discount rate are often misunderstood. A capitalization rate is applied to a single discretionary cash flow, whilst the discount rate is applied to a collection of cash flows represented in a forecast. Deducting a growth factor from the discount rate yields the capitalization rate.

Why is Discounted Rate Used?

A discount rate is used to measure a company's Net Present Value (NPV) as part of a Discounted Cash Flow (DCF) analysis. It is often used to:

- Account for the time value of money.

- Account for the riskiness of an investment.

- Reflect a firm's opportunity cost

- Serve as a hurdle rate for investment decisions

- Get various investments more comparable.

Types of Discounted Rate

There are only a few types of discount rates used for corporate finance to discount future cash flows back to the present. They are described in the following:

- Weighted Average Cost of Capital (WACC) – used to calculate a company's enterprise value.

- Cost of Equity – used to calculate a company's equity value.

- Cost of Debt – used to determine the value of a bond or fixed-income security.

- A predetermined hurdle rate – for investing in internal corporate ventures.

- Risk-Free Rate – to account for the time value of money

How to Calculate Discounted Rate?

The weighted average cost of capital (WACC) and modified present value are the two most common discount rate calculations (APV).

- WACC = E/V x Ce + D/V x Cd x (1-T), and

- APV = NPV + PV of the financing impact.

Let's take a closer look at these two formulations and how they vary below.

Weighted Average Cost of Capital (WACC)

WACC can be used to measure a company's enterprise value by weighing the cost of products available for sale against inventory, as well as common shares, preferred stock, bonds, and all other long-term debt on the ledger.

It is determined by multiplying the cost of each capital source (debt and equity) by its appropriate weight and then incorporating the items to determine the WACC value.

Adjusted Present Value (APV)

APV can also be helpful in exposing the hidden value of less obvious investment opportunities. When considering funding investment with a portion of the debt, certain prospects that may have seemed unviable based solely on NPV immediately become more appealing as investment opportunities.

Simple Discounted Rate Examples

Simple Example:

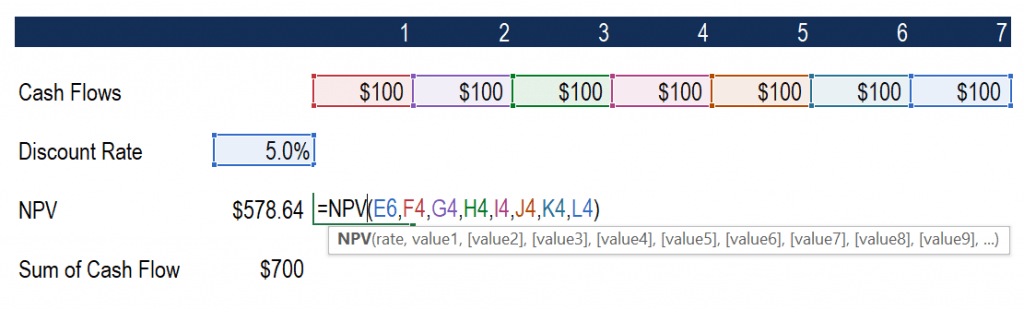

A picture of a hypothetical investment that pays 7 annual cash flows of $100 each is seen below. An analyst uses a 5% hurdle rate to measure the net present value of the investment, yielding a value of $578.64. This compares to a $700 non-discounted net cash flow.

Basically, an investor is telling, "I don't care if I get $578.64 all at once today or $100 a year for the next seven years." This statement considers the investor's potential risk profile for the investment as well as an opportunity cost that indicates what they might gain from a similar investment.

Advanced Example:

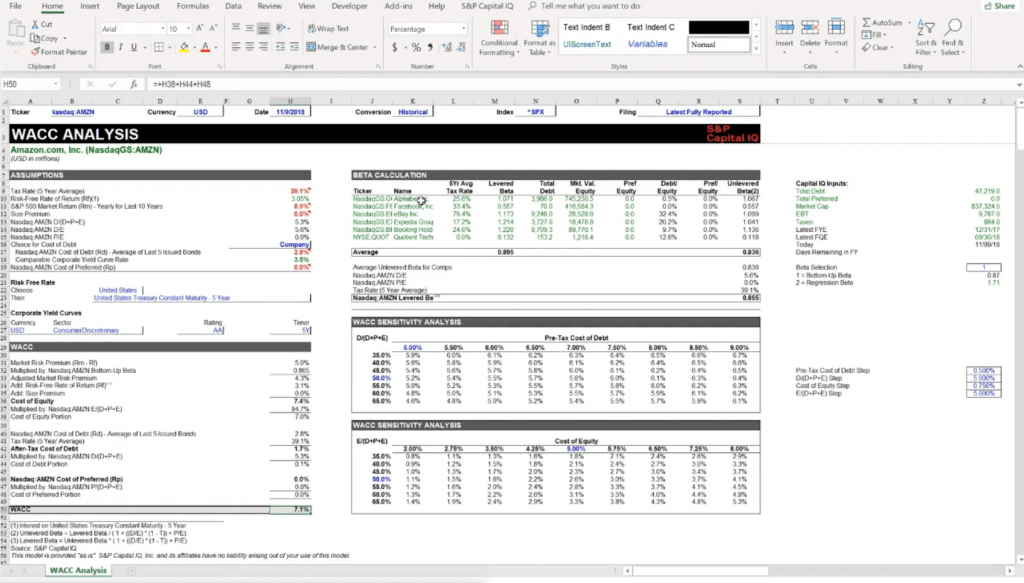

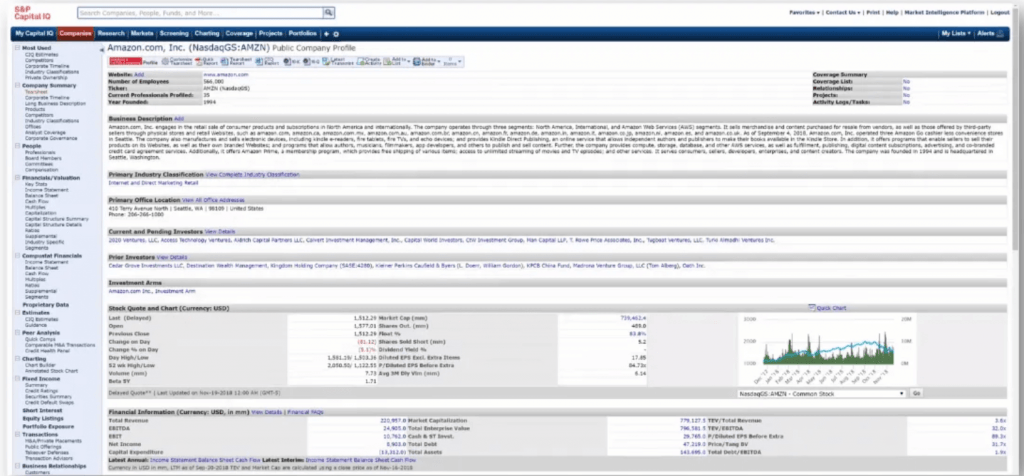

Here's an example from CFI's Amazon financial modeling course. As can be seen in the screenshot, a financial analyst estimates Amazon's projected future cash flows back to the present using an estimation of the WACC.

The analyst uses the WACC to discount cash flows to account for the approximate necessary rate of return expected by both equity and debt holders in the company.

WACC Example:

A screenshot of an S&P Capital IQ example used in CFI's Advanced Financial Modeling Course to measure Amazon's WACC is seen below.

To discover more, go to Amazon and search for CFI's Advanced Valuation Course.

Ranges of Discounted Rate

A company's discount rate is closely related to the riskiness of the operation and the ability to access capital. While discount rates for any organization will vary greatly, business owners should be aware that, in general, discount rates would fall under the following ranges:

- 10%–15% for major multinational companies with more than $1 billion in sales. These businesses have lower-risk profiles and can borrow large amounts of money. This category includes companies such as Apple and Microsoft.

- For existing upper middle-market businesses with sales ranging from $500 million to $1 billion, the rate ranges from 16% to 20%. These firms have low-risk profiles. This discount rate spectrum will apply to smaller public companies as well as big private companies.

- For middle-market firms with revenues ranging from $50 million to $500 million, the rate ranges from 21% to 25%. Companies in this range are often vulnerable to national, consumer, or product concentration. Access to capital is still also difficult.

- 26–30% for businesses in the lower middle sector with revenues ranging from $5 million to $50 million. Companies in this range are more vulnerable due to their limited debt capability.

- 30% or more for early-stage and start-up businesses. There are usually venture capital-type transactions.

If you are preparing a discount cash flow valuation and your discount rate is drastically higher or lower than those suggested above, you should certainly reconsider your assumptions because this could raise a red flag for potential acquirers about your ability to correctly measure the risks associated with your company.

Issues with Discounted Rate

Although the calculation of discount rates and their application in financial modeling may appear scientific, many assumptions are just a "best guess" about what will occur in the future.

Furthermore, only one discount rate will be used at a given point in time to value all possible cash flows, including the fact that interest rates and risk profiles are continuously evolving dramatically.

While using the WACC as a discount rate, the equation focuses on the use of a company's beta, which is an indicator of an investment's past volatility of returns. Return volatility in the past is not always a clear indicator as to how risky anything will be in the future.

What is Discounted Rate at the Federal Reserve?

As the term "discount rate" is mentioned in the financial press, it normally refers to the Federal Reserve discount rate. This is the interest rate charged by the Fed to commercial banks on short-term loans of 24 hours or less.

Banks can borrow money from the Fed to avoid liquidity problems or to cover funding shortfalls. These loans are made from one of the 12 regional Federal Reserve banks.

Banks are using these loans sparingly because loans from other banks usually have lower interest rates and needless collateral. Meanwhile, approaching the Fed for assistance is seen as a sign of weakness, which banks ought to avoid. (Since the passage of the Dodd-Frank Wall Street Reform and Consumer Protection Act, the Fed has been required to publicly publish the names and amounts borrowed from the discount window by banks.

Banks that borrow from the Fed are classified as one of three discount programs, or "discount windows."

- Primary credit, which provides overnight lending to banks in a good financial position.

- Secondary credit is lending at a higher interest rate than primary credit to banks that do not qualify for primary credit.

- Seasonal credit is available to banks that have seasonal needs in areas such as farming or tourist attractions.

Who Sets The Discounted Rate?

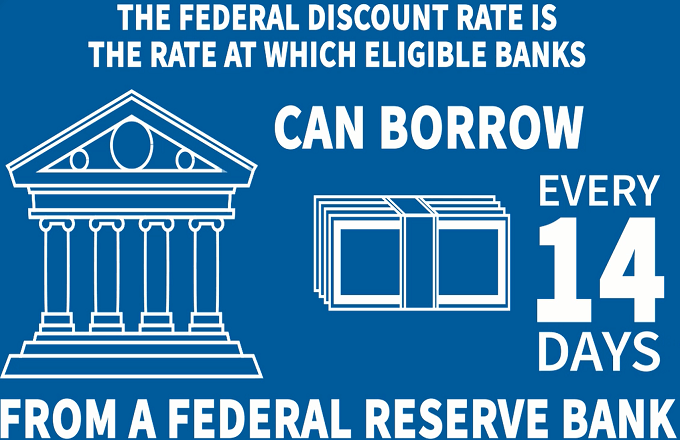

Every 14 days, the board of directors of each area Federal Reserve Bank sets the interest rate for primary credit window loans. The Federal Reserve System's Board of Governors then approves the discount rate, which seems to be quite similar in each region.

The primary rate has been 2.25 percent since October 31, 2019, and the secondary rate, which must be 50 basis points higher, has been 2.75 percent. The seasonal rate is a floating market-based fixed rate that is the average of the federal funds rate and the rate on three-month certificates of deposit (CDs).

The Importance of Discounted Rate

The discount rate influences the Federal Reserve's monetary policy. To assist stressed financial institutions in covering costs at the beginning of the previous crisis, the Fed reduced the discount rate.

In those circumstances, short-term loans seem to last a little longer. Loans with the interest rate were as long as 90 days at the height of the financial crisis in 2008.

Discounted Rate of Return

The discounted rate of return – also known as the discount rate and unrelated to the concept above – is the expected rate of return on investment. It measures the present value of a company or enterprise based on the estimated future cash flow. It is also known as the cost of capital or the required rate of return.

The discount rate defines the interest percentage that an investment may yield over its lifetime, taking into account the time value of capital. For eg, an investor expects a $1,000 investment to yield a 10% return after a year. In that situation, the discount rate for valuing or comparing this investment to others is 10%.

The discount rate enables investors and others to assess the risk of an investment and provide a benchmark for future investments. The discount rate is what senior executives refer to as a "hurdle rate," and it will help decide if a business investment would be profitable.

Businesses considering investments will calculate the discount rate based on the cost of investing today. For example, $200 spent at a 15% interest rate will rise to $230. Working backward, $230 in future value is worth $200 today after a 15% discount. This is useful if you want to invest now but afterward, it would need a specific amount.

Discounted Rate Limits

While the discount rate is always accurate, it is only an estimate. It always entails making predictions about future events without considering any of the variables. The discount rate is simply an educated estimate for certain investments.

While certain investments have stable returns, other investments' projected capital costs and returns differ. This complicates comparing such assets to a discount rate. Mostly, the discounted rate of return will just marginally tilt the odds in favor of investors and businesses.

Conclusion

It may be the end of the day if you finally get "what is discounted rate". However, measuring the discount rate as a company, on the other hand, can be a challenging task. When it comes to future planning, the discount rate is an important metric for both businesses and buyers. A reliable discount rate is critical for investing, reporting, and determining the financial viability of new projects within your organization.

Measuring the discount rate as a company, on the other hand, can be a challenging task. When it comes to future planning, the discount rate is an important metric for both businesses and buyers. A reliable discount rate is critical for investing, reporting, and determining the financial viability of new projects within your organization.

The way to set a discount rate may not always be easy, and to do so precisely, you must understand the discount rate formula. A variety of aspects, including the company's equity, liability, and inventory, must be included when deciding the discount rate. However, doing so correctly is critical to realizing the company's potential worth in comparison to its current valuation and, eventually, bridging the gap.

Check out other valuable insights from our blog now for substantial sales and customer loyalty boost for your Magento 2 stores.