You have a product, and practically a website, but the nitty-gritty of being able to deliver a secure payment platform (that backs up the brand's reputation) will certainly be a minefield. That's where a payment gateway, the functionality that connects the website to a payment network, is supposed to come in.

Interestingly, there are a large number of payment gateways available, both domestics and overseas. We have listed below the best payment gateway in Australia, but first, let's consider the particular payment gateway needs of your business, which is very necessary.

Things to Consider of Best Payment Gateway in Australia

#1 Compatibility

Would your eCommerce platform be compatible with best payment gateway in the world of your choice?

#2 Ease but Security

Is it simple to align the eCommerce website with your chosen payment gateway or it takes multiple steps to integrate them? Is it a fully integrated solution or one that is hosted offsite like PayPal's Express Checkout?

You can put yourself in the customers’ shoes to see whether they feel convenient and secure enough.

#3 Reputations, Prices and Contracts

Before committing to a specific payment gateway, analyze that company and its solution to ensure that: they are reputable; their pricing is competitive, and their contracts are flexible enough to meet your projected needs.

It's also wise to understand the current and forecasted transaction volumes, as this would have a huge impact on your ability to discuss monthly payments for most payment gateway providers.

#4 Audience Preferences

What method of payment do your consumers prefer for your products? Be sure you are aware of this long in advance and implement a customized solution to satisfy their needs.

Remember you always can offer PayPal as a secondary (or even tertiary) payment option at checkout because of its sheer popularity, reliability, and security. You'll be amazed at how often this so-called "backup gateway" will be the preferred choice for your customers.

Read more: Top 5 Best Payment Gateway For Small Business in 2021

Top 5 Best Payment Gateway in Australia

#1 eWay

The year of launch: 1998

Supported platforms

- Magento

- Shopify

- WP eCommerce

- BigCommerce

- WooCommerce

And 250+ shopping cart and other software integrations

Pricing

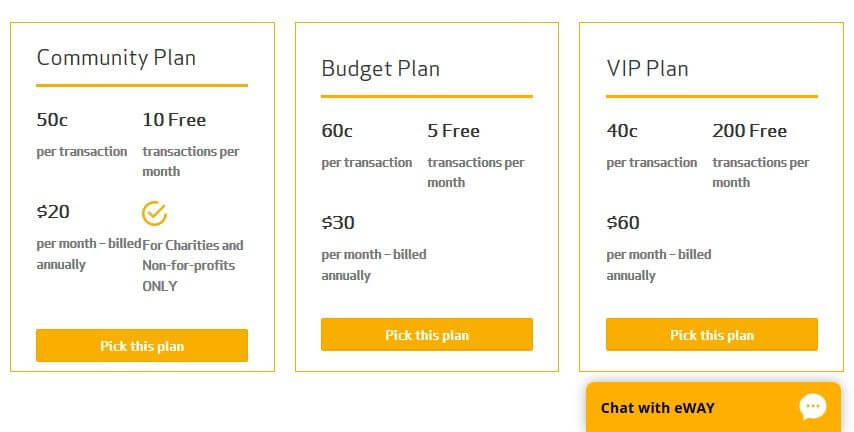

1.9 percent + 20c per Visa and MasterCard transaction on both international and domestic cards, and eWay also provides retailers using its gateway with three separate plans. They are as follows:

According to Joel S, an eWay sales executive, a merchant can choose between the flat “1.9 percent + 20c” or either of the plans previously shown.

If you already have an AMEX or Diners Club merchant account and decide to integrate it with eWay, eWay will only charge you 20c. The 1.9 percent will be charged by AMEX or Diners Club.

Payout Method and Frequency of Payout

Your subscription or sales revenue will be transferred directly into your bank account. This amount is not available in any digital wallet.

Be aware that eWay will unlock your funds after three days when running advertising campaigns.

Advantages

- One of Australia's most widely-known payment gateways

- Integrated tool to fraud prevention

- Not required a merchant account for authorized merchants.

- There is no setup cost

- The Beagle tool rates transactions for risk in real-time (a free plan)

- Since APIs are secure and robust, eWay can be integrated with almost every website in the world

- Excellent customer service

- The payment solution is scalable

Disadvantages

- Their built-in fraud detection tool must be activated manually from the merchant account.

- Only merchants with bank accounts in Australia, Singapore, New Zealand, Malaysia, Hong Kong, and the United Kingdom are eligible to receive payments via eWay.

Accepted Method of Payment

- Cards accepted: Visa, MasterCard, JCB, American Express, Discover, Diners Club

- Digital wallets: Visa checkout, Apple Pay, MasterPlus

PCI Compliance: Level 1 (the highest level)

Website Integration Method: eWay offers iFrame solutions, which are integrated gateways. The website provides access to eWay API resources.

Chargeback Policy: Chargebacks are refunds that the client receives from his or her bank or other banking entity rather than from you directly.

When it comes to eWay, merchants will be charged $44 for each chargeback transaction.

Payment Processor Availability: Certainly, eWay has its payment processor.

Sign-up time: You must have a government ID and bank account details to sign up. If those documents are accessible, the account should be ready in 2-3 business days, although it can take longer in some situations.

Rating: 4.7/5.0 (based on 847 reviews)

#2 WorldPay

The year of launch: 1997

Supported platforms

- Magento

- BigCommerce (hosted)

- Shopify

- WooCommerce

- WP Commerce

Pricing

WorldPay has two price options:

- Pay when you go (2.75 percent plus A$0.37 for credit and debit cards).

- Monthly payment (A$37.35 plus 2.75 percent for credit cards and 0.75 percent for debit cards)

If you process more than 1,000 transactions a month, you can contact WorldPay for volume pricing discounts or pay monthly alternatives.

Payout Method and Frequency of Payout: Twice a week, direct transfer to your bank account.

Advantages

- They will assist you in obtaining a PCI DSS compliance certificate (for just A $56.15 every year).

- WorldPay is authorized in over 146 nations.

- It accepts over 126 different currencies.

- There are no additional costs for subscription or billing.

- Has fraud detection mechanisms built-in for smoother transactions

- Their live dashboard allows you to track the order in real-time.

- There is no extra charge to process refunds (does not include bank fees)

- There is a virtual terminal available.

- Credit card machines are available.

- PayPal integration is supported.

Disadvantages

- Perhaps there are so many services! You must do your own research before considering their services.

- There is NO free trial available.

Accepted Payment Methods: All major cards are accepted

Website Integration Method: A list of APIs for WorldPay can be found on their website.

Chargeback Policy: WorldPay will charge you eCommerce in the event of a chargeback. If the client withdraws the chargeback order, this will be returned to you.

Payment Processor Availability: Yes, WorldPay comes with its own payment processor

Rating: 4.4/5.0 (average value). About 90% of its users will suggest it to a friend or coworker.

List of Prohibited Products

The following items are not available for sale via the WorldPay gateway:

- Casinos and gambling devices

- Betting on races

- Pornography

- Replica products

- Cigarettes and tobacco

- Medicines and firearms

- ......

The whole list can be found on their support website.

#3 SecurePay

The year of launch: 1999

Supported platforms

- WooCommerce

- BigCommerce

- Shopify

- ShopFactory

- Adobe Business Catalyst

On their website, you can find a full list of supported platforms.

Pricing

SecurePay provides you with two payment receipt alternatives. They are as follows:

- Online Payments with SecurePay

- Combines a payment gateway and a merchant account

- Domestic transactions are 1.75 percent plus $0.30 per txn (fees inclusive of GST) while 2.90 percent + $0.30 per txn for international transactions (fees inclusive of GST)

There are no setup costs and also no monthly or yearly rates.

All transactions, including refunds, pre-authorization, and card-issuer rejected payments, are subject to transaction fees.

Gateway Solution

This plan is designed for merchants who already have a merchant account with a bank or other financial institution and want to directly deal with it.

You have three choices for this plan:

- For anyone just starting, the fee is 45 cents per transaction plus an annual fee of $395.

- Those who wish to process a fixed number of transactions each year. There are no annual payments - just $800 for 3,000 transactions (you can process no more than 3,000 transactions with this plan) If you use all 3,000 transactions, it will be topped up automatically.

- For those processing more than 5,000 transactions a month

You have the chance of contacting SecurePay and negotiating personalized prices. Tailored packaging, dedicated support, and account administration are available to those with a turnover of above $1 million.

So if you meet these requirements, please contact SecurePay for more details.

Recurring Billing

- $1 for each debit

- The monthly fee is $75.

- There are no annual or setup costs.

Payout Method and Frequency of Payout: Dependent on SecurePay risk assessment policies.

Advantages

- Provides detailed reporting

- Supports Australian bank

- Provides virtual terminal

- Offers free trial period

- Includes advanced fraud protection

- Offers batch payments processing

- Provides sandboxing to examine the gateway

- Able to customize the payment page

Disadvantages

- There ARE hidden fees (service termination fee, PCI certification fee, etc.)

- Printing reports is complicated

- PoS is not provided

Accepted Payment Methods: All major cards, together with PayPal

PCI compliance: Level 1

Website Integration Method: You can get access to the link to the SecurePay API page on their website.

Payment Processor Availability: Yes, SecurePay has its payment processor and hence does not need to integrate with any other third-party processors.

Chargeback Policy: It will charge you a fee of $25 in the circumstances of a chargeback.

Rating: 4.2/5.0

Read more: Payment Gateway Comparison - Top 5 Providers in 2021

#4 Square

The year of launch: 2009

Supported platforms

- Shopify (via a 3rd party application)

- Xero

- Vend

- WooCommerce

- Acuity Scheduling

- GoDaddy website+marketing

Pricing

The app is free. The square reader costs $59 or three payments of $20.

On each transaction: 1.9 percent per tap or dip for Visa, American Express, MasterCard, EFTPOS, and international credit cards.

Advantages

- Available virtual terminal.

- Store card on file.

- Includes qualified reporting tools.

- Provides end-to-end transaction encryption.

- Unlike several other gateways, it allows deposits the next business day.

- Do not charge any refund fees.

- Provides $250 a month as part of its chargeback protection package.

- Square provides an instant deposit for a small charge (1 percent of the transfer value).

- Exceptional iPad application for brick-and-mortar stores

Disadvantages

- Typically, card-not-present transactions are highly scrutinized, resulting in substantial fee deductions.

- In most cases, disputes tend to go against the merchant

PCI Compliance: Level 1 (the highest level)

Website Integration Method: They provide both APIs and SDKs, as well as documentation, on their website.

#5 2checkout

The year of launch: 1999

Supported platforms

100 eCommerce, shopping cart, and invoicing system systems are supported, including

- Shopify

- Magento

- WooCommerce

- BigCommerce

- Drupal Commerce

Pricing

- 3.5 percent plus $0.51 on each item transaction (if you sell physical products online)

- 4.5 percent plus $0.66 on each item transaction (for recurring billing)

- 6.0 percent plus $0.88 for each item transaction (for digital products such as music or eBooks, etc.)

Payout Method and Frequency of Payout

2CheckOut can pay you via wire, ACH, check, Payoneer or Webmoney. The frequency at which it publishes your earned money is referred to as payout frequency. The funds are released on a weekly basis through 2checkout.

There is a minimum transfer limit when collecting money from 2CO which is $50/€50/£50. (2 Sell and 2 Subscribe) and $100 $100/€100/£100 (2 Monetize)

However, merchants have the ability to discuss payout frequency with 2checkout, and they do reduce the frequency in certain situations.

If your proposal for a shorter payout frequency is accepted, make sure it is in writing.

Advantages

- 87 currencies and 15 languages are supported.

- Fees are set at a flat rate for any country in the world.

- Advanced fraud detection and prevention

- There are both hosted and inline checkout solutions (hosted checkout directs the user to the payment portal website). Inline keeps them on the website.)

- Mobile-friendly

- Provides yearly billing

- WordPress shopping carts may be integrated.

- Supports nations where the laws are unfavorable to small and medium-sized businesses.

- Customers may add dishonest vendors to their blacklist.

- Tools are included to help mitigate cart abandonment.

- Facilitates driving traffic to your website

- The checkout page can be customized

Disadvantages

- A merchant account is required.

- There is no digital wallet available (you cannot save money to buy anything as you can through PayPal).

- Merchants do not have access to Live Chat.

Accepted Payment Methods:

- MasterCard (debit card & credit card)

- Visa (debit card & credit card)

- American Express (credit card only)

PCI compliance: Level 1 certified (the highest level)

Website Integration Method: You can find 2checkout's API resource page on their website.

Chargeback Policy

Chargebacks are authorized on purchases made with the following credit/debit cards:

- VISA/MasterCard

- JCB

- HyperCard

- UnionPay

- Carte Bleue

- American Express

- Discover

- Diners Club

- Elecard

Payment Processor Availability: It comes with its own payment processor.

Sign-up Time

Signing up takes between 5-10 minutes if you have any of the required information. If you don't, you should save and pick up where you left off later. You must submit the following documents during the sign-up process:

- ID from the government

- Valid address evidence

- Policies in business (refund, shipping, returning product)

Rating

- 4.5/5.0 (Joe Warnimont)

- 4.5/5.0 (Rose Holman from Merchant Maverick)

Tips to Avoid Chargebacks in Best Payment Gateway in Australia

If you've made it this far, you've already got a nagging question in your head. What steps would you take to stop chargebacks?

To be honest, chargebacks are often inevitable, but you can drastically decrease their frequency if you take the following steps:

- Declare the explanation that consumers can use on their credit card statements on your website policies page.

- Customers will only be charged for the items that are shown on your website. You are the one that would deal with chargebacks if you work as a third party.

- Card authentication can be implemented on the website.

- If a credit is required, make sure it is made on the same card that was used to make the purchase.

- Under a defined time frame, resolve all conflicts in the appropriate manner.

- In the case of large transfers, take additional precautions to ensure that the payer is the cardholder.

- Often notify the subscriber 4-5 days in advance of recurrent billing.

Read more: Top 8 Best Payment Gateway in USA For Magento 2 Merchants

Conclusion

The longer you search for the best payment gateway in Australia, the more likely you are prone to analysis paralysis. As a business owner, you must stay updated on any part of your company; payment gateways are critical, and we recommend that you keep an eye out for them.

So, which of the five gateways listed above do you believe is best suited to your needs? Check out our payment gateway integrations or drop us a comment below if you still have more questions.