Best Payment Gateway in USA #1: PayPal

Best Payment Gateway in USA #2: Authorize.net

Best Payment Gateway in USA #3: Stripe Payment Gateway

Best Payment Gateway in USA #4: 2Checkout

Best Payment Gateway in USA #5: Amazon Pay

Best Payment Gateway in USA #6: PaySimple

Best Payment Gateway in USA #7: SecurePay

Best Payment Gateway in USA #8: Braintree

The online shopping trend is booming in the United States, and every online eCommerce website must incorporate the best payment gateway in USA.

According to one survey, about 7 out of 10 Americans have shopped online, and by 2021, there will be about 230.5 million American shoppers. Not just that, but mobile shoppers in the United States account for almost 60% of the total. In addition, the share of eCommerce in the USA has increased to 16.1 percent in the second quarter of 2020, up from 10.8 percent in the second quarter of 2019.

To conduct those transactions on online platforms, business owners in the United States need payment gateways that are fast, secure, and reliable. The best payment gateway in USA will facilitate you in earning the trust of your clients. It ensures the brand's credibility with your customers.

But how do you tell which ones are the best? Don't be worried. We have compiled a detailed list of the best payment gateway in USA.

Best Payment Gateway in USA #1: PayPal

PayPal was founded in 1998 and has since been one of the most commonly used payment gateways in the United States and around the world. It has a huge number of active users who send and receive payments through their payment gateway on a regular basis.

There are absolute reasons why it is one of the oldest and top payment gateway providers in the USA.

PayPal is one of the best payment gateway in the world. PayPal's business payment gateway supports over 100 currencies, making it the biggest payment gateway in the US for overseas transactions.

Besides PCI compatibility, it has express checkout, barcode scanning, bills me later, a mobile card reader, a credit card reader, and a variety of other services. Furthermore, withdrawals from PayPal are simple and fast, and merchants can withdraw funds within seconds after paying a little fee.

Pros:

- The activation and integration processes are fast

- Excellent security features

- More than 100 currencies are supported

- Provide customer service in 17 languages 24 hours a day, 7 days a week

- System for fast fund withdrawals

Cons:

- The exchange fees are exorbitant

- Payment completion is redirected to PayPal

Pricing – (Fees and other Charges): There are no setup or monthly payments

- Inside the United States: 2.9% plus a flat rate depending on currency per sale

- Outside of the United States: 4.4% plus a flat rate depending on currency per sale

- For immediate fund withdrawals, the fee is 1% up to a limit of $10

Read more: How to Use Paypal in Stores? - Ultimate Guide for Retailers

Best Payment Gateway in USA #2: Authorize.net

Authorize.Net, which was established in 1996, is the next payment gateway on our list of the best in the USA. It is a common payment gateway in the USA that is suitable for small businesses. If you already have a merchant bank account, their payment gateway is the only solution that is the most affordable payment gateway in the United States.

Authorize.net accepts all major credit and debit card providers from around the world, making it one of the best payment gateways in the USA. It includes an account updater and an automated check processor, making payment collection easier and more flexible. It is also a prominent payment gateway in other countries such as the United Kingdom, Canada, Europe, and Australia, owing to an excellent platform and innovative fraud-prevention programs.

Pros:

- All major credit cards are accepted

- Account Updater & E-Check Processing - Advanced Fraud Protection System

- Available 24 hours a day, 7 days a week

- Billing on a regular basis (recurring)

Cons:

- The user interface is difficult to use

Pricing – (Fees and other Charges):

For Payment Gateway solution (for merchant having a merchant bank account)

- There is no setup charge, although there is a monthly fee of $25 for the gateway.

- There is a charge of $10 per transaction.

- The daily batch fee of $10

For an all-in-one solution (for merchant without a merchant bank account)

- There is no setup fee, but there is a monthly gateway price of $25, which is 9 percent plus 30 cents per transaction.

Best Payment Gateway in USA #3: Stripe Payment Gateway

Stripe is an API-oriented cloud payment gateway provider based in the United States. It stands out as an innovative and dominant payment gateway in comparison to other top payment gateways in the United States.

Stripe's APIs give merchants complete control about which payment methods they wish to integrate. Their payment solutions are ideally suited for SMBs and startups looking to scale their operations at the future stage of their growth.

This payment gateway has world-class security and fraud prevention functionality. It accepts and processes payments in over 135 currencies. Moreover, Stripe offers both a normal Stripe payment version and a Stripe subscription version, so merchants can choose what works best for them.

Stripe provides services such as consolidated checkout, a personalized UI toolkit, a mobile interface, recurring payments, and 24/7 technical assistance, and others. It is also one of the most PCI-compliant payment gateways in the United States.

Pros:

- There are over 135 different currencies that are accepted and processed

- About 42 countries get it operational.

- Multiple options can be integrated using an API-based method.

- Customer service is available 24/7

- Withdrawing funds in Minutes

Cons:

- Dispute Resolution

- Timelines are typically lengthy

- Timelines are typically available

Pricing – (Fees and other Charges):

- There are no setup fees.

- There are no recurring or hidden fees.

- For cards or digital wallets, the processing fee is 2.9 percent plus 30 percent.

- For foreign cards, the purchase rate is 3.9 percent plus a fixed fee. (1 percent extra for currency exchange if necessary)

- 1% for instant fund withdrawal

Best Payment Gateway in USA #4: 2Checkout

2Checkout, or 2CO, is another common payment gateway in the United States that was recently acquired by VeriFone. VeriFone is the world's leading provider of commerce and payment solutions. Both 2CO and VeriFone share the responsibility of providing streamlined and modern commerce solutions while still enabling hassle-free payment. Following the acquisition, both companies will benefit from financial strength, scalability, partnerships, resources, and market potential.

2CO's payment gateway accepts payments from over 200 countries around the world. It provides 45+ online and offline payment options, depending on the package you choose. Along with 29+ language support, 2checkOut can process payments in 100 currencies, making it a popular alternative among US business owners.

However, their all-in-one option has high fees, making it not one of the most reasonable payment gateways in USA.

Pros:

- Accepts payments from more than 200 countries/territories

- Checkout is available in multiple languages (29+)

- Payments can be processed in 100 different currencies

- 45+ online/offline payment options are available

- Specialized Fraud Management and Protection

Cons:

- Certain goods are prohibited from being sold

Pricing – (Fees and other Charges):

The 2CO payment gateway has three plans: 2Sell, 2Subscribe, and 2Monetize.

- Charges for the 2Sell option are 3.5 percent plus $0.35 per purchase.

- Charges for the 2Subscribe package are 4.5 percent plus $0.45 per purchase.

- Charges for the 2Monetize package are 6.0 percent + $0.6 per purchase.

Read more: Top 5 Best Payment Gateway For Small Business

Best Payment Gateway in USA #5: Amazon Pay

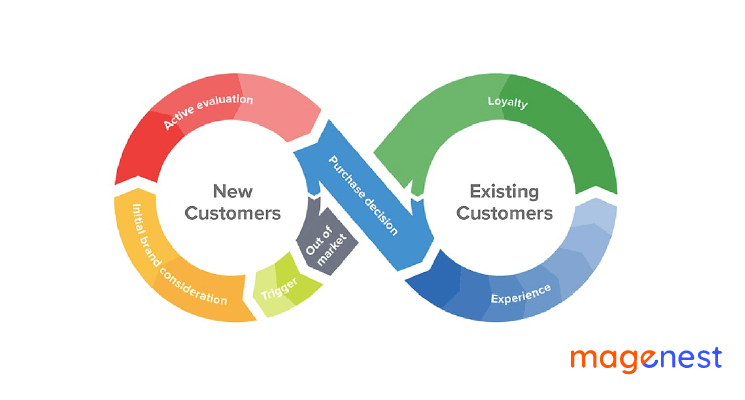

Amazon began offering payment services in 2007 to enable its users to transact with ease on its website. Since then, it has grown to become one of the most common payment gateways in the United States. It not only encourages customers to pay Amazon merchants, but it also helps Amazon users to pay securely on external websites and applications.

Amazon offers payment services in over 18 nations, with extensive support for multi-currency processing. Amazon Pay collaborated with WorldPay in 2019 to enable its users to integrate Amazon Pay for payment acceptance. The payment gateway is jam-packed with awesome features that entice customers to buy and pay with Amazon Pay.

Pros:

- Beneficial for re-engaging loyal customers

- Conversions increase significantly

- Upgrades to features on a regular basis

- Guaranteed customer security from A to Z

- Built-in Amazon's own fraud prevention technology

Cons:

- Sometimes, it takes 2 to more than 3 days to withdraw funds

Pricing – (Fees and other Charges):

There are no setup or hidden costs.

- Transaction by transaction 2.9 percent + $0.3 inside the USA via online and tablet, and 4 percent + $0.3 via Alexa

- Transaction by transaction 3.9 percent + $0.3 outside of the USA via web and tablet, and 5 percent + $0.3 via Alexa

Best Payment Gateway in USA #6: PaySimple

PaySimple is the latest payment gateway service in the United States. It is a SaaS-based platform that seeks to strengthen small and medium-sized businesses and also eCommerce business owners. Their payment systems are especially helpful for omnichannel retailers that support both online and in-store payments. Customers can pay efficiently and simply through PaySimple's payment gateway.

Both major credit cards and e-check payments are accepted through this modern payment gateway in the United States. It can also streamline billing with recurring billing, easily monitor consumer accounts, have a mobile app for payments, and ensure PCI DSS compliance, among other things. The only cache is that it is only available to companies operating in the United States.

Pros:

- Suitable for small service-based businesses

- Customer service is good

- E-check processing and billing are simple to set up and activate

- There are no termination costs

Cons:

- There are several hidden fees

- International labels are not supported

Pricing – (Fees and other Charges):

- Monthly fee of $59.95

- Credit card transactions are charged at a rate of 49 percent.

- For ACH/eCheck processing, additional $0.60 + 0.20 percent.

Best Payment Gateway in USA #7: SecurePay

SecurePay is a payment gateway that is one of the most secure in the United States. It is the creation of the OLB Group, a leading merchant service and software development firm. The SecurePay payment gateway meets all of the requirements for eCommerce by connecting the merchant's online store with their secure servers for payment processing.

SecurePay is a PCI-compliant payment solution that safely processes, transmits, and stores payment card data. It is equipped with security, dependability, and innovation, making it an excellent option for merchants. It also has recurring billing, 24/7 support, API support, and a fraud prevention feature.

Pros:

- Ideal for small businesses.

- Online and offline payments are also safe.

- Allows for a variety of payment methods

- PCI enforcement with recurring billing

Cons:

- There are still no price details available.

- Not one of the common payment gateways in the United States.

Pricing – (Fees and other Charges): Find out more on their website.

Best Payment Gateway in USA #8: Braintree

Braintree is next on our list of payment gateway services in the United States. Braintree was established in 2007 and is now owned by PayPal. Since the acquisition, it has spread to over 45 nations around the world, including the United States. Braintree, in collaboration with Coinbase, could accept Bitcoin payments. It specializes in providing mobile and online payment gateways to eCommerce businesses.

Braintree includes features such as 3D secure, advanced fraud prevention, Level 1 PCI enforcement, Braintree Vault for data encryption, and more. The best thing about Braintree is that it helps shoppers to pay through a variety of options, including PayPal, Venmo, Google Pay, Apple Pay, MasterCard, Visa, American Express, and more.

Pros:

- Customer support is available 24/7 on both email and phone

- There are 3D secure and advanced fraud prevention functionality in place

- A wide selection of available options for payments

- Also approves Bitcoin as a payment method

- PCI Compliance is on Level 1

Cons:

- The time to set up an account is long

- Not included in the most price-competitive payment gateways in USA

Pricing – (Fees and other Charges):

- There are no setup, annual, or hidden payments

- On all major credit/debit cards and digital wallets, processing fees are 2.9 percent + $0.3

- For ACH direct debit, you will get a 75% up to $5

Visit the website for more information on pricing.

Read more: Top 5 Best Payment Gateway UK For eCommerce Stores

Conclusion

Having a payment gateway for your eCommerce store or mobile checkout cart has been an utter must for business owners. Choosing the best payment gateways in the United States is thus a task that any newcomer and startup entrepreneur must confront.

And with this post, we've done our best to shed some light on the top payment gateways in the United States that you can think about before choosing a suitable one for your store.

You can choose from the above-listed best payment gateway in USA. Please contact us if you need any additional assistance in determining the best payment gateway in USA.