The demand for eCommerce sites in the UAE has skyrocketed and is expected to continue at a rapid pace.

According to researchers, the UAE e-commerce market is expected to generate US$5,351 million in sales by the end of 2020. The revenue is anticipated to increase at a 16.2 percent annual rate, resulting in a market volume of US$9,700 million by 2024.

And as eCommerce has developed, so has the need for secure, scalable, and responsive online payment gateways. Whether the company is a small start-up, a large brick-and-mortar retailer that wants to go online, or a well-established eCommerce business, you must have a reliable online payment gateway that can scale as your web grows.

In this article, we will examine the best payment gateway in UAE for eCommerce websites.

Criteria to Look Out For in Best Payment Gateway in UAE

It has always been a tough decision to make, as there are many choices on the market. So let consider transaction fees, payment aid, customer care, retailer flexibility, development policy, and several more criteria to go for when picking any payment gateways for any website in any country.

Here are some factors of the best payment gateway in UAE to think about before making your decision:

- Support: How simple is it for a buyer to place an order, what is the refund process like, is there 24/7 email and phone assistance, and how long does it take for complaints to be resolved? You can gain a greater understanding of how the gateway responds to issues you may encounter in your everyday business by addressing these questions.

- Add-ons: What integration codes, plugins, and other extensions are available for you to use? Always consider how well it integrates with the other systems. You can't be sure you're making the best decision for your specific business until you grasp how the gateway integrates.

- Time: How long would it take for the money to settle in your bank account? This is a simple one: you want the money to be transferred, and any delays may trigger problems. It is important to double-check this with your gateway.

- Cost: And, of course, how much would the payment gateway cost, are there any hidden costs, are you on the right strategy for your current volume of business. And are you receiving genuine value for money? You should also consider how you could modify or broaden your strategy as your company scales up in the long term.

However, today's article about the best payment gateway in UAE will focus on the following criteria only:

- Support in the UAE and throughout the world

- Structure of pricing

- Supported shopping-cart platforms

- Payment options available

- Options for integration

Read more: Top 10 best payment gateway for eCommerce business

Top 5 Best Payment Gateway in UAE

#1 Telr

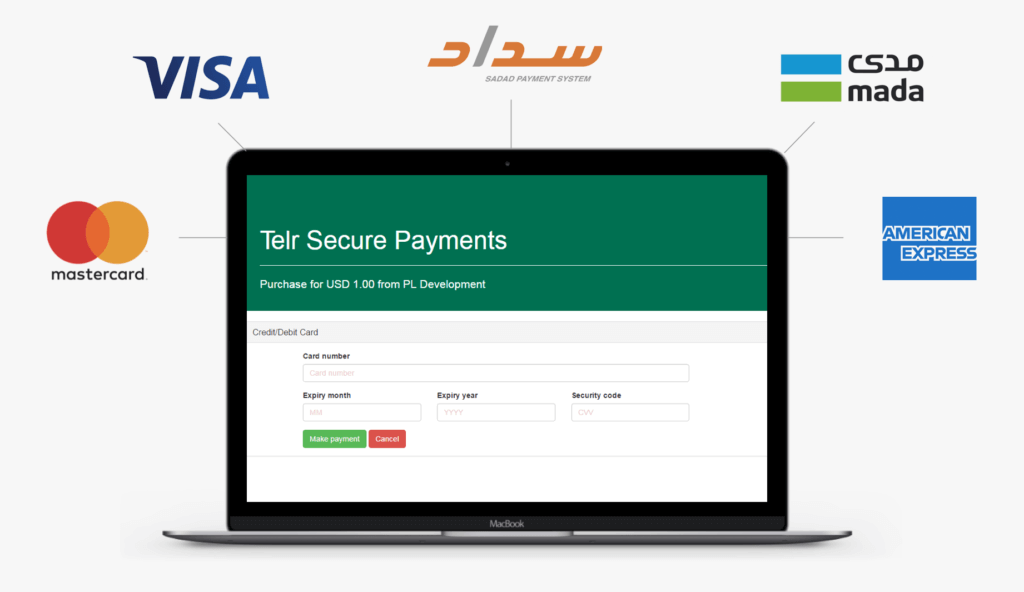

Telr (which used to be known as Innovative Payments) is a well-known payment gateway in the UAE. It is a payment gateway based in Dubai and Singapore that provides services to customers in developing nations. With its global reach of about 120 countries, it has a large enough audience to justify its credibility.

Telr is regarded as a leader among other payment gateway integration methods for Sharjah, Abu Dhabi, Dubai, and Ajman. Telr's major digital marketing programs will help you improve your online business and leave your competitors in the dust.

To open an account with Telr, you must first go to their website. Once you have completed all of the formalities, you will be given the key to access the website and documentation, as well as access to their support page.

At that point, you must navigate to the Account section of the website and include all relevant documentation about your business. If you require the accounting system to acquire credit cards, you may provide additional details. In the account section, you can find all of the information you need about the plans.

Supported Countries

Telr can be considered one of the most recommended choices in the Middle East and also the best payment gateway in UAE since it is now present in more than 100 countries.

- The UAE: Yes

- Globally: Yes

Structure of Pricing

Monthly Cost: The payment gateway provides a monthly subscription service to start with. Learn more about them by visiting their website.

Basically, eCommerce store merchants can choose from three account levels:

- Entry Level: AED 349 pa

- Small Level: AED 99 pa + Transaction Charges

- Medium Level: AED 49 pa + Transaction Charges

Set-up Cost: Free

Per Transaction Cost:

- Small Level: 2.69% + AED 1.00

- Medium Level: 2.49% + AED 0.50

Supported eCommerce Platforms

- Woocommerce

- Shopify

- Magento

- OpenCart

- Prestashop

Available Payment Options

- Visa

- MasterCard

- American Express cards

- N.E.T. Banking (Indian banks)

- SADAD (Saudi Arabian banks)

Options for Integration

There are three different ways to integrate:

- Telr will host the payment gateway: Then the user will be redirected to Telr to complete the transaction. They will return to the website after the payment.

- iFrame method: Incorporate the checkout site into our website with an iframe and apply our CSS to the form.

- Complete payment form incorporation into their website: This requires that PCI DSS be approved (Payment Card Industry Data Security Standard).

- Plugin option for Magento, Shopify, Opencart, WooCommerce PrestaShop, etc.

#2 Amazon Payment Services

Amazon Payment Services is an Amazon company that works in Arabic-speaking countries and surrounding areas such as the United Arab Emirates, Lebanon, and Qatar. What distinguishes Amazon Payment Services is that it accepts and facilitates a wide range of online payment solutions and methods with the highest level of reliability, mitigating any potential transaction risks and boosting your sales.

This best payment gateway in UAE became very popular among entrepreneurs and new businesses. The monthly fee is around AED 280, with no setup fees. The cost per transaction is 2.8 percent, and an extra AED 1.00 must be charged as an exchange charge. Individuals who are concerned about the payment framework's level of security will pay an additional monthly fee of AED 35, with a setup fee of around AED 135, to have the capability to recognize any fraudulent activities in the payment framework.

Since the platform is tailored exclusively to trends in Dubai and its surroundings, it is an excellent choice for an eCommerce site located in the UAE.

Supported Countries

- The UAE: Yes

- Globally: The Middle East region primarily

Structure of Pricing

- Set-up Cost: Free

- Per Transaction Cost: Per 2.94% + AED 1.84

- Monthly Cost: AED 420

Supported eCommerce Platforms

- Woocommerce

- Magento

- Shopify

- OpenCart

- CS-Cart

- Prestashop

Available Payment Options

- Visa

- MasterCard

- Apple Pay

Options for Integration

Checkout methods:

- Merchant Page (pay from a website without redirection)

- Tokenization (substituting card details with a token).

- Tokenization API allows the retailer to save the customer's credit card data in a confidential and secure location by replacing the sensitive card details with a non-sensitive equivalent known as a Token.

- You will use the Token to process new transactions for customers without having to insert card information through different networks.

Integration:

- ONE API - API Integration

- via Plugins

Read more: Top 5 Best Payment Gateway For Small Business

#3 Checkout

Checkout is an international eCommerce gateway known for making purchases seamless, and they are committed to helping their customers gain more value with each transaction that happens on their eCommerce site.

Their end-to-end platform is intended to make the business move more rapidly, and they provide a range of customizable and scalable solutions that provide granular details and valuable insights. The app is capable of adapting to the specific market and providing an exceptional user experience.

Checkout originated in the United Kingdom and has since expanded to the Middle East area, offering verified payment gateway solutions in the UAE. Checkout is regarded as one of the best Payment Gateways integration methods for the UAE Dubai, Abu Dhabi, Sharjah, and Ajman. Perhaps the best aspect of this payment solution is its simplicity to set up.

With a transaction fee of AED 0.75 to 2.75 percent of the total volume, this is the best payment gateway in UAE for young entrepreneurs starting their businesses in the UAE.

Supported Countries

- The UAE: Yes

- Globally: Yes

Structure of Pricing

- Set-up Cost: Free

- Per Transaction Cost: 2.9% + AED 1.10

- Monthly Cost: None

Supported eCommerce Platforms

- Magento

- Woocommerce

- Shopify

- Prestashop

Available Payment Options

- Visa

- MasterCard

- American Express cards

- PayPal

- Mada

- Apple Pay

- QPay

- Google Pay

- Alipay

Options for Integration

- Iframe: Embed an iframe payment form on the website. The transfer will be processed by the payment gateway by exchanging tokens.

- Checkout.js: A payment processing widget that sits on the website's checkout tab.

- API

#4 PayTabs

PayTabs, a gateway in the UAE founded in 2014, is well known for its cutting-edge payment processing and fraud prevention technology.

This best payment gateway in UAE is both safe and adaptable. It is intended to assist eCommerce companies in receiving and making purchases electronically, and the device will generate and deliver invoices using innovative and versatile technologies. Additionally, it is very easy to integrate and set up.

In less than 24 hours, you will set up all of our PayTabs systems and get it running. There are many ways to consolidate PayTabs, including plug-ins, iFrames, SDKs, and direct joining via API. At the moment, they charge 2.85 percent + 1 AED per transaction.

Supported Countries

PayTabs is a fantastic option within the UAE.

- The UAE: Yes

- Globally: Yes

Structure of Pricing

- Set-up Cost: Free

- Per Transaction Cost:

- PayTabs Start-Up (up to $ 2000): None

- PayTabs Growth Plan (over $ 2000): 2.7% + AED 1

- PayTabs Enterprise (over $ 100,000): more information on their website

- Monthly Cost:

- PayTabs Start-Up (up to $ 2000): AED 183.50

- PayTabs Growth Plan (over $ 2000): None

- PayTabs Enterprise (over $ 100,000): more information on their website

Supported eCommerce Platforms

- Magento

- Woocommerce

- CS-Cart

- Shopify

- OpenCart

- Prestashop

Available Payment Options

- Visa

- MasterCard

- American Express cards

- Mada

- Stc pay

Options for Integration

- Plugins

- Direct API

- Express Checkout

- There will be no redirection. Checkout process for online shoppers that keeps them on the merchant's website when making a purchase and even after it is completed.

#5 2checkout

2Checkout is a payment gateway that approves payments from any device and any location on the planet. 2Checkout boasts "transactions from 196 countries, via 8 payment channels, 26 currencies, and 15 languages." 2Checkout has grown to become an all integrated payment gateway, allowing businesses to collect payments from their global audience. 2Checkout also collaborated with FreshBooks to provide new online payment options for small businesses.

It is very hard to build a company, scale it up, and sell it to a global audience all at the same time. The intriguing highlights of 2Checkout make it easy to connect comprehensively and sell your items.

They charge 3.9 percent + 45 cents for each transaction and accept 87 currencies. They also bill 1.5 percent for clients outside the UAE, as well as $25 for each chargeback. These costs may seem to be exorbitant, but there is no set-up fee and no monthly management fees.

Supported Countries

It is one of the most robust options and is used in a wide range of industries around the world.

- The UAE: Yes

- Globally: Yes

Structure of Pricing

- Set-up Cost: FREE

- Per Transaction Cost:

- 2Checkout 2 SELL: 3.5% + AED 1.28

- 2Checkout 2 SUBSCRIBE: 4.5% + AED 1.84

- 2Checkout 2 MONETIZE: 6% + AED 2.2

- Monthly Cost: NONE

Supported eCommerce Platforms

Almost all E-commerce platforms. Learn more on their website.

Available Payment Options

- Visa

- MasterCard

- American Express cards

- Apple Pay

- Bank Transfer

- PayPal

Options for Integration

- API Method

- iFrame method

Read more: Top 8 Best Payment Gateway in USA For Magento 2 Merchants

Conclusion

Since there are several options of the best payment gateway in UAE available, each with its own array of benefits and drawbacks, you must determine which one is best for you.

At the end of the day, it all boils down to what you'd like to do for your business and the objectives you've set for your site. It is critical to consult with professional eCommerce developers to determine which payment gateway can better meet your unique requirements.

One point to bear in mind is that you may choose a basic package for any of the gateways (that seem to be profitable now), but as the eCommerce website in UAE expands, you will need to upgrade to the business or premium version of that gateway. Then you have no choice but to purchase the expensive package.

So, before you choose anything, properly plan for the future. Take a look at our Payment Gateway Integrations, perhaps you can find something for your eCommerce business.